Collecting and validating employer and occupation information from claimants can be challenging for agencies and confusing for claimants. Here are some high impact improvements states can try to ease friction for both groups.

Recommendation 1: Better support claimants to recognize their employer when the employer legal name is different from the commonly used name.

A common point of friction we heard from current and former UI directors and their leadership was the difficulty that results from a claimant not recognizing their employer in state records. This may happen because they are familiar only with the employer’s “Doing Business As (DBA)” name, for example in the case of franchises, or when employers use third party payroll companies. This may cause general confusion on the part of the claimant causing them to pause or abandon their application. It may also result in a claimant removing a valid employer from their application requiring a necessary intervention by state agency staff and further fact finding. Below are several interventions which may mitigate this high impact problem area.

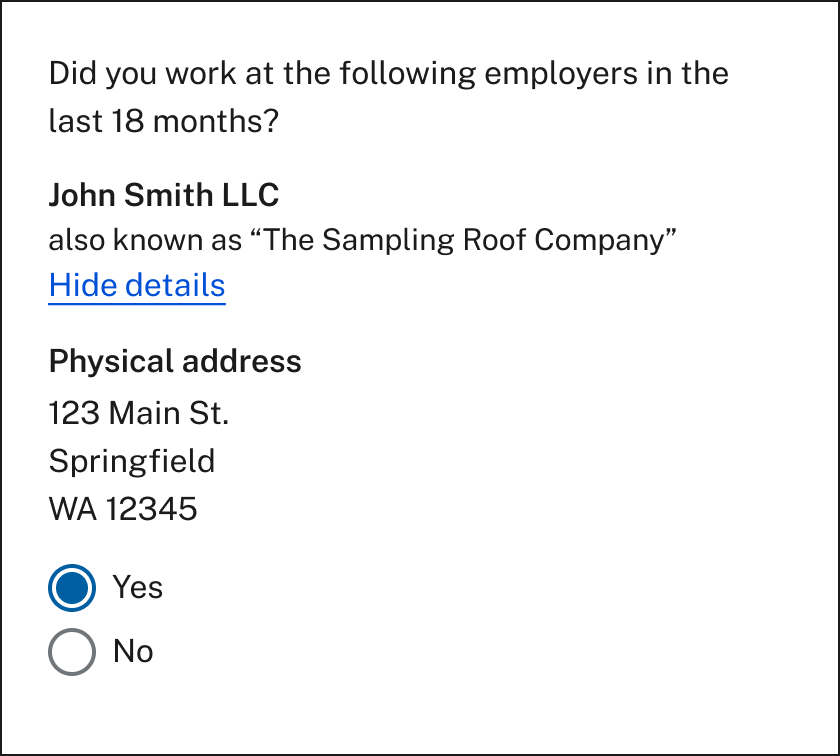

Add the “Doing Business As (DBA)” name to the claimant interface.

Related cx principles: Plain language

- Add a field to the interface for an employer’s “Doing Business As” (DBA) name so that claimants can more easily confirm the agency’s records.

- Instead of using the acronym D.B.A. in claimant-facing interfaces, consider the plain language rephrase of “also known as”.

