Resolve FLSA and FMLA Violations Quickly and Avoid Litigation

The Wage and Hour Division (WHD) offers the Payroll Audit Independent Determination (PAID) program to help employers resolve potential minimum wage and overtime violations under the Fair Labor Standards Act (FLSA), as well as certain potential violations under the Family and Medical Leave Act (FMLA). This program allows employers to correct mistakes efficiently and ensure employees receive back wages or other remedies promptly, all while avoiding litigation.

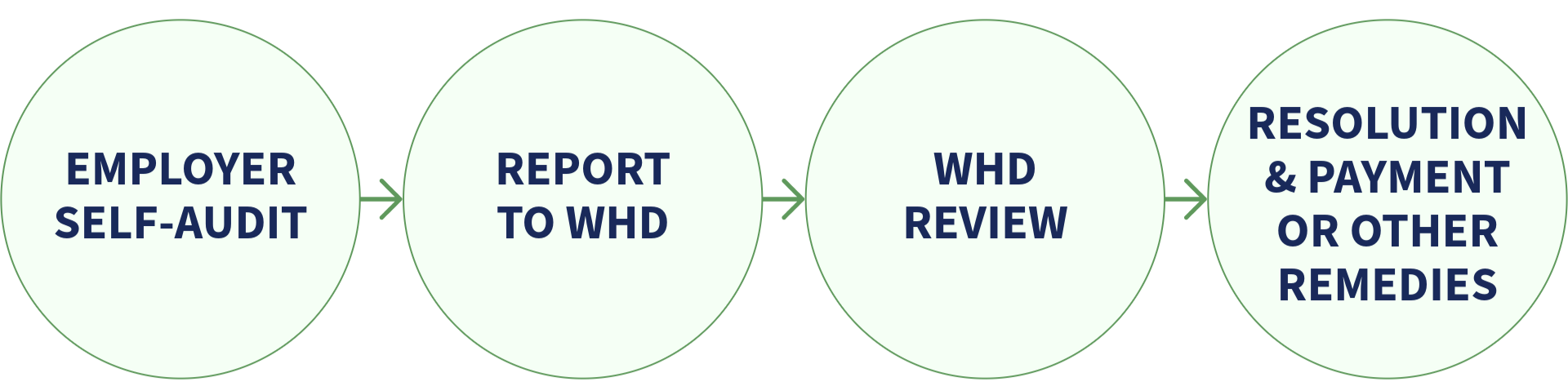

Under PAID, employers are encouraged to conduct audits and, if they discover FLSA or FMLA violations, to self-report those violations. Employers may then work in good faith with WHD to correct their mistakes and to quickly provide 100% of the back wages due or other remedies to their affected employees.

The PAID program allows employers to identify and correct potential minimum wage, overtime, and certain FMLA violations efficiently while working with us to ensure employees receive back wages.

- Employer Self-Audit -- Employers should review compliance assistance materials; specifically identify the potential violations, employees affected, and timeframes each employee was affected; calculate the amount of back wages owed to each employee, if applicable; and specify any other FMLA remedies that are necessary for compliance.

- Report to WHD -- Employers then contact WHD to discuss their findings, back wage calculations, remedies due, supporting evidence, and methodology. Employers must also submit a concise statement of the scope of the potential violations for inclusion in a release of liability, and certification that the employer reviewed and meets all the program's requirements.

- WHD Review -- WHD will evaluate the submission and provide guidance on next steps, including any additional information required to review the back wages and other remedies due for the identified compensation and leave practices.

- Resolution & Payment or Other Remedies -- Employers pay back wages and/or remedies within 15 days of receiving the summary of unpaid wages and provide proof of payment and documentation of other remedies to WHD.

To participate in PAID, you must be (1) covered by the FLSA and/or the FMLA, (2) interested in proactively resolving potential minimum wage, overtime, tip retention and/or FMLA claims, and (3) willing to commit to future compliance under the FLSA and/or the FMLA.

Coverage Under FLSA

Does your organization have two or more employees?

- If yes, go to the next question.

- If no, your employee is not covered under the FLSA by enterprise coverage but still may be covered under individual coverage (see below).

