Private Pension Plan Bulletin

Abstract of 1996 Form 5500 Annual Reports

U.S. Department of Labor

Pension and Welfare Benefits Administration

Office of Policy and Research

Number 9, Winter 2000

Introduction

This is the ninth edition of the Private Pension Plan Bulletin. The tabulations presented in this report contain data based on 1996 Form 5500 filings. Reports for 1996 plan years were filed by plans for fiscal years ending anywhere from December 31, 1996 to December 30, 1997. The Internal Revenue Service (IRS) processed 1996 filings from August 1997 through July 1999.

Form 5500 reports are filed annually with the IRS. Plans covering 100 or more participants must file a Form 5500 every year containing extensive financial, participant, and actuarial data. Plans covering fewer than 100 participants are required to file a less detailed report (known as a Form 5500 C/R).

The universe for this Bulletin consists of all private pension plans for which a Form 5500 or Form 5500 C/R has been filed with the IRS in accordance with Title I of the Employee Retirement Income Security Act of 1974 (ERISA). Such plans may be defined benefit or defined contribution plans. They generally cover private wage and salary employees and are sponsored either by employers or jointly by employers and unions.

The IRS processes the reports and provides computerized edited files to the Department of Labor's Pension and Welfare Benefits Administration. To produce this report, data on all plans covering 100 or more participants are combined with a 5 percent sample of small plan filers. This combined file is subjected to additional editing and weighted to represent the universe of private pension plans covering two or more participants.

Key findings from the 1996 filings are summarized in the Highlights on pages 2 and 3. The tabulations are organized into five sections. Section A contains summary data on plans, participants, assets, income and expenses. Section B contains more detailed data on plans and participants, showing distributions by different size measures. Section C contains balance sheets and income statements for the major types of pension plans. Section D contains detailed data on defined contribution plans. Section E contains historical data from 1977 to 1996. The organization of this Bulletin is similar to the previous edition with the exception of additional tables in Section E on aggregate rates of return of 401(k) type plans.

This publication was prepared by Richard Hinz, Helen Lawrence, David McCarthy, Deloris Penic-Stevens, Daniel Beller, Steve Donahue, and Phyllis Fernandez of the Office of Policy and Research. Although this Bulletin is not copyrighted, proper acknowledgment would be appreciated. The recommended citation is:

United States Department of Labor, Pension and Welfare Benefits Administration. Abstract of 1996 Form 5500 Annual Reports. Private Pension Plan Bulletin No. 9, Winter 1999-2000. Washington, DC: United States Government Printing Office, 1999.

Contents

- Section A: Summary

- Table A1: Number of Pension Plans, Total Participants, Active Participants, Assets, Contributions, and Benefits by type of plan, 1996

- Table A2: Number of Participants in Pension Plans by type of plan entity, type of plan, and type of participant, 1996

- Table A3: Balance Sheet of Pension Plans by type of plan, 1996

- Table A4: Income Statement of Pension Plans by type of plan, 1996

- Table A5: Amount of Assets in Pension Plans by type of plan and method of funding, 1996

- Table A6: Collective Bargaining Status of Pension Plans, Participants, and Assets by type of plan, 1996

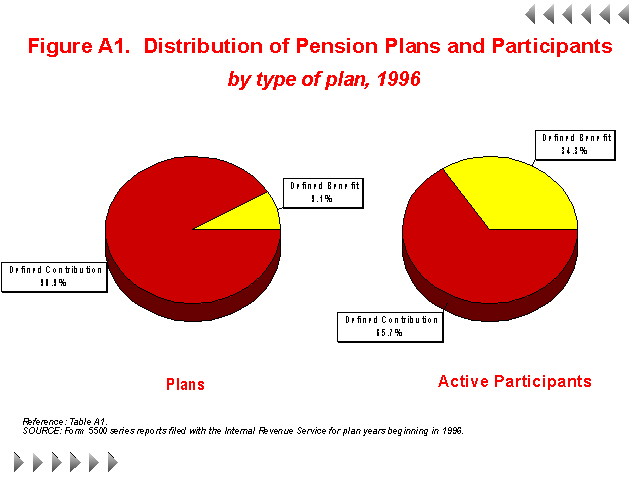

- Figure A1: Distribution of Pension Plans and Participants by type of plan, 1996

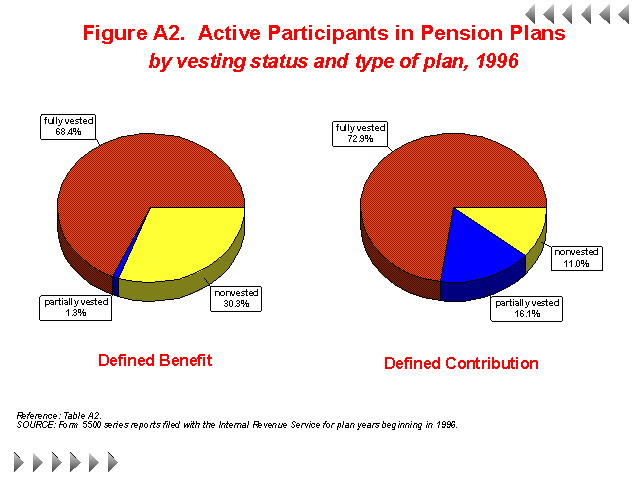

- Figure A2: Active Participants in Pension Plans by vesting status and type of plan, 1996