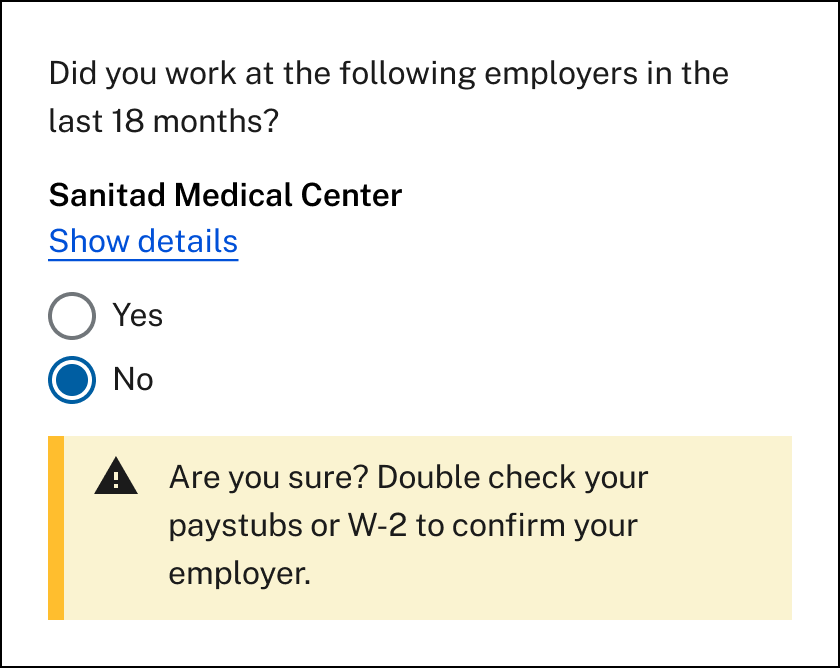

Use consequential help to discourage a claimant from removing a valid employer because they don’t recognize them.

Related cx principles: Provide contextual help

- When a claimant is reviewing the employers matched to them from state records and takes an action that would remove an employer, show a warning and advise them to check their official documentation. For more information on consequential help, review the principle here.

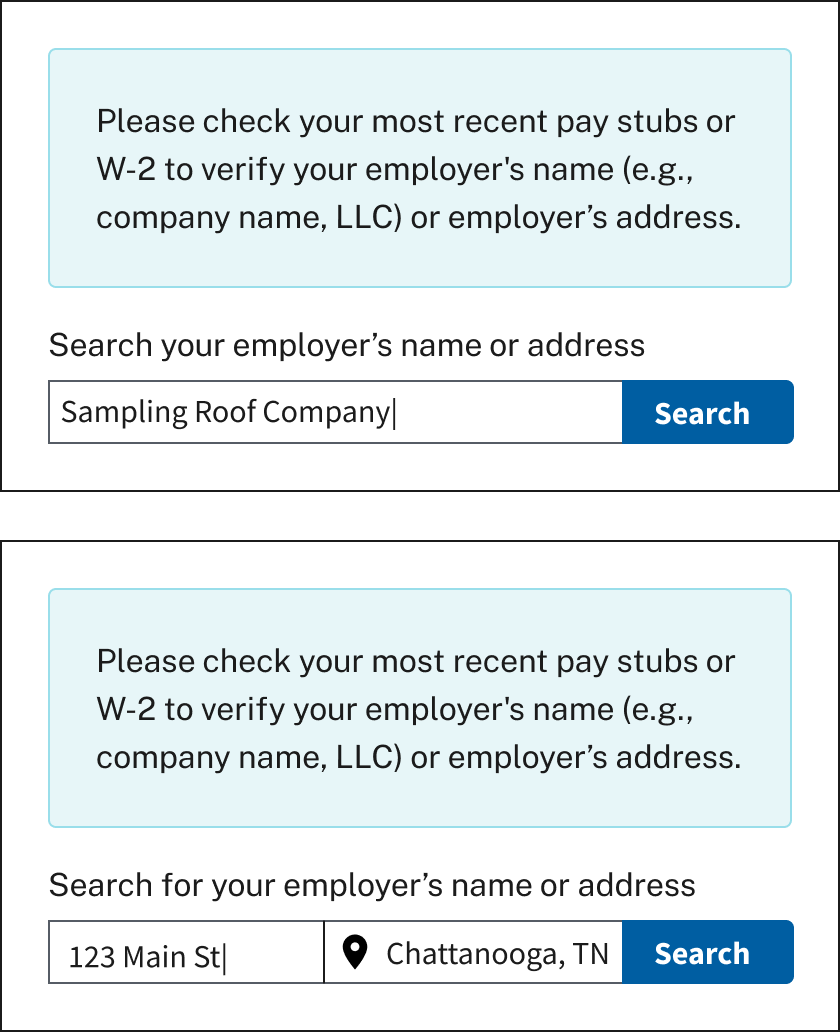

Allow claimants to search for their employer using information that is familiar to them such as the DBA name or franchise address.

Claimants who work for an employer that uses a DBA name may not know the employer goes by any other name. These claimants will try to search using the employers name or employer information they know. Add additional functionality to the "add an employer" search feature to allow a claimant to search by DBA name or business location/ franchise address.

- Add functionality to an employer search feature that allows a claimant to search by DBA name or business location/franchise address.