Is your organization:

- A Federal, state, or local government agency;

- A hospital, or an institution primarily engaged in the care of the sick, the aged, or the mentally ill or developmentally disabled who live on the premises (it does not matter if the hospital or institution is public or private or is operated for profit or not-for-profit);

- A pre-school, elementary or secondary school, institution of higher learning (e.g., college), or a school for mentally or physically handicapped or gifted children (it does not matter if the school or institution is public or private or operated for profit or not for profit); or

- A company/organization with annual dollar volume of sales or receipts in the amount of $500,000 or more?

- If yes to any one of the above, your employees are covered under the FLSA by enterprise coverage.

- If no, your employees are not covered under the FLSA by enterprise coverage but still may be covered under individual coverage.

Do your employees:

- Engage in interstate commerce;

- Produce goods for interstate commerce and/or provide services closely related and directly essential to the production of goods for interstate commerce; or

- Provide domestic service?

- If yes to any of the above, your employees are covered under the FLSA by individual coverage.

- If no, your employees are not covered under the FLSA by individual coverage.

Additional information on FLSA Coverage:

Fact Sheet #14: Coverage Under the Fair Labor Standards Act (FLSA)

Coverage under the FMLA

Is your organization:

- A private-sector employer who employs 50 or more employees in 20 or more workweeks in either the current calendar year or previous calendar year?

- A Federal, state, or local government agency, regardless of the number of employees?

- A local educational agency (including public school boards, public elementary and secondary schools, and private elementary and secondary schools, regardless of the number of employees)?

If not, your business is not covered by the FMLA.

Additional information on FMLA Coverage:

Fact Sheet #28: The Family and Medical Leave Act

If you have any questions about PAID, coverage or general compliance concerns, you can call WHD confidentially at 1-866-4USWAGE.

When contacting WHD about potentially participating in PAID to resolve FLSA minimum wage, overtime, or tip retention violations, be prepared to certify the following as true:

- You are an employer covered by the FLSA.

- The employees included in your proposed PAID self-audit are not subject to prevailing wage requirements under the H-1B, H-2B, or H-2A Visa Programs, the Davis Bacon Act or Related Acts, or the Service Contract Act.

- Neither WHD nor a court of law has found within the last three years that you have violated the FLSA minimum wage and/or overtime requirements.

- You are not currently a party to any litigation (e.g., private, with WHD, or with a state enforcement agency) asserting that the compensation practices at issue in this proposed PAID self-audit violate FLSA minimum wage and/or overtime requirements.

- To the best of your knowledge, WHD is not currently investigating the compensation practices at issue in this proposed PAID self-audit.

- You have informed WHD of any recent complaints of which you are aware by your employees or their representatives to you or your representatives, to WHD, or to a state wage enforcement agency asserting that the compensation practices at issue in this proposed PAID self-audit violate FLSA minimum wage and /or overtime requirements.

- You have not previously participated in PAID within the last three years to resolve potential FLSA minimum wage or overtime violations.

- You acknowledge that you have a continuing duty, during the audit process, to update WHD on any changes to the above information and/or representations.

- You acknowledge that participating in the PAID program does not cut off employee rights under other state or local laws.

WHD maintains its discretion to determine whether to accept employers into PAID. Potential participants are examined on a case-by-case basis.

When contacting WHD about potentially participating in PAID, be prepared to certify the following is true:

- You are an employer covered by the FMLA.

- The employees included in your proposed PAID self-audit are not subject to prevailing wage requirements under the H-1B, H-2B, or H-2A Visa Programs, the Davis Bacon Act or Related Acts, or the Service Contract Act.

- Neither WHD nor a court of law has found within the last three years that you have violated the FMLA.

- You are not currently a party to any litigation (e.g., private, with WHD, or with a state enforcement agency) asserting violation of the FMLA practices at issue in this proposed PAID self-audit.

- WHD is not currently investigating the FMLA practices at issue in this proposed PAID self-audit.

- You have informed WHD of any recent FMLA or state leave law complaints of which you are aware by your employees or their representatives to you or your representatives, to WHD, or to a state enforcement agency asserting that the leave practices at issue in this proposed PAID self-audit violate the FMLA requirements.

- You have not previously participated in PAID within the last three years to resolve potential FMLA violations resulting from the leave practices at issue in this proposed PAID self-audit.

- You have a continuing duty, during the audit process, to update WHD on any changes to the above information and/or representations.

- You acknowledge that participating in the PAID program does not cut off employee rights under other federal, e.g., Americans with Disabilities Act, Pregnant Workers Fairness Act, Title VII, state, or local laws.

