Fact Sheet #39H(a): Pre-Employment Requirements for Youth with Disabilities under Rehabilitation Act Section 511

July 2022

This fact sheet provides general information on the impact of section 511 of the Rehabilitation Act of 1973 (section 511) on the payment of subminimum wages (SMWs) to individuals with disabilities who are age 24 or younger (youth) under section 14(c) of the Fair Labor Standards Act (FLSA). Section 511 limits the ability of employers to pay SMWs to workers with disabilities, when the employer holds a certificate under section 14(c) that would otherwise allow the payment of SMWs. These limits are designed to ensure that workers who are paid SMWs under section 14(c) have access to necessary support and resources. Importantly, an employer that has not complied with the requirements of section 511 does not have authority to pay SMWs to workers with disabilities under section 14(c).

Section 511 requires that individuals with disabilities who are age 24 or younger complete several requirements (“pre-SMW services”) designed to improve their access to competitive integrated employment, before they are paid SMWs. Section 511 also requires that all workers with disabilities who are paid SMWs, of any age (including youth), receive other required services. Employees must receive these services twice in the first year they are hired at SMWs and at least one time every year after. Such requirements help ensure that workers receive critical information and services in a timely fashion, which helps maximize opportunities to obtain competitive integrated employment. This fact sheet focuses on the pre-SMW service requirements for youth with disabilities seeking a job paying SMWs. Please see Fact Sheet #39H(b) for more information about the requirements for all employees, including youth with disabilities, and Fact Sheet 39H for general information about section 511.

Pre-Employment Requirements for Youth with Disabilities

Section 511 does not allow employers with a section 14(c) certificate to pay SMWs to any individual with a disability who is 24 years of age or younger, unless the employer has first obtained, reviewed, and verified, that the youth has completed three requirements before being paid SMWs:

- Transition services under the Individuals with Disabilities Act (IDEA) and/or pre-employment transition services under section 113 of the Rehabilitation Act;

- Vocational rehabilitation (VR), as follows:

- The youth applied for VR services and was found ineligible, OR

- The youth applied for VR services and was found eligible, AND

- had an individualized plan for employment (IPE), AND

- worked toward an IPE employment outcome for a reasonable period without success, AND

- the VR case was closed; and

- Career counseling, and information and referrals to Federal and State programs and other resources in the individual’s local area.

The Designated State Unit (DSU), which is the VR agency in the state, is required to provide these services (or ensure that they are provided) and to provide youth with a document showing that they completed the services as soon as possible after the services, but usually within 45 calendar days. The DSU must also provide a cover sheet that lists each of the documents that have been provided to the youth. The employer is required to keep a copy of the documents that show that each youth received these services before being paid SMWs.

Employers who hired youths before July 22, 2016, did not have to obtain, verify, or maintain their pre-SMW service documents. However, the employer is required to ensure that each such youth receives regular career counseling and information during SMW employment, as required by section 511 and discussed in more detail on Fact Sheet #39H(b).

Documentation to be Kept by the Employer

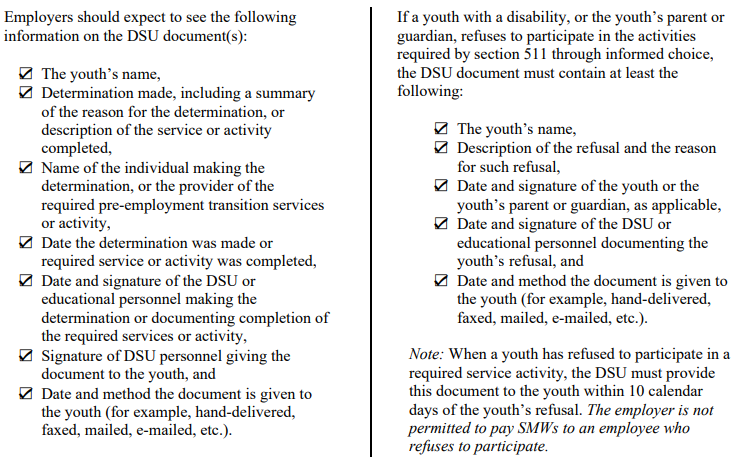

Employers must keep records showing that each youth has completed the pre-SMW services. An employer should keep the cover sheet and any other related documents provided to the employer.

For example, an employer wishes to pay SMWs to a youth with a disability. The employer asks the youth to provide a copy of the documents that the DSU provided to them when they completed their pre-SMW services.

Scenario 1: The youth gives the employer the cover sheet they received from the DSU. The employer must keep a copy of this cover sheet, review that each of the required pre-SMW services were documented as completed, and verify that the documentation was signed by the DSU.

Scenario 2: The youth says that they lost the cover sheet from the DSU but that they do have other documents, and provides them to the employer. Upon review, the employer sees that these other documents contain the required information that the DSU must provide to the youth. The employer must keep a copy of these documents.

Scenario 3: The youth cannot provide any documents to the employer and the employer cannot verify with the DSU that all of the pre-SMW services were completed. The employer in this scenario cannot pay the youth less than the full Federal minimum wage until the pre-SMW services are completed, documented, and verified, or the youth turns age 25.

Pre-SMW Services Documentation Can be Used by Multiple Employers

The DSU must provide the individual with documents when they complete their pre-SMW services. These documents belong to the worker and can be shown to another employer if the individual decides to get another SMW job.

Example: XYZ Inc. wants to hire Luca, a 23-year-old, and pay him SMWs under section 14(c). XYZ Inc. explains to Luca and his mother that Luca first needs to receive pre-SMW services. Luca’s mother says that he already received pre-SMW services before going to work at another job where he worked at SMWs last year. The next day, Luca provides XYZ Inc. with the DSU cover sheet and supporting documents that he had previously provided to his former employer. XYZ Inc. verifies the documents and keeps a copy of them for its files.

| 2021 | 2022 |

|---|---|

| Luca worked at ABC Inc. Prior to beginning work at SMWs, ABC Inc. obtained, verified, and maintained documents reflecting Luca’s completion of pre-SMW services. | Luca quit working at ABC Inc. and was hired by XYZ Inc. to work at SMWs. Luca provides the same documents from the DSU to show he completed his pre-SMW services to XYZ Inc. |

| Both ABC Inc. and XYZ Inc. can use Luca’s pre-SMW services documents from the DSU to satisfy each employer’s requirement to obtain, verify, and maintain the documents showing he completed his pre-SMW services. The pre-SMW documents can be used by multiple employers. | |

Timing for Youth Pre-SMW Services

Pre-SMW services must be received before an employer can pay the youth SMWs. If an employer hires a youth before it obtains, reviews, and verifies documents showing that the youth has completed the pre-SMW services, the employer must pay at least the Federal minimum wage for all hours worked until it can obtain and verify the documents showing that the youth has completed all pre-SMW services, or until the youth turns age 25.

For example, an employer with a 14(c) certificate hires a youth with a disability to be paid at SMWs, but the employer is unable to determine if the youth completed the required pre-SMW services. While the employer is seeking to obtain the documents showing that pre-SMW services were received, the employer must pay the youth at least the Federal minimum wage for all hours of work. After the employer receives and verifies the documents showing that the youth has completed all pre-SMW services, it may pay the youth SMWs according to the requirements of section 14(c).

Where to Obtain Additional Information

For additional information, visit our Wage and Hour Division Website: http://www.dol.gov/agencies/whd and/or call our toll-free information and helpline, available 8 a.m. to 5 p.m. in your time zone, 1-866-4USWAGE (1-866-487-9243).

This publication is for general information and is not to be considered in the same light as official statements of position contained in the regulations.