Introduction

Plant and business closings, downsizings, and reductions in hours affect employees in numerous adverse ways. Workers lose income, the security of a steady job and, often, the health and retirement benefits that go along with working full-time. As a dislocated worker, you may have questions about your benefits, such as: What happens to my health benefits? Can I keep my health coverage until I get another job? Do I have access to my retirement funds?

You may have rights to certain health and retirement benefit protections even if you lose your job.

If your company provided a group health plan, you may be entitled to temporary continued health benefits if you cannot find a job immediately. You and your family may also have more affordable or more generous options for health coverage available to you, such as through a spouse's plan, the individual Marketplace, and certain governmental programs.

You should also understand how your retirement benefits are affected.

Knowing your rights can help you protect yourself and your family until you are working full-time again. This booklet addresses some of the common questions dislocated workers ask. There is also a brief guide to additional resources at the back. Together, they can help you make critical decisions about your health care coverage and your retirement benefits.

Protecting Your Health and Retirement Benefits

The Employee Benefits Security Administration enforces the Employee Retirement Income Security Act (ERISA), which provides rights and protections for private-sector health and retirement plan participants and their beneficiaries.

The Health Insurance Portability and Accountability Act (HIPAA) provides special enrollment rights in other group health coverage for workers and their family members (for example, in a spouse's employer-provided plan).

The Consolidated Omnibus Budget Reconciliation Act (COBRA) provides workers with the right to continue their health coverage in their former employer's plan for a limited time after they lose their jobs.

The Affordable Care Act (ACA) also provides special enrollment rights for individual coverage in the Health Insurance Marketplace®. The ACA includes additional health coverage protections for dislocated workers and their families. For example, group health plans and Marketplace plans cannot deny health coverage to individuals due to a preexisting condition.

The following questions and answers explain these laws and how they may affect you.

Maintaining Your Health Coverage

I lost my job. Is there any way I can get health coverage for myself and my family?

Even if you are healthy, you never know when you might need health coverage. HIPAA, COBRA, and the ACA all provide ways for you to stay covered. You may be able to:

- Enroll in another group health plan

- Continue in your old plan

- Find individual health coverage

You, your spouse, and your dependents each have the independent right to decide among various options for continuing health coverage. For instance, you may enroll in your spouse's plan, while one of your dependents may elect COBRA coverage through your former employer's plan.

Enrolling in Another Plan

HIPAA offers protections for people who lose their jobs and their health coverage. The law provides additional opportunities to enroll in certain health plans if you lose other coverage or experience certain life events. The law also prohibits discrimination against employees and their dependents based on any health factors they may have, including prior medical conditions, previous claims experience, and genetic information.

For health coverage through an insurance company, state laws may offer additional protections. Check your plan documents or ask your plan administrator to see if your plan is insured. If it is, visit the National Association of Insurance Commissoners' website for contact information for your state.

How can I enroll in a new plan?

One option that may be more cost-effective for maintaining health coverage is special enrollment. If other employer-sponsored group health coverage is available (for example, through your spouse's employer-provided plan) and you are eligible, you should consider special enrollment in that plan. It allows you and your family to enroll, regardless of enrollment periods. To qualify, you must request enrollment within 30 days of losing eligibility for other coverage.

After you request special enrollment due to your loss of eligibility for other coverage, your new coverage will begin no later than the first day of the next month.

You and your family members each have an independent right to choose special enrollment under an employer-sponsored group health plan for which you or your family members are eligible. A description of special enrollment rights should be included in the plan materials you received when you were initially offered the opportunity to sign up for the plan.

Special enrollment rights also arise in the event of a marriage, birth, adoption, or placement for adoption. You have to request enrollment within 30 days of the event. In special enrollment as a result of birth, adoption, or placement for adoption, coverage is retroactive to the day of the event. In the case of marriage, coverage begins on the first day of the next month.

You and your dependents may also have special enrollment rights if you:

- Lose coverage under a state Children's Health Insurance Program (CHIP) or Medicaid or

- Are eligible to receive premium assistance under those programs.