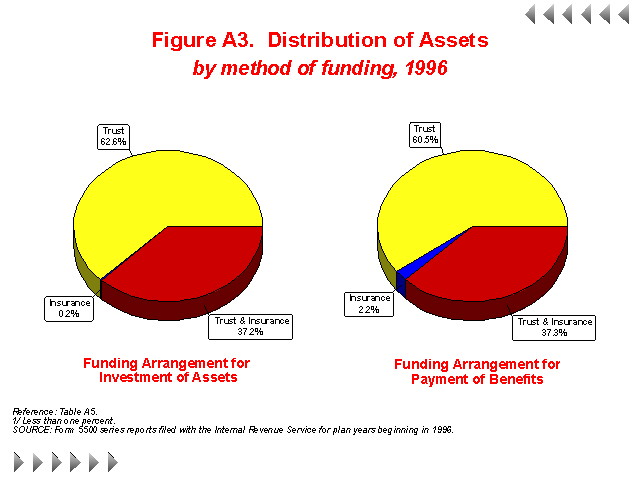

- Figure A3: Distribution of Assets by method of funding, 1996

- Section B: Plans and Participants

- Table B1: Distribution of Pension Plans by number of participants, 1996

- Table B2: Distribution of Pension Plans by amount of assets, 1996

- Table B3: Distribution of Pension Plans by industry, 1996

- Table B4: Distribution of Participants by number of participants, 1996

- Table B5: Distribution of Participants by amount of assets, 1996

- Table B6: Distribution of Participants by industry, 1996

- Table B7: Distribution of Active Participants by type of plan, 1996

- Table B8: Number of Plans by type of plan and method of funding, 1996

- Table B9: Number of Participants by type of plan and method of funding, 1996

- Section C: Financial

- Table C1: Distribution of Assets by number of participants, 1996

- Table C2: Distribution of Assets by asset size, 1996

- Table C3: Distribution of Assets by industry, 1996

- Table C4: Balance Sheet of Pension Plans with 100 or More Participants by type of plan, 1996

- Table C5: Balance Sheet of Single Employer Pension Plans with 100 or More Participants by type of plan, 1996

- Table C6: Balance Sheet of Multiemployer Pension Plans with 100 or More Participants by type of plan, 1996

- Table C7: Percentage Distribution of Assets in Defined Benefit Pension Plans with 100 or More Participants by type of asset and size of plan, 1996

- Table C8: Percentage Distribution of Assets in Defined Contribution Pension Plans with 100 or More Participants by type of asset and size of plan, 1996

- Table C9: Income Statement of Pension Plans with 100 or More Participants by type of plan, 1996

- Table C10: Income Statement of Single Employer Pension Plans with 100 or More Participants by type of plan, 1996

- Table C11: Income Statement of Multiemployer Pension Plans with 100 or More Participants by type of plan, 1996

- Table C12: Percentage Distribution of Income in Defined Benefit Plans with 100 or More Participants by source of income and size of plan, 1996

- Table C13: Percentage Distribution of Income in Defined Contribution Plans with 100 or More Participants by source of income and size of plan, 1996

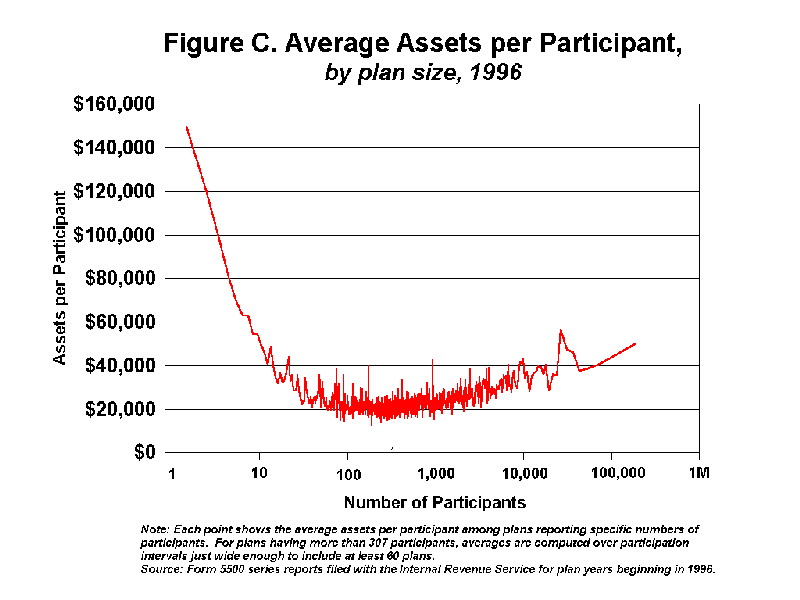

- Figure C: Average Assets per Participant by plan size, 1996

- Section D: Defined Contribution Plans

- Table D1: Balance Sheet of Defined Contribution Plans with 100 or More Participants by type of plan, 1996

- Table D2: Income Statement of Defined Contribution Plans with 100 or More Participants by type of plan, 1996

- Table D3: Number of 401(k) Type Plans, Participants, Active Participants, Assets, Contributions, and Benefits by type of plan, 1996

- Table D4: Number of 401(k) Type Plans by number of participants and primary or supplemental status, 1996

- Table D5: Number of Active Participants in 401(k) Type Plans by number of participants and primary or supplemental status, 1996

- Table D6: Balance Sheet of 401(k) Type Plans 1996

- Table D7: Income Statement of 401(k) Type Plans 1996

- Table D8: Balance Sheet of 401(k) Type Plans with 100 or More Participants 1996

- Table D9: Income Statement of 401(k) Type Plans With 100 or More Participants 1996

- Table D10: Number of Employee Stock Ownership Plans (ESOPs), Total Participants, Active Participants, Assets, Contributions, and Benefits by type of assets, 1996

- Table D11: Number of Employee Stock Ownership Plans (ESOPs), Total Participants, Active Participants, Assets, Contributions, and Benefits by type of ESOP, 1996

