NOTICE: On March 14, 2025, President Trump issued Executive Order 14236, “Additional Rescissions of Harmful Executive Orders and Actions,” (90 FR 13037), which revoked, among other items, Executive Order 14026 of April 27, 2021, “Increasing the Minimum Wage for Federal Contractors” (86 FR 22835). Pursuant to section 2(d) of Executive Order 14236, the Department of Labor is no longer enforcing Executive Order 14026 or the implementing rule (29 CFR part 23) and will take steps, including rescinding 29 CFR part 23, to implement and effectuate the revocation of Executive Order 14026.

U.S. Department of Labor

Wage & Hour Division

Washington D.C. 20210

February 15, 2019 (PDF)

MEMORANDUM FOR:

Regional Administrators

Directors of Enforcement

District Directors

FROM:

Keith E. Sonderling

Acting Administrator

SUBJECT:

WHD Enforcement of WIOA Limitations on Payment of Subminimum Wages under FLSA 14(c) – Section 511’s Definition of “Subminimum Wages”

This memorandum provides additional guidance to Wage and Hour Division (WHD) field staff regarding the limitations imposed by the Workforce Innovation and Opportunity Act (WIOA) on the payment of subminimum wages (SMW) under section 14(c) of the Fair Labor Standards Act (FLSA), 29 U.S.C. 214(c). Specifically, this memorandum clarifies that the WIOA requirements apply to employees who are paid commensurate wages under the FLSA or the McNamara-O’Hara Service Contract Act (SCA), 41 U.S.C. 6701 et seq. that are less than the Federal minimum wage (MW),1 but do not apply to commensurate wages paid under the SCA that are above the FLSA Federal minimum wage or to commensurate wages paid pursuant to Executive Order 13658.

I. Background

Section 14(c) of the FLSA authorizes employers, after receiving a certificate from WHD, to pay SMWs—wages less than the Federal minimum wage, but commensurate with individual productivity—to workers who have disabilities for the work being performed. The certificate also allows the payment of wages that are less than the prevailing wage to workers who have disabilities for work on contracts subject to the SCA (some of which are also subject to Executive Order 13658), and the Walsh-Healey Public Contracts Act (PCA).

Section 458 of WIOA added section 511 to the Rehabilitation Act, 29 U.S.C. 794g (section 511). This provision limits the ability of employers to pay SMWs to persons with disabilities under section 14(c). These requirements took effect on July 22, 2016.

Section 511 requires that youth with disabilities (age 24 or younger) receive various services by the Designated State Unit (DSU) designed to improve their access to competitive integrated employment before they are employed at an SMW, including transition services, vocational rehabilitation, and career counseling, information, and referral services (“pre-SMW employment services”). Section 511 also requires that all workers, including youth, be regularly provided with career counseling, information, and referrals (CCIR) in addition to information about peer mentoring, self-advocacy, and self-determination training opportunities available in their geographical area as a condition to payment of an SMW (“during-SMW employment services”).

WHD issued Field Assistance Bulletin (FAB) No. 2016-2, Fact Sheet 39H, and a public PowerPoint presentation to provide general guidance on the provisions of section 511 and its impacts to the section 14(c) program. This bulletin supplements these materials to define “subminimum wages” for use in applying the section 511 provisions to SMWs paid under other related federal laws.

II. Section 511’s Definition of Subminimum Wage

Section 511(a) prohibits a section 14(c) certificate holder from compensating an individual with a disability who is age 24 or younger at a “wage … that is less than the Federal minimum wage” unless the individual has been provided with the required pre-SMW employment services. Similarly, section 511(c) prohibits certificate holders from continuing to employ any individual at a ”subminimum wage” unless the during-SMW employment services are provided at specific intervals. Finally, section 511(f) defines the term “Federal minimum wage” as “the rate applicable under section 6(a)(1) of the FLSA.” Therefore, the term “subminimum wage” in section 511 refers to a wage rate that is less than the FLSA section 6(a) wage, which is currently $7.25 per hour.

III. Subminimum Wages under the Service Contract Act (SCA)

The SCA is a federal labor law that applies to contracts in excess of $2,500 that are entered into by the United States or the District of Columbia, the principal purpose of which is to furnish services in the United States through the use of service employees. Every service employee performing any of the contract work under a service contract covered by the SCA must be paid not less than the monetary wages and required fringe benefits specified in the SCA wage determination included in the contract. The SCA allows employers who hold a section 14(c) certificate to pay service employees with disabilities a commensurate wage based on the prevailing wage required by the wage determination. Employers must pay full fringe benefits, or the equivalent cash payment in lieu of providing the benefits, regardless of whether they hold a section 14(c) certificate.

Because the section 511 requirements apply only to employees who are paid less than the Federal minimum wage, i.e., less than $7.25 per hour, individuals who are paid more than the Federal minimum wage, are not subject to the section 511 requirements, even if they are paid less than the SCA wage determination. Instead, these individuals’ wages are subject to the SCA and section 14(c) requirements.