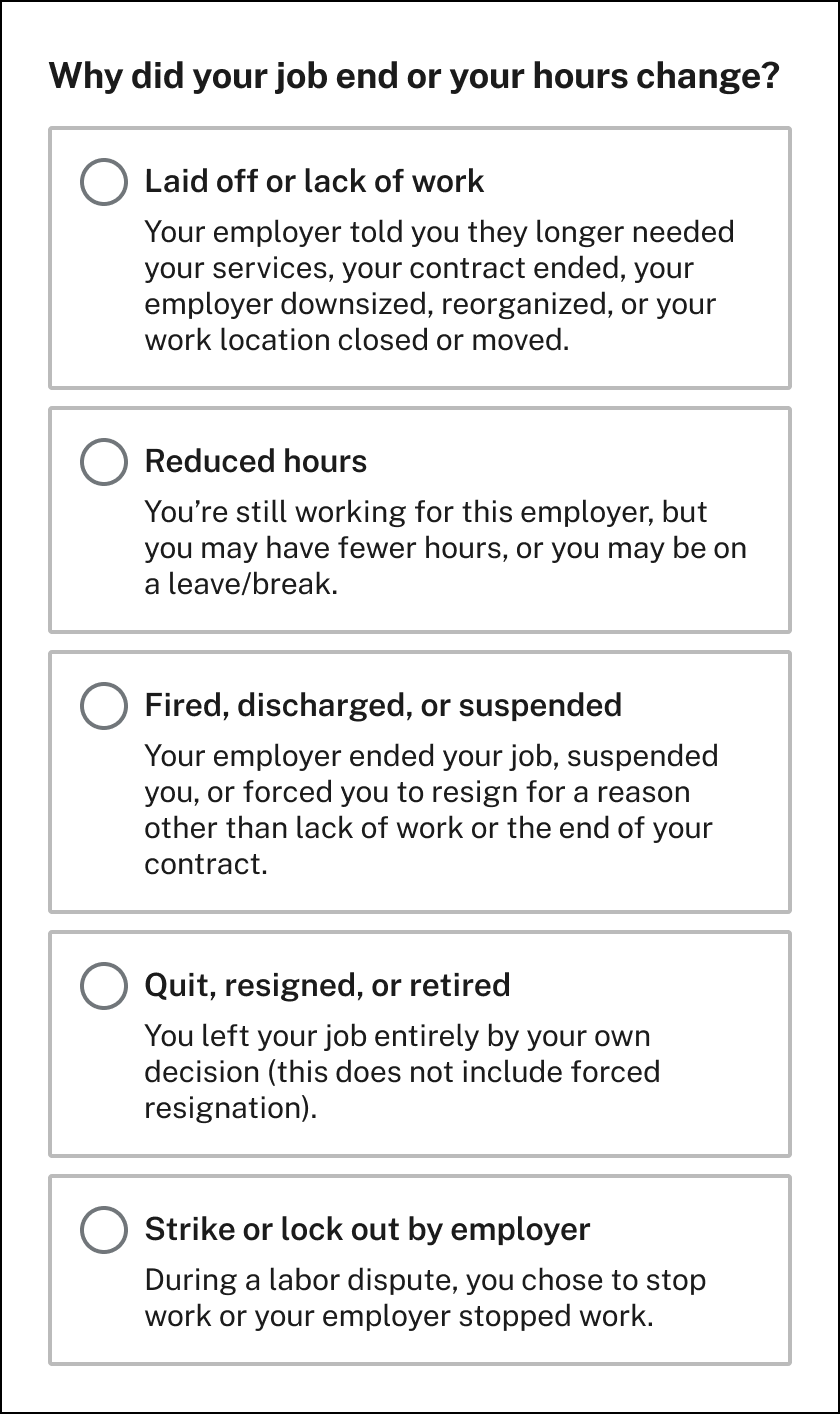

Recommendation 2: Better support claimants to choose an accurate reason for separation from their employer.

States and claimants have shared with us that difficulties can stem from the reason for separation question in common UI applications. Claimants may not understand the terminology in the question or the answer choices that represent complex employment or the eligibility rules that apply to different situations. This confusion may cause them to reach out to state agency staff for clarification or to pause the application. State agency staff, on the other hand, must gather additional information and launch fact finding when a claimant supplies an inaccurate or contested. Taken together, this question and its multiple-choice answers is the beginning of a time consuming and potentially frustrating process. The principles and examples below may mitigate some of the pain associated with the reason for separation question, though states should interpret this guidance according to their own state’s laws.