You or your dependent must request enrollment within 60 days of losing coverage or the determination of eligibility for premium assistance. You may be eligible under CHIP or Medicaid for assistance to pay your group health premiums. For more information, see Finding Individual Health Coverage.

What coverage will I get when I take advantage of a special enrollment opportunity?

Employer-sponsored group health plans must offer special enrollees the same benefits that would be available if you were enrolling for the first time. They cannot require you to pay more for the same coverage than individuals who enrolled when they were first eligible for the plan.

Can my new plan deny me coverage or benefits because I have a preexisting condition?

Under the ACA, an employer-sponsored group health plan cannot deny you coverage due to a preexisting condition. A group health plan generally cannot limit or deny benefits relating to a health condition that was present before you enrolled.

Can my new group health plan deny me or charge me more for coverage based on my health status?

No. An employer-sponsored group health plan cannot deny you and your family coverage because of a health factor, including:

- Health status,

- Physical and mental medical conditions,

- Claims experience,

- Receipt of health care,

- Medical history,

- Genetic information,

- Evidence of insurability, and

- Disability.

The plan also cannot charge you more than similarly situated individuals because of a health factor. However, the plan can distinguish among employees by employment-based classifications, such as those who work part-time or in another geographic area, as long as those classifications are genuine and are consistent with the employer's usual business practice. The plan can establish different benefits or premiums for those different groups.

Continuing in Your Old Plan

Another way to maintain health coverage between jobs is to elect COBRA coverage.

While you may lose health coverage from your former employer, you may have the right to continue coverage under certain conditions. Health continuation rules enacted under COBRA apply to dislocated workers and their families as well as to workers who change jobs or whose work hours have been reduced, thus causing them to lose eligibility for health coverage. This coverage is temporary, however, and the employee may have to pay the full cost, which may be more than the employee was paying while employed.

Am I eligible for COBRA coverage?

To be eligible for COBRA coverage:

- You must have been enrolled in your employer's health plan when you worked,

- The health plan must continue to be in effect for active employees, and

- You must elect COBRA coverage.

Which employers are required to offer COBRA coverage?

Employers with 20 or more employees are usually required to offer COBRA coverage. COBRA applies to private-sector employees and to most state and local government workers.

In addition, many states have laws similar to COBRA, including those that apply to insurers of employers with fewer than 20 employees (sometimes called mini-COBRA). Check with your state insurance commissioner's office to see if such coverage is available to you.

What if the company closed or went bankrupt and there is no health plan?

If there is no longer a health plan, no COBRA coverage is available. However, if the company offers another plan, you may be eligible for coverage under that plan.

Union members who are covered by a collective bargaining agreement that provides for a medical plan also may be entitled to continued coverage.

How do I find out about COBRA coverage, and how do I elect to take it?

Employers or health plan administrators must provide an initial general notice if you are entitled to COBRA coverage. You probably received this initial notice when you were hired.

When you are no longer eligible for health coverage, your employer must provide you with an election notice regarding your rights to COBRA continuation benefits.

Here is the sequence of events:

Within 30 days after your termination or a reduction in hours that causes you to lose health benefits, employers must notify their plan administrators.

Within 14 days after the administrator has received notice from the employer, the plan administrator must notify you and your covered dependents, in writing, of your right to elect COBRA coverage.

By the 60th day after the written notice is sent or the day health care coverage ceased, whichever is later, you must respond to this notice and elect COBRA coverage. If you do not respond, you will lose all rights to COBRA coverage.

Spouses and dependent children covered under your health plan have an independent right to elect COBRA coverage upon your termination or reduction in hours. If, for instance, you have a family member with an illness when you are laid off, that person alone can elect coverage.

Certain Trade Adjustment Assistance (TAA) Program participants have a second opportunity to elect COBRA coverage:

- Individuals who are eligible and receive Trade Readjustment Allowances,

- Individuals who would be eligible to receive Trade Readjustment Allowances, but have not yet exhausted their unemployment insurance benefits, and

- Individuals receiving benefits under Alternative Trade Adjustment Assistance or Reemployment Trade Adjustment Assistance, and who did not elect COBRA during the general election period.