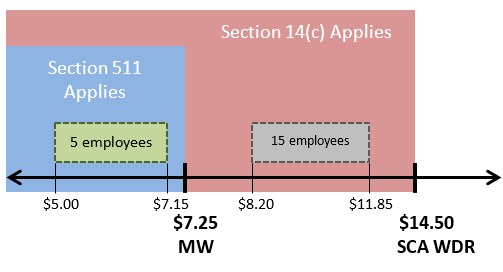

For example, a section 14(c) certificate holder pays 20 employees under a section 14(c) certificate for janitorial work performed on an SCA contract. The wage determination rate (WDR) for janitorial work on this contract is $14.50 per hour. Five (5) employees have varying productivity ratings that result in wages below $7.25; their wages are between $5.00 and $7.15 per hour. The other 15 employees have varying productivity ratings that result in wages above $7.25; their wages are between $8.20 and $11.85 per hour.2

The five employees whose commensurate wage rates are less than $7.25 per hour are subject to the section 511 during-SMW employment services requirements. The 15 employees earning at least the Federal minimum wage are not subject to the section 511 requirements.

Note: If any employee’s wages fall below the Federal minimum wage, the section 511 requirements will apply to that employee.

IV. Subminimum Wages under Executive Order 13658: Establishing a Minimum Wage for Contractors

Executive Order 13658 establishes a minimum wage for work performed on or in connection with a covered contract with the Federal Government.3 Workers covered by this Executive Order include workers with disabilities whose wages are calculated pursuant to certificates

issued under section 14(c). See Fact Sheet: Final Rule to Implement Executive Order 13658, Establishing a Minimum Wage for Contractors for an overview of the Executive Order regulations, including coverage requirements.

Certificate holders must calculate a commensurate wage rate under section 14(c) for a worker employed on or in connection with an Executive Order-covered contract; however, if the commensurate wage rate, whether hourly or piece rate, is less than the Executive Order minimum wage, the contractor must pay the higher Executive Order minimum wage rate. If the commensurate wage due on an Executive Order-covered contract is higher than the Executive Order minimum wage, the contractor must pay the worker the higher commensurate wage as required by section 14(c) of the FLSA.

Because all wages paid on Executive Order-covered contracts are higher than the FLSA section 6(a) minimum wage, individuals properly paid under a section 14(c) certificate that is subject to the Executive Order 13658 minimum wage would not be subject to the section 511 requirements. These individuals’ wages are subject to the section 14(c) and Executive Order requirements.

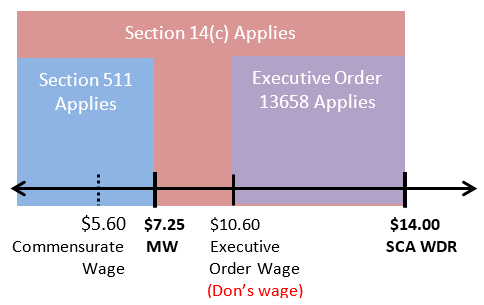

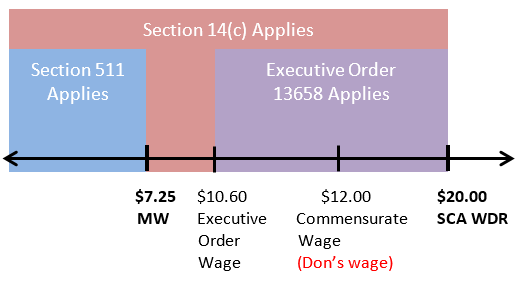

For example, Don works for a section 14(c) certificate holder that has SCA contracts for various cleaning services that are also covered by Executive Order 13658. The SCA WDR for a janitor on one contract is $14.00, and the wage determination rate for a window washer on a different contract is $20.00.

- Don currently has a 40% productivity rating for his work as a janitor, resulting in a commensurate wage rate of $5.60 per hour. Since Don’s wage rate for this job would be lower than the current Executive Order minimum wage, Don is paid the higher Executive Order rate of $10.60. Because the Executive Order raises Don’s wage rate to $10.60, the section 511 requirements do not apply.

Don currently has a 60% productivity rating for his work as a window washer, resulting in a commensurate wage rate of $12.00 per hour. Since Don’s wage rate for this job is higher than the current Executive Order minimum wage, Don is paid the higher wage rate of $12.00 and, therefore, the section 511 requirements do not apply.

V. Conclusion

The section 511 service requirements apply to employees who are paid commensurate wages that are less than the Federal minimum wage, as defined by section 6(a) of the FLSA, but do not apply to commensurate wages paid under the SCA and Executive Order 13658 when those wages are above the FLSA Federal minimum wage.

For more information about section 14(c) and section 511, please see the WHD Employment of Workers with Disabilities website at: https://www.dol.gov/agencies/whd/workers-with-disabilities.

Footnotes

1 The Federal minimum wage is defined at section 6(a) of the FLSA.

2 For the purposes of this example, the SCA contract is not subject to Executive Order 13658. See section IV.

3 As of January 1, 2019, the current Executive Order 13658 minimum wage is $10.60 per hour. See https://www.dol.gov/agencies/whd/government-contracts/minimum-wage for any updates to the Executive Order 13658 minimum wage.