- Table D12: Number of Employee Stock Ownership Plans (ESOPs) by number of participants and primary or supplemental status, 1996

- Table D13: Balance Sheet of Employee Stock Ownership Plans (ESOPs) with 100 or More Participants by leveraged status, 1996

- Table D14: Income Statement of Employee Stock Ownership Plans (ESOPs) with 100 or More Participants by leveraged status, 1996

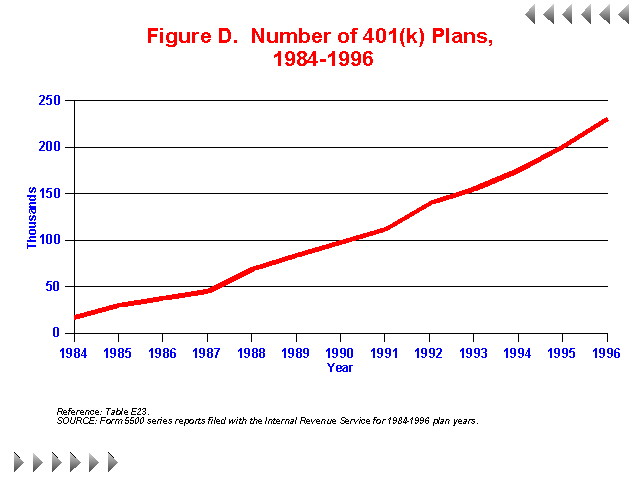

- Figure D: Number of 401(k) Plans 1984-1996

- Section E: Historical Tables

- Table E1: Number of Pension Plans by type of plan, 1977-1996

- Table E2: Number of Pension Plans with Fewer than 100 Participants by type of plan, 1977-1996

- Table E3: Number of Pension Plans with 100 or More Participants by type of plan, 1977-1996

- Table E4: Estimated Private Wage and Salary Worker Participation Rates Under Primary and Supplemental Pension Plans 1977-1996

- Table E5: Number of Participants in Pension Plans by type of plan, 1977-1996

- Table E6: Number of Participants in Pension Plans with Fewer than 100 Participants by type of plan, 1977-1996

- Table E7: Number of Participants in Pension Plans with 100 or More Participants by type of plan, 1977-1996

- Table E8: Number of Active Participants in Pension Plans by type of plan, 1977-1996

- Table E9: Number of Active Participants in Pension Plans with Fewer than 100 Participants by type of plan, 1977-1996

- Table E10: Number of Active Participants in Pension Plans with 100 or More Participants by type of plan, 1977-1996

- Table E11: Pension Plan Assets by type of plan, 1977-1996

- Table E12: Pension Plan Assets of Plans with Fewer than 100 Participants by type of plan, 1977-1996

- Table E13: Pension Plan Assets of Plans with 100 or More Participants by type of plan, 1977-1996

- Table E14: Pension Plan Contributions by type of plan, 1977-1996

- Table E15: Pension Plan Contributions of Plans with Fewer than 100 Participants by type of plan, 1977-1996

- Table E16: Pension Plan Contributions of Plans with 100 or More Participants by type of plan, 1977-1996

- Table E17: Pension Plan Benefits Disbursed by type of plan, 1977-1996

- Table E18: Pension Plan Benefits Disbursed From Plans with Fewer than 100 Participants by type of plan, 1977-1996

- Table E19: Pension Plan Benefits Disbursed From Plans with 100 or More Participants by type of plan, 1977-1996

- Table E20: Percentage Distribution of Active Participants in Plans with 100 or More Participants by vesting status, 1977-1996

- Table E21: Percentage Distribution of Active Participants in Single Employer Plans with 100 or More Participants by vesting status, 1977-1996

- Table E22: Percentage Distribution of Active Participants in Multiemployer Plans with 100 or More Participants by vesting status, 1977-1996

- Table E23: Number of 401(k) Type Plans, Participants, Assets, Contributions, and Benefit Payments 1984-1996

- Table E24: Aggregate Rates of Return Earned by Pension Plans with 100 or More Participants 1985-1996

- Table E25: Aggregate Investment Performance of Private Pension Plans with 100 or More Participants 1985-1996

- Table E26: Aggregate Rates of Return Earned by Employee Stock Ownership Plans (ESOPs) and 401(k) Plans with 100 or More Participants 1990-1996