This second election period is measured 60 days from the first day of the month in which an individual is determined eligible for and receives the TAA benefits. For example, if an eligible individual's general election period runs out at the beginning of the month, they would have approximately 60 more days to elect COBRA. However, if this same individual meets the eligibility criteria at the end of the month, the 60 days are still measured from the first of the month, in effect giving the individual about 30 days.

You must elect COBRA no later than 6 months after TAA-related loss of coverage. COBRA coverage chosen during the second election period typically begins on the first day of that period. More information about the Trade Act is available on the Department of Labor's Employment and Training Administration website.

If I elect COBRA, how much do I pay?

When you were an active employee, your employer may have paid all or part of your group health premiums. Under COBRA, as a former employee, you will usually pay the entire premium – that is, the amount you paid as an active employee plus the amount of the contribution made by your employer. In addition, there may be a 2 percent administrative fee.

It is likely that there will be a lapse of a month or more between the date of layoff and the time you make the COBRA election decision, so you may have to pay health premiums retroactively – from the time of separation from the company. The first premium, for instance, will cover the entire time since your last day of employment with your former employer.

You should also be aware that you have to pay for COBRA coverage even if you do not receive a monthly statement. If timely payment is not made, the employer may cease providing coverage.

Although they don't have to do so, some employers may pay for part or all of the cost of health coverage, including COBRA coverage, for terminating employees and their families as part of a severance agreement. If you do receive this type of severance benefit, talk to your plan administrator about how this would impact your COBRA coverage or your special enrollment rights.

If I elect COBRA, can I later enroll in a Health Insurance Marketplace® plan?

If you elect COBRA coverage, you will have another opportunity to request special enrollment in a Marketplace plan or new group health plan if you have a new special enrollment event, such as marriage, the birth of a child, or exhausting your COBRA coverage. You may also choose to drop your COBRA continuation coverage and enroll in a Marketplace plan during the annual Marketplace open enrollment period, even if you have not yet exhausted your COBRA coverage.

You must complete the maximum period of COBRA coverage available (usually 18 months for job loss) to exhaust your COBRA coverage. If you choose to terminate your COBRA coverage early or fail to pay your COBRA premiums, you generally will have to wait to enroll in other coverage until the next open enrollment period for the Marketplace or the new group health plan.

If you decide to change plans, you may want to keep your COBRA coverage until your Marketplace plan is effective to avoid a gap in coverage.

When does COBRA coverage begin?

Once you elect coverage and pay for it, COBRA coverage begins on the date your health care coverage stopped, even if that date has already passed.

How long does COBRA coverage last?

Generally, individuals who qualify are initially covered for a maximum of 18 months, but coverage may end earlier under certain circumstances, including:

- You don't pay your premiums on time,

- Your former employer decides to discontinue a health plan altogether,

- You obtain coverage with another employer's group health plan, or

- You qualify for Medicare benefits.

Employers may offer longer periods of COBRA coverage, but they are only required to do so under special circumstances, such as disability (yours or a family member's), an employee's death or divorce, or when an employee's child ceases to meet the definition of a dependent child under the health plan.

Who can answer other COBRA questions?

Three federal agencies are responsible for COBRA administration. The Department of Labor handles questions for private-sector employees. The Department of Health and Human Services handles questions for state and local government workers. The Internal Revenue Service, as part of the Department of the Treasury, has other COBRA responsibilities.

You can get more details about COBRA on the Employee Benefits Security Administration's website.

To receive a copy of An Employee's Guide to Health Benefits Under COBRA or to speak to a benefits advisor, you can contact the Employee Benefits Security Administration online or call 1-866-444-3272.

For telephone numbers of the Department of Health and Human Services office closest to you, call 1-844-USA-GOV1 (872-4681) or visit USA.gov.

