The U.S. Department of Labor’s Tiger Teams are multi-disciplinary teams of experts designed to analyze state UI systems and process challenges. Tiger Teams work with states to identify ways to enhance their existing efforts and make actionable recommendations, along with allocated grant funding, for states to make near-term impacts within the pillars of Equity & Accessibility, Timeliness & Backlog, and Fraud Prevention & Detection. In addition, the Tiger Teams work across the national UI system to identify promising practices and develop tools and resources for the states.

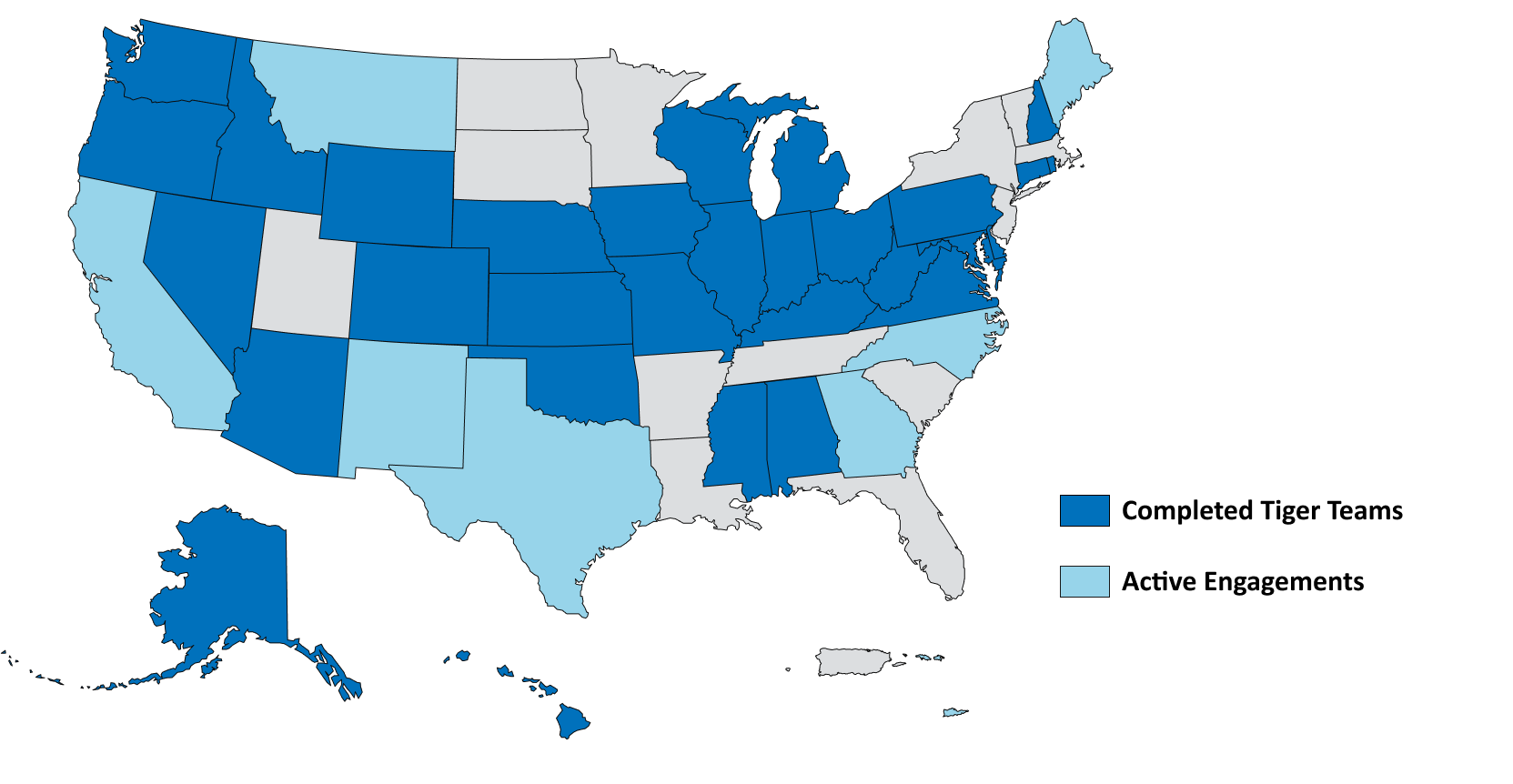

Tiger Team Initiative State Participation

Current as of July 2023

States with completed Tiger Team engagements: Alabama, Alaska, Arizona, Colorado, Connecticut, Delaware, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Maryland, Michigan, Mississippi, Missouri, Nebraska, Nevada, New Hampshire, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, Virginia, Washington State, West Virginia, Wisconsin, and Wyoming

States with active engagements: California, Georgia, Maine, New Mexico, North Carolina, and the US Virgin Islands

Tiger Team trends

In its first 24 months, the UI Tiger Teams Initiative has served 36 states through customized systems-improvement engagements. Following a consultative assessment, the Tiger Teams provide states with recommendations that can be implemented in the short term to revitalize state UI systems through improvements in equity and accessibility, timeliness and backlog processing, and fraud prevention and detection.