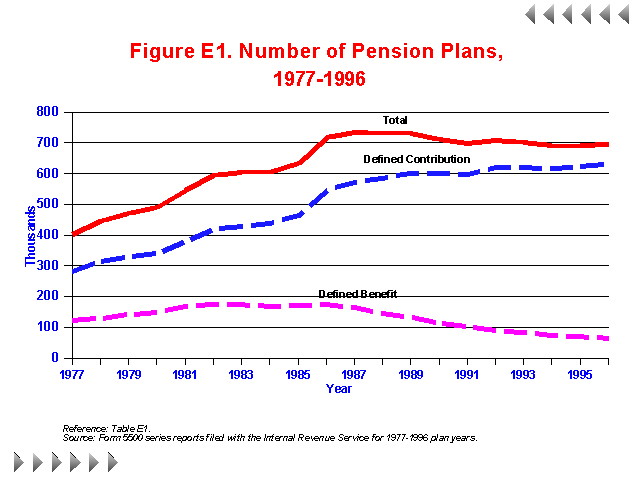

- Figure E1: Number of Pension Plans 1977-1996

- Figure E2: Pension Plan Active Participants 1977-1996

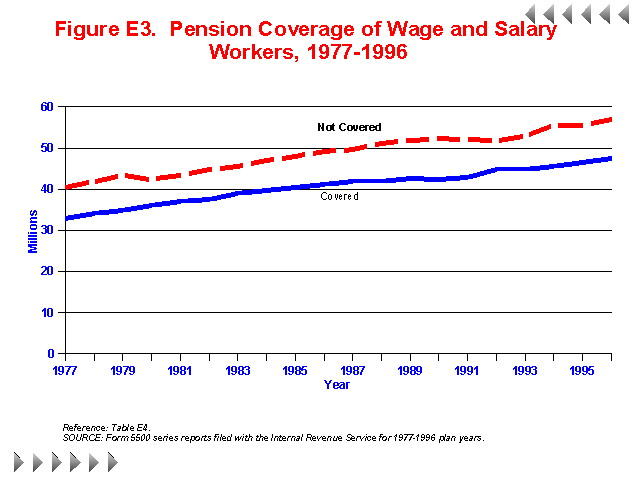

- Figure E3: Pension Coverage of Wage and Salary Workers 1977-1996

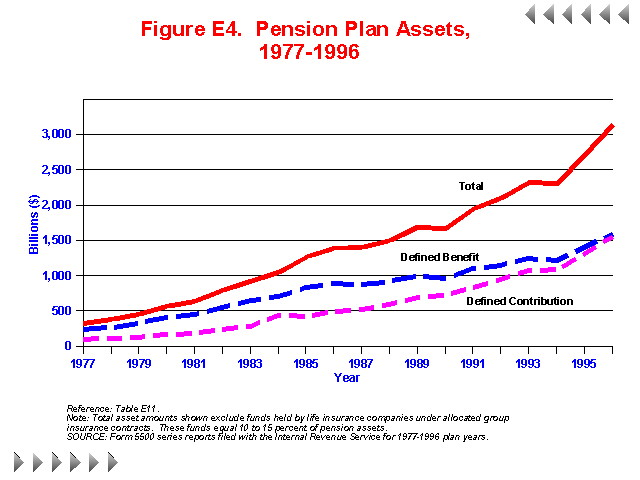

- Figure E4: Pension Plan Assets 1977-1996

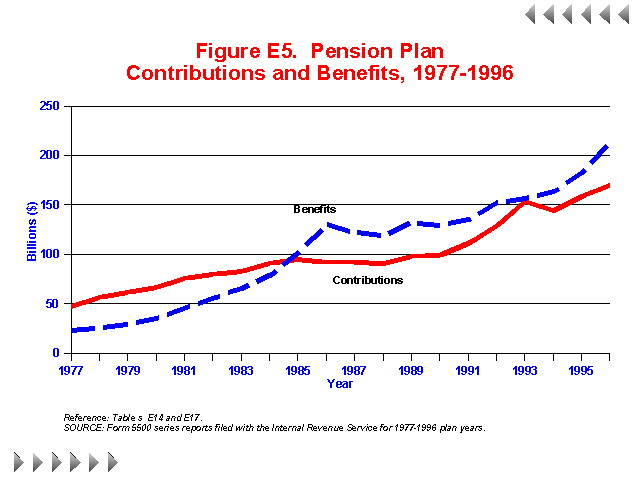

- Figure E5: Pension Plan Contributions and Benefits 1977-1996

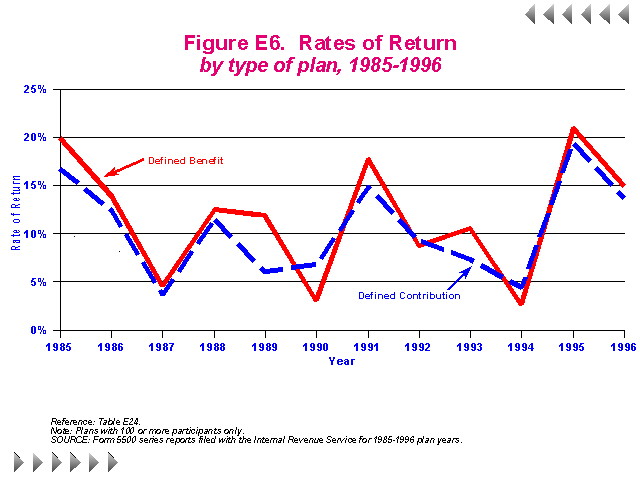

- Figure E6: Rates of Return by type of plan, 1985-1996

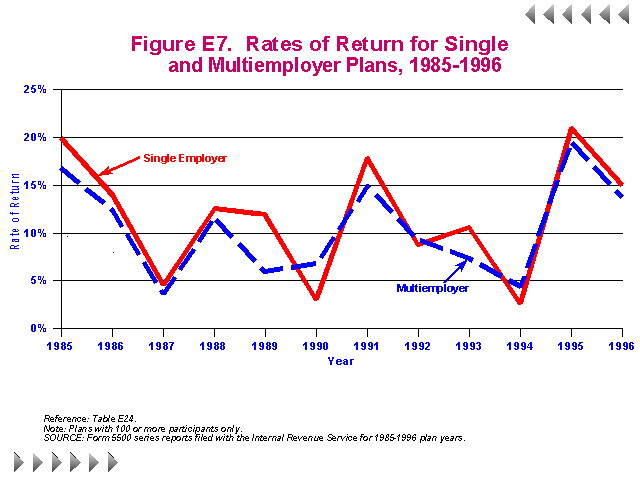

- Figure E7: Rates of Return for Single and Multiemployer Plans 1985-1996

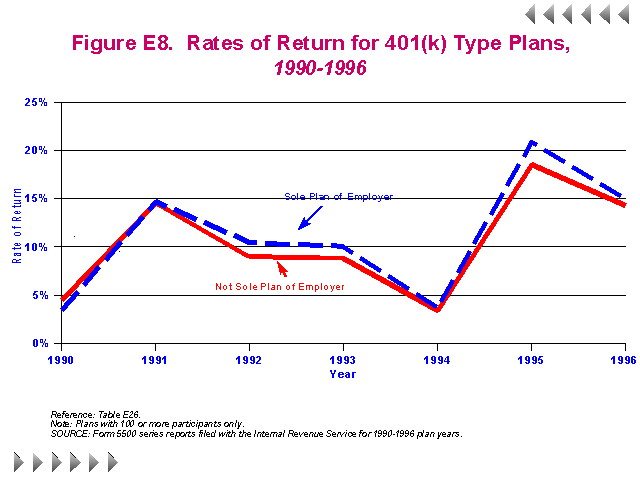

- Figure E8: Rates of Return for 401(k) Type Plans 1990-1996