Possible benefits for trade affected workers

The Trade Adjustment Assistance Program helps workers who have lost or may lose their jobs due to negative effects of global trade. This program seeks to provide adversely affected workers with opportunities to obtain the skills, credentials, resources, and support necessary to become reemployed.

Through grants to states, workers who are part of a worker group that is covered by a certified Trade Adjustment Assistance petition may be eligible for benefits and services such as employment and case management services, training, job search and relocation allowances, wage supplements for older workers, and income support (called Trade Readjustment Allowances) while in training. States receive Trade Adjustment Assistance funds throughout the year. For more information about this program, visit the Employment and Training Administration's website or call 1-888-DOL-OTAA (365-6822).

The Health Coverage Tax credit expired on December 31, 2021. If you have questions about the Health Coverage Tax Credit, visit the IRS's website.

Finding Individual Health Coverage

Marketplace Coverage

The Health Insurance Marketplace® is another way for workers who lose their jobs to find comprehensive health coverage for themselves and their families. You may be eligible for a premium tax credit that will lower your monthly health insurance bill, and cost-sharing reductions that will lower your out-of-pocket costs for deductibles, coinsurance, and copayments.

In the Marketplace, you can compare your coverage options and see what your premium, deductibles, and out-of-pocket costs will be before you decide to enroll. You can also choose between different categories and types of plans.

A Marketplace plan, like a group health plan, cannot limit or deny you coverage due to a preexisting health condition.

When can I enroll in Marketplace health coverage if I lose my job-based coverage?

Losing your job-based health coverage is a special enrollment event that allows you to enroll in a Marketplace plan outside of the open enrollment period. To qualify for special enrollment, you must select a plan within 60 days (before or after) of losing your job-based coverage. Keep any documentation you have of your current coverage and effective dates, because you may need it when you apply for Marketplace coverage.

Additionally, every year (usually November 1), there is an open enrollment period when anyone can enroll in a Marketplace plan effective January 1. You also can change from your current Marketplace plan to another Marketplace plan during open enrollment. Your insurance company will send you information about any updates to the premiums and benefits for your current plan so you can decide if you want to make changes.

If I enroll in coverage through the Marketplace, when does coverage begin?

The date your coverage will start depends on when you select a plan. For more information, visit HealthCare.gov.

If you need health coverage in the time between losing your job-based coverage and beginning coverage through the Marketplace (for example, if you or a family member needs medical care), you may want to elect COBRA coverage from your former employer's plan. Electing COBRA will ensure you have health coverage until the coverage through the Marketplace begins. For more information, see Continuing in Your Old Plan.

You should also consider your new plan's eligibility requirements, including any waiting period that applies, and make sure you are covered until you enroll in your new plan.

How do I apply for coverage through the Marketplace?

You can apply for Marketplace coverage online at visit HealthCare.gov or by calling 1-800-318-2596. Before you begin, review plans and prices available in your area.

When I get a new job, can I change my health coverage?

When you get a new job, you can consider enrolling in your new employer's group health plan if they offer one. Talk to your new employer about eligibility for the new plan, the benefits it offers, and how to enroll. If you have Marketplace coverage at the time you get a new job, you may no longer be eligible for any premium tax credit you may have been receiving. If you enroll in health coverage at your new job, you can end your Marketplace coverage by logging into your account or contacting the Marketplace call center at 1-800-318-2596. For more information, visit HealthCare.gov.

Medicaid and CHIP

When you fill out a Marketplace application, you also can find out if you and your family qualify for free or low-cost coverage from Medicaid and/or the Children's Health Insurance Program (CHIP).

Medicaid is a state-administered health coverage program for low-income families and children, pregnant women, the elderly, people with disabilities, and in some states, other adults. While the Federal government provides a portion of the funding and sets guidelines, states can choose how to design their program, so Medicaid varies by state. To find information on your state's program, visit Medicaid's website.