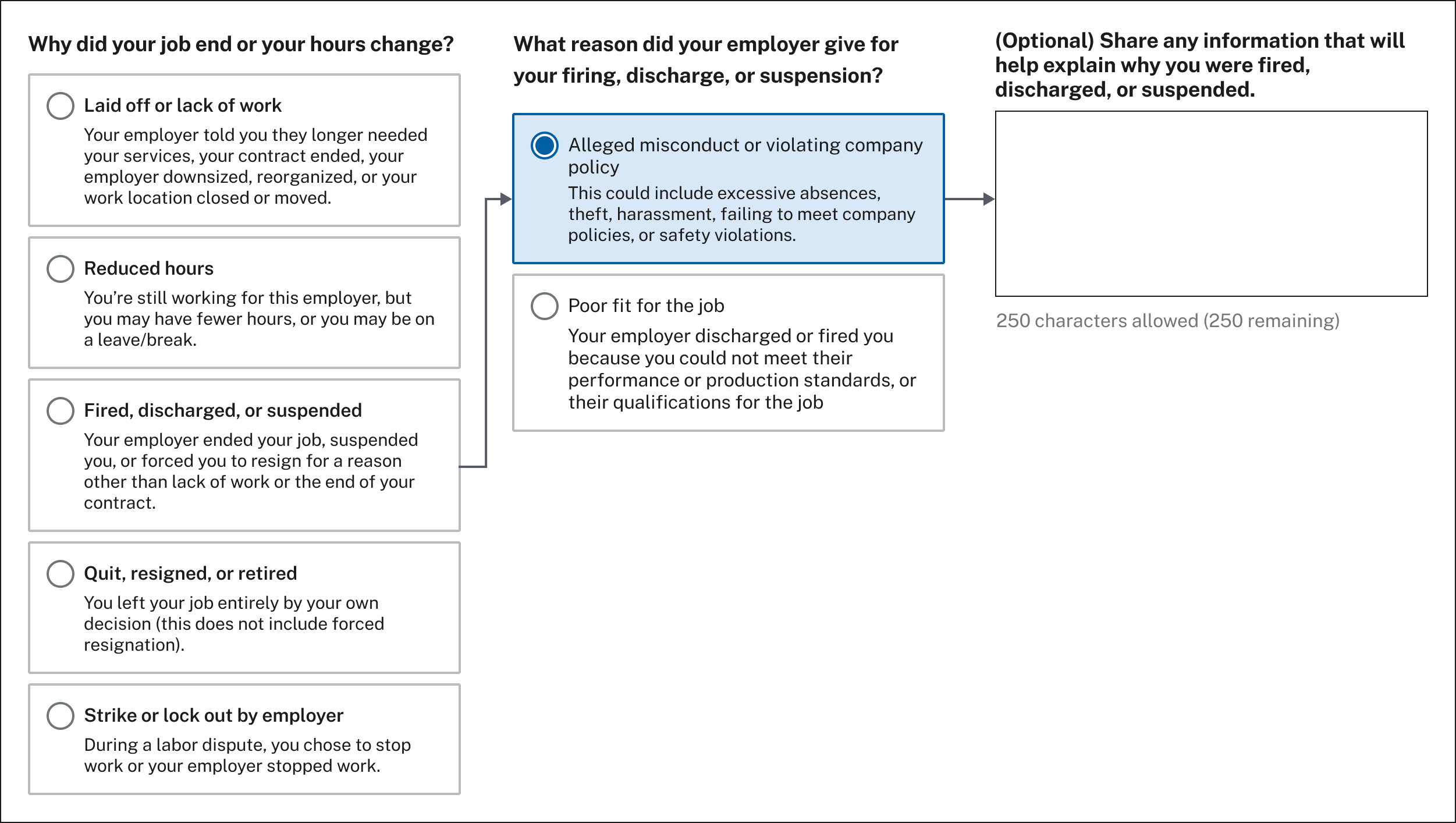

Rephrase the question and multiple-choice answers in plain language and define each answer choice.

Related cx principles: Plain language

- Instead of “What is the reason for separation” ask claimants why their job ended or why their hours changed.