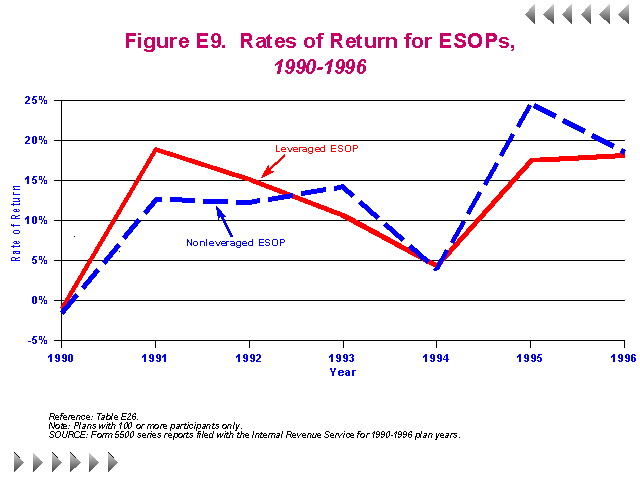

- Figure E9: Rates of Return for ESOPs 1990-1996

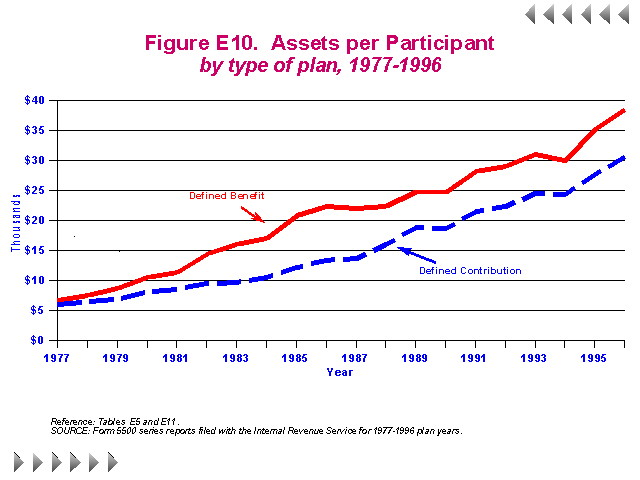

- Figure E10: Assets Per Participant by type of plan, 1977-1996

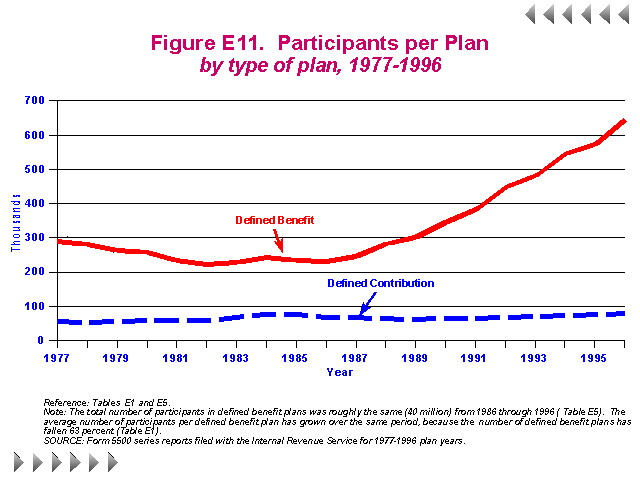

- Figure E11: Participants per Plan by type of plan, 1977-1996

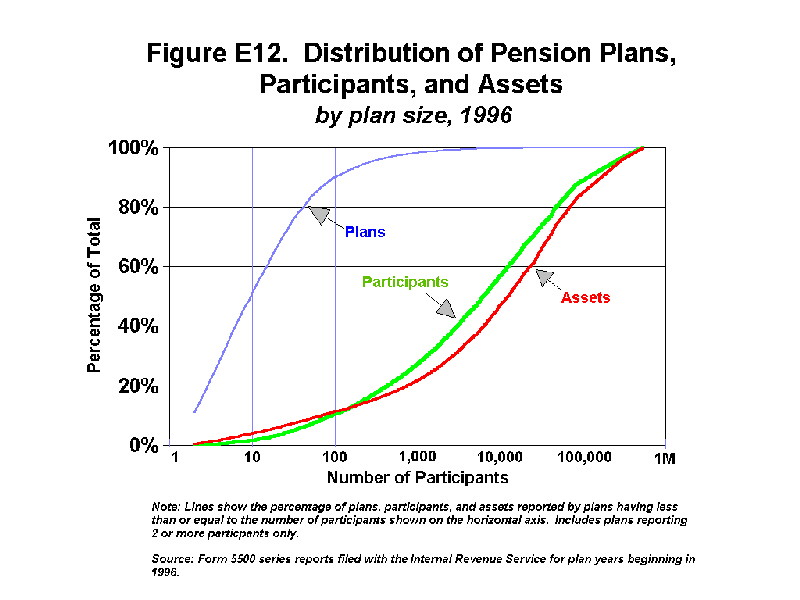

- Figure E12: Distribution of Pension Plans, Participants, and Assets by plan size, 1996

Highlights from the 1996 Form 5500 Reports

Assets held by private pension plans in 1996 totaled $3.1 trillion, a 15% increase from the $2.7 trillion reported in 1995. Defined contribution (DC) plan assets increased 17% in 1996 to $1.6 trillion while defined benefit (DB) plan assets increased 13% to $1.6 trillion.