These recommendations will improve equity and accessibility in state UI systems by taking service-related actions such as increasing the use of plain language in claimant communications, standardizing translation, and improving equity and accessibility data metrics. Other improvements will help with state timeliness and backlog issues through means such as technology improvements to streamline current processes, including by increasing appropriate automation in making determinations. Finally, these efforts will help with fraud prevention and detection through technology improvements in verifying identity, crossmatching claim data with existing databases, improving the use of the National Association of State Workforce Agencies’ (NASWA’s) Integrity Data Hub and risk analytics, and improving staff training on fraud awareness and prevention.

Equity and accessibility

Equity data collection and metrics

- Help states enhance data collection and analytics capabilities to make sure that claimants of all demographics have equitable access to benefits.

- Use data to understand all the points along the claim journey at which claimants might get stuck and to make sure that undue burdens and barriers to access are addressed.

Essential Impact Team

- Establish a state level data-focused team to implement claimant-centric solutions and continuously improve service delivery.

- This designated team collaborates regularly with internal and external stakeholders to review data, gain insights, validate challenges, and identify, prioritize, and resolve bottlenecks.

Plain language standards

- Identify common communications to claimants that may be hard to understand and may present navigation challenges.

- Redesign critical communications by simplifying the language and making sure claimants know what they are being asked to do, and by when they need to do it.

Language access services

- Provide comprehensive language translation and interpretation across appropriate communication channels in a way that ensures they will be understood by the target audiences.

- Enhance quality of interpreter services and translated resources so that limited English proficient claimants can more easily navigate the benefits process on their own.

Community engagement and feedback loops

- Establish partnerships with claimant-focused community-based organizations for multiple purposes that include, but are not limited to, identification of pain points, communication improvement, and building cultural competency.

- Build on improving access and equity on a regular basis by reaching out directly to claimants, claimant-focused community groups, and community members to learn more about which parts of the UI process claimants find the most challenging and which aspects work well.

- Gather insights along the claim cycle through surveys/questionnaires, chatbots, and social media monitoring, which can be used to make appropriate process changes, better inform outreach campaigns, and enhance user experience.

- Recruit diverse participants to perform user testing of technologies and features and make necessary adjustments to implementations based upon feedback.

Pathway to Equity and Access (online/offline)

- Make sure the metaphorical front doors to systems are open and transparent, so that claimants can access benefits through the methods most comfortable to them (whether online, in person, by phone, or by other means).

- Ensure all current and future online content meets Web Content Accessibility Guidelines, particularly for people with disabilities.

- Promote equitable access by ensuring claimants have in-person access to critical UI material as well as UI staff, and that claimants have the means to complete required activities related to their benefit application and ongoing claim.

Proactive status updates

- Provide the means for claimants to track the status of their claims, which may serve to improve both transparency and customer experience.

- Ensure claim status tracker is intuitive, informative, and easy-to-use, which increases claimant understanding of the claim process and their responsibilities.

- Allow claimants to independently find out where they are in the process, which frees up staff resources from answering basic status questions to helping claimants with more involved questions.

Timeliness and backlog

Case management and dynamic fact finding

- Implement and integrate a case management system to reduce manual effort related to tracking, prioritizing, and assigning workflow items so staff can focus on issuing timely determinations and decisions.

- Identify opportunities to setup dynamic fact-finding questionnaires to gather information through intelligent “question trees.”

- Allow claimants and employers to answer questions more directly related to their situation. Party responses are presented to adjudicators to make a determination and allows the state agency to process claims more efficiently.

Robotic process automation and process re-engineering

- Perform process mapping for process re-engineering and identify opportunities to automate tasks and/or processes.

- Automate manual, non-discretionary tasks of existing processes using Robotic Process Automation (RPA), allowing staff to focus on more critical tasks.

- Identify and prioritize potential use cases for automation.