In addition, children in families who don't have health coverage due to a temporary reduction in income (for instance, due to job loss) may be eligible for CHIP, a Federal/state partnership that helps provide children with health coverage. Like Medicaid, states have flexibility with CHIP programs. They may choose to expand their Medicaid programs, design separate child health insurance programs, or create a combination of both.

You can apply for and enroll in Medicaid or CHIP any time of year. If you qualify, your coverage can begin immediately. Visit HealthCare.gov or call toll-free 1-800-318-2596.

You can also apply for Medicaid by contacting your state Medicaid office. Find out more at Medicaid.gov.

To learn more about the CHIP program in your state, call 1-877-KIDS NOW (543-7669) or visit InsureKidsNow.gov.

Protecting Your Retirement Assets

ERISA protects the assets of millions of Americans so that funds placed in your retirement plan will be there when you retire.

Dislocated workers face two important issues when they leave employment: access to retirement funds and the continued safety of their retirement plan investments.

What happens to my retirement money if I lose my job?

Money that you and your employer put toward your retirement doesn't just disappear if you lose your job. There are several things that could happen (depending on the type of benefit plan and the plan documents), including:

- Getting a lump sum distribution when you leave the company

- Your retirement money staying in the plan until you reach retirement age

- Rolling over your retirement money into a new plan

Can I get my retirement money if I am laid off?

Generally, if you are enrolled in a 401(k), profit sharing, or other type of defined contribution plan (a plan in which you have an individual account), your plan may provide a lump sum distribution of your retirement money when you leave the company. A lump sum distribution means you get the money all at once.

However, if you are in a defined benefit plan (a plan in which you receive a fixed, pre-established benefit), your benefits begin at retirement age. These types of plans generally distribute money through an annuity, which comes in the form of multiple payments to you over time. They are less likely to allow you to receive money early.

Your plan documents will state whether you have a defined contribution or a defined benefit plan, the form of your retirement plan distribution (lump sum, annuity, etc.), and the date your benefits will be available to you. Some plans do not permit distribution until you reach a specified age. Other plans do not permit distribution until you have been separated from employment for a certain period of time. Some plans process distributions throughout the year, and others only process them once a year. You should contact your plan administrator to find out more.

One of the most important documents defining your benefits is the Summary Plan Description (SPD). It outlines what your benefits are and how they are calculated. Your employer or retirement plan administrator can provide a copy.

In addition, you may request an individual benefit statement showing, among other things, the value of your retirement benefits, the amount you have actually earned to date, and your vesting status. These documents contain important information, regardless of whether you receive your money now or later.

Is my plan required to give me a lump sum distribution?

ERISA does not require that retirement plans provide lump sum distributions. Lump sum distributions are possible only if the plan documents specifically provide for them.

If I withdraw money before I retire, are there any potential negative effects?

Yes. It can affect your unemployment eligibility, the amount of taxes you have to pay, and the amount of money you ultimately end up with.

First, receiving a lump sum or other distribution from your retirement plan may affect your ability to receive unemployment compensation. You should check with your state unemployment office.

In addition, withdrawing money from your retirement plan may mean you have to pay income tax on it. Generally, if the money is withdrawn before age 59 ½, you will also be charged an additional 10 percent tax penalty.

However, you can defer these taxes if you keep the money in your plan or if you "roll over" the money into a qualified retirement plan or Individual Retirement Account (IRA). Your plan generally must withhold 20 percent of an eligible rollover distribution for tax purposes. However, in the case of a "direct rollover," where you elect to have the money sent directly to an eligible retirement plan, including an IRA, there is no tax withholding. The full amount of your eligible rollover distribution is paid into the new eligible retirement plan.

If you do not elect a direct rollover, you will have to make up the 20 percent withholding to avoid tax consequences on the full rollover amount. If an eligible rollover distribution, when added to other rollover distributions you received during the year, is less than $200, the Internal Revenue Service does not require the 20 percent withholding.