Among plans with 100 or more participants, DC plans achieved a 15.0% aggregate rate of return (investment earnings and appreciation) in 1996, with additional asset growth arising from a positive cash flow of $16.2 billion (contributions minus benefit payout and administrative expenses). Defined benefit plans had a 14.8% aggregate rate of return in 1996, but achieved a lower overall rate of increase in total assets because of a negative cash flow of -$61.9 billion.

Aided by a large positive cash flow, assets held by 401(k) type plans continued to increase at a more rapid rate (23%) than other types of pension plans. The aggregate rate of return for medium and large 401(k) type plans, 80% of which permit participants to choose among investment options for their individual accounts, was 14.8% in 1996. This was about the same as the 14.9% average for all pension plans in 1996.

With the number of 401(k) type plans and active participants also increasing at a strong rate in 1996, 401(k) type plans now make up one-third of the pension plan universe, cover 45% of all active participants, and hold 34% of all plan assets.

Other findings from the Form 5500 series reports filed for 1996 plan years are summarized below:

- The number of private pension plans increased from 693,400 in 1995 to 696,200 in 1996, a continuation of the gradual increase in the pension plan universe.

- The 10 year downward trend in the number of DB plans continued in 1996, with an 8% decrease from 69,500 in 1995 to 63,700 in 1996.

- Offsetting the decrease in DB plans, the number of DC plans increased 1% from 623,900 in 1995 to 632,600 in 1996. 401(k) type plans increased by 15% to 230,800, while non-401(k) DC plans decreased 5% to 401,800.

- Part of the decrease in the number of non-401(k) DC plans from 1995 to 1996 resulted from conversions of existing non-401(k) DC plans to 401(k) status. Among plans with 100 or more participants, 905, or 2%, indicated that they had a 401(k) plan feature (containing a cash or deferred arrangement) in 1996 but not in 1995.

- Total active participants in private pension plans increased by 3% in 1996 to 67.9 million in 1996. The long term patterns of decreases in DB plan active participants and increases in DC plan active participants continued in 1996, with the number of DB plan active participants decreasing by 1% to 23.3 million and the number of DC plan active participants increasing by 5% to 44.6 million.

- Since 1980, the percentage of the private sector labor force with DB plan coverage has declined by an average of one percentage point per year. In 1996, an estimated 22% of the workforce received coverage under a DB plan, compared to about 38% under either a primary or supplemental DC plan.

- Among pension covered workers, participation in a DB plan fell to 49% in 1996. The number participating in a DC plan in 1996 is estimated at 83%, with 51% covered only under one or more DC plans, and 32% covered under both a DB and a DC plan.

- An estimated 65% of all pension covered workers (and about 30% of all private wage and salary workers) were in 401(k) type plans in 1996. For about half of all workers with 401(k) plan coverage, the 401(k) plan is their only plan. Among 401(k) participants with duel coverage, over four-fifths also participate in a DB plan.

- The number of workers participating in 401(k) type plans increased by 2.8 million in 1996, including a 2.3 million increase among plans covering 100 or more participants. Among these larger plans, about 43% of the increase was due to conversions of existing DC plans to 401(k) type plans, 37% was due to the establishment of new 401(k) type plans, and the remaining 20% was due to increases in the number of workers covered by existing 401(k) type plans.

- Benefit payments from plans to retirees, survivors, and terminating employees increased by 17% in 1996 to $213.4 billion. Benefits paid out by DB plans increased by 14% to $96.9 billion and benefit payments from DC plans increased 19% to $116.5 billion.

- Total plan contributions increased 7% from $158.8 billion in 1995 to $169.5 billion in 1996.

- Contributions to DB plans decreased by 14% from $41.4 billion in 1995 to $35.8 billion in 1996. Defined contribution plans received $133.7 billion in contributions during 1996, a 14% increase over the $117.4 billion received in 1995.

- The percentage of total DC contributions made by plan participants has been steadily increasing over the last decade and in 1996 was 16% higher than employer contributions to DC plans.

- Of total employer and employee contributions made to 401(k) plans, 66% were made by employees. For workers participating only in a 401(k), 61% of contributions were made by employees compared to 69% for workers participating in both a 401(k) plan and another plan sponsored by their employer.

- Among plans with 100 or more participants the aggregate rate of return on ESOPs was 18.4% in 1996, compared with an aggregate rate of return of 14.9% for all plans.