- Rephrase the answers choices to be as plain language as possible.

- Add brief definitions under each answer to help claimants understand which situation applies to them.

Consider using dynamic/conditional questions for reasons for separation and an open text field for claimant details.

- Once a claimant selects a reason their job ended or their hours changed, dynamically follow up with another set of questions to get more information about the reason.

- Even after rephrasing the questions in plain language and defining terminology, a state agency may find that some claimants will not see their situation reflected in the options. States may benefit from adding a free text response to the end of the dynamic question flow so that a claimant can describe their reason in their own words and agency staff can use it to assist in any necessary follow-up or fact finding.

- Mark this open text field as optional.

- To reduce the variability of claimant supplied information in the open text field, guide the claimant with a prompt related to the reason for separation reason they previously selected.

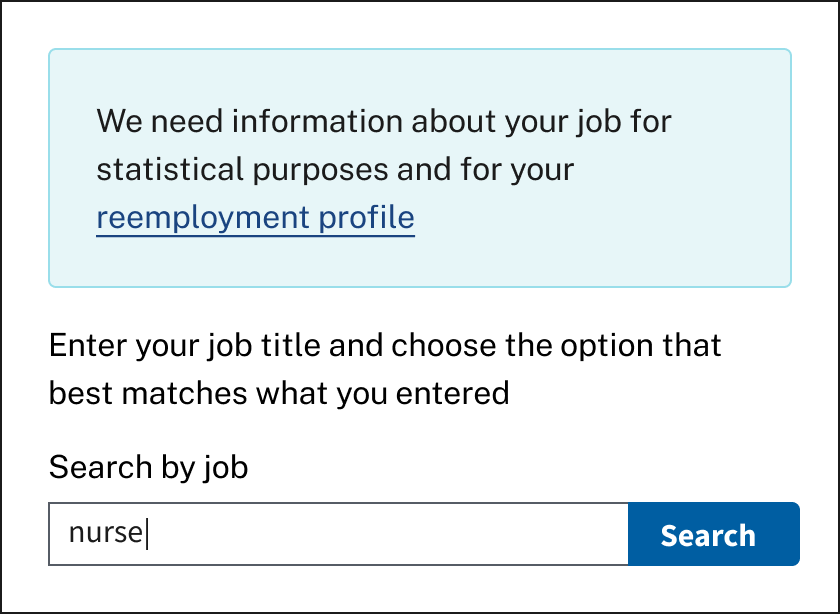

Recommendation 3: Ease claimant anxiety and encourage claimants to provide accurate occupation information.

Related cx principles: Plain language, provide contextual help

UI programs need to collect a claimant’s occupation for statistical purposes and for re-employment services, but this is often a difficult question for claimants to answer. The term “occupation” is not a word most people use to describe their work. In addition, claimants may have multiple occupations, or may be leaving one occupation and hoping to start or resume a different one. As a result, claimants may experience anxiety as they try to find an occupation that reflects how they think of their work, pause the application to contact a call center, or answer inaccurately. To lessen the stress placed on claimants and improve the accuracy of answers supplied to agencies, consider making the following improvements:

- Use the term "job" or "job title" instead of “occupation,” to be easier to understand.

- Encourage claimants to find their "best match" in the search results.

- Provide context about how the information will be used to allow claimants to answer in a way that best matches their situation.

Recommendation 4: Do employment and income calculations for the claimant whenever possible.

Claimants often struggle when they are asked to make calculations or quantify information before reporting it. Questions that ask claimants to compare length of employment between jobs, quantify how much money they made, etc., could cause claimants to make unintentional mistakes, pause their applications, and cause more work for state agency staff to correct. For more information on doing calculations for the claimant whenever possible, review the principle here.

To lessen the stress placed on claimants to calculate and report numbers in the employment and occupation sections, consider making the following improvements:

- In cases where it is necessary to know which employer the claimant worked for the longest: This may be calculated for the claimant using their start and end dates at each employer.

- In cases where a claimant must meet a minimum number of days worked: Aim for choices, such as “did you work for this employer for more than 30 days?” to replace a question that asks for a specific number of days and which would require manual calculation.

- If a claimant needs to add a new employer including wage information: Gather necessary information to begin fact-finding, and make additional questions optional.