WHD maintains its discretion to determine whether to accept employers into PAID. Potential participants are examined on a case-by-case basis.

Now that you have confirmed that your business must comply with the FLSA, to participate in PAID, you must review compliance assistance materials about the FLSA. This material will not only help you understand the program but also help you more fully understand your minimum wage and overtime obligations under the FLSA before conducting your self-audit.

You will be asked to enter your name and the name of your business at the start of the review. You must review the material presented on each screen before proceeding to the next item. Materials include a series of short videos on FLSA topics. Videos are hosted on YouTube so please ensure you are viewing them on a device that supports YouTube.

After you complete the Compliance Assistance Review, the system will generate a Certificate of Completion. Please print the certificate or save it as a pdf, as you will need to present it to WHD with the rest of your documents.

If you would like additional information, you may visit or bookmark the Compliance Assistance page.

These materials are for general information and are not regulations.

Now that you have confirmed that your business must comply with the FMLA, to participate in PAID, you must review compliance assistance materials about the FMLA. This material will not only help you understand the program but also help you more fully understand your obligations under the FMLA before conducting your self-audit.

You will be asked to enter your name and the name of your business at the start of the review. You must review the material presented on each screen before proceeding to the next item. Materials include videos on FMLA topics. Videos are hosted on YouTube so please ensure you are viewing them on a device that supports YouTube.

After you complete the Compliance Assistance Review, the system will generate a Certificate of Completion. Please print the certificate or save it as a pdf, as you will need to present it to WHD with the rest of your documents.

Start the Certification Process:

If you would like additional information, you may visit or bookmark the Compliance Assistance page.

These materials are for general information and are not regulations.

Once you have completed the PAID Compliance Assistance review and generated and saved your Completion Certificate, you must audit your business's compensation practices. Before moving to the next steps, be sure that you have:

- Specifically identified the potential FLSA and/or FMLA violations that may have occurred in the last two years;

- Identified which employees were affected within the last two years;

- Identified the timeframes, within the last two years, in which each employee was affected; and

- Calculated the amount of back wages you believe are owed to each employee, and/or specify any other FMLA remedies that are necessary to be in compliance.

IMPORTANT: If you pay back wages to your employees before WHD reviews the back wages owed, those employees will not have waived their rights to pursue a private lawsuit for these potential violations under the FLSA and/or FMLA because WHD did not supervise the settlement of these back wages.

When you contact the WHD district office, you will be asked to provide WHD with:

- The names, addresses, and phone numbers of all affected employees;

- Your back wage calculations along with supporting evidence and methodology used to make those calculations;

- Any other FMLA remedies described above, along with supporting evidence and methodology;

- Payroll records and any other relevant evidence;

- For FLSA violations, records demonstrating hours of work of each affected employee during the time frame at issue;

- For FMLA violations, records demonstrating the nature of the violation and impact to affected employee(s);

- Records to show that you have corrected the compensation and/or leave practices to comply with the FLSA and/or the FMLA;

- A concise explanation of the scope of the potential violations for possible inclusion in a release of liability;

- A certification that you reviewed all of the program's information, terms, and compliance assistance materials; and

- A certification that you meet all eligibility criteria of the program.

WHD will then evaluate this information and contact you to discuss next steps, including collecting any other information necessary for WHD to review the back wages or other remedies due for the identified violations. If WHD accepts you into PAID, WHD will provide you with the proposed scope of the release of liability for the potential violations presented.

After WHD reviews the back wages due, it will issue a summary of unpaid wages to the employer. WHD will also issue forms describing the settlement terms for each employee, which employees may sign to receive payment. The employee may freely choose to accept or decline the payment. The employer may not retaliate against any employee who does not accept the payment. The release of claims provided in the form will reflect the previously provided release language and, again, will be limited to the potential violations for which the employer had paid back wages. Employers are responsible for issuing prompt payment; WHD will not distribute the back wages.

Employers must pay all back wages due within 15 days of receiving the summary of unpaid wages and provide proof of payment to WHD expeditiously.

If other FMLA remedies were due, WHD will review the records of violations and proposed remedies and confirm adequacy of the proposed remedy based on your submission. Remedies must be implemented within 15 days of receiving the finalized self-audit results from WHD.

How to Get More Information

If you have questions or need additional information, contact us online or call 1-866-487-9243 between 8 a.m. and 5 p.m. in your time zone.

Last updated on September 10, 2025.