Section A: Summary

Table A1: Number of Pension Plans, Total Participants, Active Participants, Assets, Contributions, and Benefits

by type of plan, 1996

|

Type of Plan |

Number of Plans(1) |

Total Participants |

Active Participants |

Total Assets |

Total Contributions |

Total Benefits |

|---|---|---|---|---|---|---|

|

Total |

696,224 |

91,716 |

67,888 |

$3,136,281 |

$169,540 |

$213,399 |

|

Defined benefit |

63,657 |

41,111 |

23,262 |

1,585,397 |

35,803 |

96,914 |

|

Defined contribution |

632,566 |

50,605 |

44,625 |

1,550,884 |

133,737 |

116,485 |

|

Profit sharing and thrift-savings |

497,173 |

39,764 |

35,257 |

1,259,214 |

112,613 |

94,365 |

|

Stock bonus |

4,612 |

3,562 |

3,041 |

97,190 |

6,497 |

7,849 |

|

Target benefit |

5,905 |

147 |

132 |

4,777 |

280 |

421 |

|

Money purchase |

98,875 |

4,759 |

4,131 |

125,342 |

9,097 |

9,146 |

|

Annuity-403(b)(1) |

13,695 |

116 |

108 |

587 |

79 |

70 |

|

Custodial account-403(b)(7) |

1,210 |

13 |

12 |

169 |

21 |

12 |

|

IRAs or annuities (Code 408) |

787 |

33 |

25 |

935 |

46 |

41 |

|

Other defined contribution |

10,310 |

2,212 |

1,919 |

62,671 |

5,104 |

4,582 |

Footnotes

- Excludes plans covering only one participant.

- Includes active, retired, and separated vested participants not yet in pay status. The number of participants also includes double counting of workers in more than one plan.

- Active participants include any workers currently in employment covered by a plan and who are earning or retaining credited service under a plan. Active participants also include nonvested former employees who have not yet incurred a break in service.

- Total asset amounts shown exclude funds held by life insurance companies under allocated group insurance contracts for payment of retirement benefits. These excluded funds make up roughly 10 to 15 percent of total pension fund assets.

- Includes both employer and employee contributions.

- Amounts shown include both benefits paid directly from trust funds and premium payments made by plans to insurance carriers. Amounts exclude benefits paid directly by insurance carriers.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Table A2: Number of Participants in Pension Plans

by type of plan entity, type of plan, and type of participant, 1996 (numbers in thousands)

|

Type of Participant |

Total Plans |

Total Plans |

Total Plans |

Single Employer Plans(1) |

Single Employer Plans(1) |

Single Employer Plans(1) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

|---|---|---|---|---|---|---|---|---|---|

|

Total participants |

91,716 |

41,111 |

50,605 |

80,841 |

32,467 |

48,374 |

10,876 |

8,644 |

2,231 |

|

Active participants(3) |

67,888 |

23,262 |

44,625 |

61,417 |

18,681 |

42,736 |

6,470 |

4,581 |

1,889 |

|

Fully vested |

48,429 |

15,912 |

32,517 |

44,268 |

13,485 |

30,782 |

4,161 |

2,427 |

1,734 |

|

Partially vested |

7,475 |

297 |

7,178 |

7,367 |

217 |

7,150 |

108 |

79 |

29 |

|

Nonvested |

11,983 |

7,053 |

4,930 |

9,782 |

4,978 |

4,804 |

2,201 |

2,075 |

126 |

|

Retired or separated participants receiving benefits |

9,552 |

8,929 |

622 |

7,209 |

6,623 |

586 |

2,343 |

2,307 |

36 |

|

Separated part. with vested right to benefits |

14,277 |

8,920 |

5,358 |

12,215 |

7,163 |

5,052 |

2,062 |

1,756 |

306 |

Footnotes

- Includes single employer plans, plans of controlled groups of corporations and multiple-employer noncollectively bargained plans.

- Includes multiemployer plans and multiple-employer collectively bargained plans.

- Plans with less than 100 participants are required to provide only the total participant count. For these plans, which cover approximately 10 percent of all participants, the distribution of active, retired, and separated vested participants was assumed to be the same as for larger plans in each column.

Note: Excludes plans covering only one participant.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Table A3: Balance Sheet of Pension Plans

by type of plan, 1996 (amounts in millions)

|

Type of Asset or Liability |

Total |

Defined Benefit |

Defined Contribution |

|---|---|---|---|

|

Assets |

|||

|

Cash |

$92,219 |

$29,227 |

$62,992 |

|

Receivables |

55,027 |

23,957 |

31,070 |

|

Corporate debt and equity instruments |

833,705 |

362,140 |

471,565 |

|

U.S. Government securities |

165,105 |

114,251 |

50,853 |

|

Real estate and mortgages (other than to participants) |

17,225 |

10,969 |

6,256 |

|

Mortgage loans to participants |

1,441 |

144 |

1,297 |

|

Other loans to participants |

24,148 |

476 |

23,671 |

|

Other investments and assets |

1,946,985 |

1,043,948 |

903,037 |

|

Buildings and other property used in plan operations |

428 |

285 |

143 |

|

Total Assets |

3,136,281 |

1,585,397 |

1,550,884 |

|

Liabilities |

|||

|

Payables |

15,615 |

7,677 |

7,937 |

|

Acquisition indebtedness |

17,003 |

939 |

16,064 |

|

Other liabilities |

27,966 |

12,712 |

15,254 |

|

Total Liabilities |

60,584 |

21,329 |

39,255 |

|

Net Assets |

3,075,697 |

1,564,068 |

1,511,629 |

Note: Total asset amounts shown exclude funds held by life insurance companies under allocated group insurance contracts for payment of retirement benefits. These excluded funds make up roughly 10 to 15 percent of total pension fund assets.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Table A4: Income Statement of Pension Plans

by type of plan, 1996 (amounts in millions)