Intelligent document processing

- Identify opportunities to incorporate optical character recognition/intelligent character recognition (OCR/ICR) technology to assist with sorting, scanning, and routing incoming documents to be read and converted to digital text automatically.

- Reduce manual intervention and data entry necessary for processing documents sent by claimants or employers.

- Re-engineer the adjudication, appeals, and benefit payment control processes to reduce document management backlog and improve the timeliness of services.

Knowledge base tool

- Provide state staff with centralized and up-to-date resources such as scripts/guidance throughout the claims lifecycle to provide claimants with timely and accurate information.

- Robust search capabilities to locate information quickly for daily work activities.

- Measure common inquiries and topics that can then be used to create new training materials, processes, and internal requirements.

Implementing State Information Data Exchange System (SIDES) and uptake campaign

- Implement additional NASWA SIDES exchanges to improve the timeliness and streamline employer information sharing.

- Enhance efficiency by implementing employer communication campaigns leveraging behavioral insight techniques to increase employer participation rates in SIDES.

Reduce number of contacts with claimants

- Identify opportunities to reduce the number of contacts between state agency staff and claimants and making sure those contacts are through efficient means while being mindful of customers’ unique service needs.

- Identify opportunities for improvement in the claims intake process to ensure the state agency is getting the most complete and accurate claimant information.

Fraud Prevention and Detection

Identity proofing

- Implement/refine processes of collecting, validating, and verifying information about a person as a means to verify customers’ identities.

- Implementation of National Institute of Standards and Technology (NIST) compliant identity proofing during the initial claims filing process and for re-accessing their account.

Claim risk scoring (e.g., case management enhancements) and fictitious employer risk scoring

- Sophisticated risk analytics are available to assign a risk-based score to claims to help the state to detect suspect activity early in the claims process, as well as minimize the number of false positives which helps to protect innocent claimants from being flagged for fraud.

- Risk-based scoring to claims/employers to help the state to detect fictitious employer schemes, associating risk scoring to existing/new employer data elements.

Implementing NASWA Behavioral Insights toolkit

- Simplify communications to claimants to allow for quick responses to information requests that will deter fraudulent and unintentional fraudulent activity.

- Implement/enhance wage calculator functionality to facilitate the accuracy of claimant reporting of earnings, which will reduce the number of earning related issues to be adjudicated, reduce improper payments, and reduce the number of established overpayments/underpayments.

Adopt full usage of the NASWA Integrity Data Hub (IDH)

- Establish IDH web-service connectivity to establish real-time crossmatch of the Suspicious Actor Repository (SAR), identity verification (IDV) service, multi-state claimants, fraud alerting, foreign IP addresses, suspicious Email Domains, and related data points.

- Shift customer identity validations and cross matching to point of website registration.

Expand 3rd party crossmatch sources

- Perform front-end crossmatching through various databases, such as Business licensing, Dept Revenue, Drivers Licensing, Social Security Administration data, Prisoner Update Processing System (PUPS) and other public records databases, to help verify that the claimant is who they say they are and are not prohibited from getting benefits using resources.

Identity authentication (e.g., device identification & reputation technology)

- Adopt Device Fingerprinting/Reputation Management – in appropriate use cases, technology that can verify that the device a claimant uses for application of benefits belongs to the claimant. This can help narrow the population that needs to be more carefully scrutinized.

- Tool focuses on establishing a combination of inputs to assist in the authentication of a user’s identity during ongoing use with state UI systems.

Investigative case management

- Case Management integration can help prioritize investigations and automate the assignment of tasks.

- Enables states to monitor of claim status and progress in real time, as well as streamlines analytics and reporting features.

Integration of CAPTCHA

- This provides an additional layer of prevention from mass intrusion, including bot attacks.

Interactive Voice Recognition (IVR) enhancements

- Incorporate telephony within the states IVR system to automate the state’s identity verification process.

- Ensure that identity verification is happening more consistently, accurately, and completely.

- Reduce the overall call handle time allowing states to serve more customers.

Online collections functionality

- Enable claimants to make payments through a secure online portal via credit card, debit card or automated clearing house (ACH).

- Reduce the number of checks that are manually processed will allow staff to repurpose and focus on other substantive integrity functions.

Fraud awareness training

- Develop fraud awareness training program of available resources as appropriate to state needs.

Learn more

For more detailed information about the Department's UI Tiger Team Initiative, see Unemployment Insurance Program Letter (UIPL) No. 02-22, Change 2.