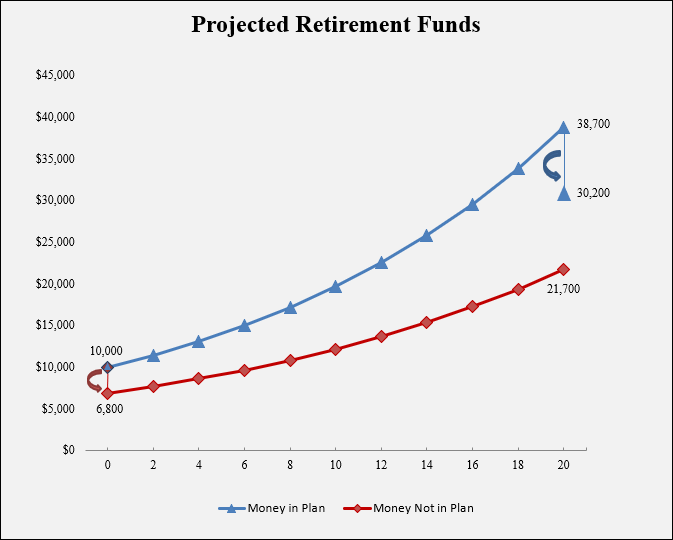

Before you request retirement funds from the plan, you should talk to your employer, bank, union, financial adviser, or tax professional for practical advice about the long-term and tax consequences for your particular situation. Withdrawing money from your plan before retirement age also affects the amount of money you will accumulate over time. The graph below shows the consequences of receiving money from your retirement plan and not depositing it in another qualified plan within the required time limit.

The blue line in the graph above shows how your money grows tax-free if you leave it in the plan for a period of 20 years. When the money is distributed to you, you pay taxes on it, so your account balance decreases.

The red line shows where you start if you remove your money from the plan and do not roll it over into an IRA or another plan. Your account balance decreases during that initial year because you will pay taxes and incur a 10 percent penalty for withdrawing the money before age 59½. After that, your money grows for the next 20 years but at a lower rate because you are paying taxes on your investment earnings.

In this example, you have $10,000 in a retirement plan account or IRA. Your money is invested in a mix of stocks and bonds that earns an average return on investment of 7 percent. In 20 years, your account will grow, with compounding, to $38,700. If you withdraw this amount after you reach age 59½ (the age at which you can receive money without a 10 percent penalty) and pay 22 percent income tax on that amount, you will keep nearly $30,200.

However, if you close your retirement plan account before age 59½, your account balance will decrease from $10,000 to $6,800 after paying the 10 percent penalty and 22 percent income tax. Your money grows for the next 20 years but at a lower rate of growth, because you are paying taxes on your investment earnings. As a result, the value of your money after 20 years will be approximately $21,700.

This means the tax consequences of early withdrawal will cost you 28 percent of your account balance&emdash;in this case, about $8,500&emdash;at retirement.

If you receive retirement funds, you may want to hire someone to manage your money. The law generally requires money managers to be clear and open about their fees and charges and to explain whether they are paid by commissions or for the sales of financial products, such as annuities and mutual funds. Ask questions, get references, and avoid anyone who guarantees good investment performance.

How do I roll over my retirement funds?

You have 60 days to roll over the distribution you received to another qualified plan or IRA, under IRS rules. If you have a choice between leaving the money in your current retirement plan or depositing it in an IRA, you should carefully evaluate the investments available through each option.

You can ask your plan administrator to transfer your account balance directly to your new employer's plan (if it accepts such transfers) or to an individual retirement account (IRA). Transferring your retirement plan account balance to another plan or an IRA will protect the tax advantages of your account and preserve the benefits for retirement.

If I am laid off, are my retirement funds safe?

Generally, your retirement funds should not be at risk even if a plant or business closes. Employers must comply with Federal laws regarding retirement plans, and the consequences of not prudently managing plan assets are serious.

Your benefits may be protected by the Federal government. The Pension Benefit Guaranty Corporation, a Federal government corporation, insures most private-sector traditional pension plans (defined benefit plans). If an employer cannot fund the plan and the plan does not have enough money to pay the promised benefits, the Pension Benefit Guaranty Corporation will assume responsibility as trustee of the plan or provide assistance to the plan. The benefits paid will be up to a certain maximum guaranteed amount.

The Pension Benefit Guaranty Corporation does not insure defined contribution plans.

If your retirement benefit remains with your former employer, stay informed about any changes your former employer makes, including changes of address, mergers, and business name. If you move, give the plan administrator your new contact information.

Our guide, Ten Warning Signs That Your 401(k) Contributions Are Being Misused, can help you monitor your retirement plan for potential financial problems and ensure your retirement security. If you suspect your retirement benefits aren't safe or aren't prudently invested, contact us electronically or call 1-866-444-3272 to be connected to the office nearest you.

What if my company goes out of business and the retirement plan terminates?

In a defined contribution plan, the plan administrator generally submits certain retirement plan and tax-related information to the IRS. This process may delay plan termination and subsequent payment of any benefits. You should contact your plan administrator for information on status and how long it will be before you receive your money.

In a defined benefit plan, the plan administrator generally files certain documents with the IRS and the Pension Benefit Guaranty Corporation if the plan is insured. Once the Pension Benefit Guaranty Corporation approves the termination, benefits are generally distributed in a lump sum or as an annuity within 1 year of termination.

Regardless of the type of benefit plan, you should know the name of the plan administrator. This information is in the latest copy of your SPD. If you can't find the name of your plan administrator, you can contact:

- Your company's personnel department,

- Your union representative (if applicable), or

- The IRS or Pension Benefit Guaranty Corporation (in the case of most defined benefit plans).

You may need to know your employer's identification number, a 9-digit number that can be found on last year's wage tax form (Form W-2). The EBSA regional offices may be able to help you obtain this information.

What if the company declares bankruptcy?

Employer-declared bankruptcy can take many forms. A Chapter 11 (reorganization) bankruptcy may not have any effect on your retirement plan and the plan may continue to exist. A Chapter 7 (final) bankruptcy, where the employer's company ceases to exist, is a more complicated matter.

Because each bankruptcy is unique, you should contact your plan administrator, your union representative, or the bankruptcy trustee and request an explanation of the status of your plan.

Key Documents to Know

You should know your plan's rules regarding how your retirement plan assets and health care benefits are treated if you are laid off.

The following documents contain valuable information about your health care and retirement plans. You should be able to get most of them from your plan administrator, union representative, or human resource coordinator.

- Summary Plan Description (SPD): A brief description of your retirement or health plan

- Summary of Benefits and Coverage: An easy-to-understand summary of your health plan coverage that includes a glossary of common terms

- Summary Annual Report: A summary of the plan's annual finances, which should contain important names and addresses

- Enrollment forms listing you and/or your family members as participants in a plan

- Earnings and leave statements

- Notices or letters showing the date your health care coverage ended or will end

- Individual Benefit Statements showing how much money is in your retirement plan account or the value of your retirement benefits

Save these documents, as well as any memos or letters from your company, union, or bank that relate to your retirement or health plans. They may prove valuable in protecting your retirement and health benefit rights.

For More Information

The Employee Benefits Security Administration offers more information on HIPAA, COBRA, ACA, and ERISA, including:

- An Employee's Guide to Health Benefits Under COBRA

- Work Changes Require Health Choices...Protect Your Rights

- What You Should Know About Your Retirement Plan

For copies of the above publications or if you have questions about your rights to retirement or health benefits under HIPAA, COBRA, the ACA, or ERISA, contact us electronically or call toll-free: 1-866-444-3272. If you are deaf, hard of hearing, or have a speech disability, please dial 7-1-1 to access telecommunications relay services.

Your Guaranteed Pension guidebook and other information on terminated pension plans are available on the Pension Benefit Guaranty Corporation website. Or call toll-free: 1-800-400-7242. If you are deaf, hard of hearing, or have a speech disability, please dial 7-1-1 to access telecommunications relay services.