|

Income and Expenses |

Total |

Defined Benefit |

Defined Contribution |

|---|---|---|---|

|

Income |

|||

|

Contributions received or receivable from: |

|||

|

Employers |

$92,342 |

$34,486 |

$57,857 |

|

Participants |

68,766 |

793 |

67,973 |

|

Others |

7,856 |

441 |

7,415 |

|

Noncash contributions |

576 |

83 |

493 |

|

Total contributions |

169,540 |

35,803 |

133,737 |

|

Investment earnings(1) |

51,338 |

24,163 |

27,175 |

|

Net gain (loss) on sale of assets |

33,087 |

18,273 |

14,814 |

|

Other or unspecified income(2) |

326,123 |

165,519 |

160,604 |

|

Total Income |

580,089 |

243,758 |

336,331 |

|

Expenses |

|||

|

Benefit payments and payments to provide benefits |

|||

|

Direct benefits |

204,828 |

92,458 |

112,371 |

|

Other benefits |

8,571 |

4,457 |

4,115 |

|

Total payments |

213,399 |

96,914 |

116,485 |

|

Total administrative expenses |

8,650 |

6,255 |

2,395 |

|

Other or unspecified expenses |

4,195 |

250 |

3,946 |

|

Total Expenses |

226,244 |

103,418 |

122,826 |

|

Net Income |

353,845 |

140,340 |

213,505 |

Footnotes

- Includes interest earnings, dividends, and rents.

- Includes net gain (loss) from pooled funds, unrealized appreciation (depreciation) of assets, and miscellaneous other income items.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Table A5: Amount of Assets in Pension Plans

by type of plan and method of funding, 1996 (amounts in millions)

|

Method of Funding |

Total Plans |

Total Plans |

Total Plans |

Single Employer Plans(1) |

Single Employer Plans(1) |

Single Employer Plans(1) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

|---|---|---|---|---|---|---|---|---|---|

|

Funding arrangement for investment of Assets |

|||||||||

|

Total |

$3,136,281 |

$1,585,397 |

$1,550,884 |

$2,837,125 |

$1,316,599 |

$1,520,526 |

$299,156 |

$268,798 |

$30,358 |

|

Trust |

1,963,090 |

1,006,083 |

957,007 |

1,791,744 |

853,965 |

937,779 |

171,346 |

152,118 |

19,228 |

|

Insurance |

6,892 |

3,846 |

3,046 |

6,796 |

3,783 |

3,014 |

96 |

64 |

32 |

|

Trust and insurance |

1,166,174 |

575,468 |

590,706 |

1,038,460 |

458,851 |

579,608 |

127,714 |

116,617 |

11,098 |

|

Other |

125 |

0 |

125 |

125 |

0 |

125 |

0 |

0 |

0 |

|

Funding arrangement for payment of benefits |

|||||||||

|

Total |

$3,136,281 |

$1,585,397 |

$1,550,884 |

$2,837,125 |

$1,316,599 |

$1,520,526 |

$299,156 |

$268,798 |

$30,358 |

|

Trust |

1,889,857 |

885,102 |

1,004,755 |

1,763,514 |

771,391 |

992,123 |

126,343 |

113,712 |

12,632 |

|

Insurance |

69,157 |

37,834 |

31,323 |

67,173 |

36,386 |

30,787 |

1,984 |

1,448 |

536 |

|

Trust and insurance |

1,165,847 |

660,623 |

505,224 |

995,542 |

507,436 |

488,105 |

170,305 |

153,186 |

17,119 |

|

Other |

11,419 |

1,838 |

9,581 |

10,896 |

1,386 |

9,510 |

524 |

453 |

71 |

Footnotes

- Includes single employer plans, plans of controlled groups of corporations, and multiple-employer noncollectively bargained plans.

- Includes multiemployer plans and multiple-employer collectively bargained plans.

Note: Total asset amounts shown exclude funds held by life insurance companies under allocated group insurance contracts for payment of retirement benefits. These excluded funds make up roughly 10 to 15 percent of total pension fund assets.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Table A6: Collective Bargaining Status of Pension Plans, Participants, and Assets

by type of plan, 1996

|

Collective Bargaining Status |

Total Plans |

Total Plans |

Total Plans |

Defined Benefit |

Defined Benefit |

Defined Benefit |

Defined Contribution |

Defined Contribution |

Defined Contribution |

|---|---|---|---|---|---|---|---|---|---|

|

Total |

696,224 |

91,716 |

$3,136,281 |

63,657 |

41,111 |

$1,585,397 |

632,566 |

50,605 |

$1,550,884 |

|

Collectively bargained plans |

16,298 |

28,730 |

1,068,864 |

8,311 |

19,614 |

813,765 |

7,987 |

9,116 |

255,100 |

|

Noncollectively bargained plans |

679,926 |

62,987 |

2,067,416 |

55,346 |

21,497 |

771,632 |

624,579 |

41,490 |

1,295,784 |

Footnotes

- Asset amounts shown exclude funds held by life insurance companies under allocated insurance contracts for payment of retirement benefits. These excluded funds make up roughly 10 to 15 percent of total pension fund assets.

Note: Some collectively bargained plans cover nonbargaining unit employees under a separate non-negotiated benefit structure.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Section B: Plans and Participants

Table B1: Distribution of Pension Plans by number of participants, 1996

|

Number of Participants |

Total Plans |

Total Plans |

Total Plans |

Single Employer Plans(1) |

Single Employer Plans(1) |

Single Employer Plans(1) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

|---|---|---|---|---|---|---|---|---|---|

|

Total |

696,224 |

63,657 |

632,566 |

692,957 |

61,790 |

631,167 |

3,267 |

1,867 |

1,399 |

|

None or not reported |

57,083 |

6,312 |

50,771 |

57,009 |

6,286 |

50,722 |

75 |

26 |

49 |

|

2-9 |

309,611 |

21,746 |

287,865 |

309,534 |

21,697 |

287,836 |

78 |

49 |

28 |

|

10-24 |

141,183 |

8,371 |

132,812 |

141,183 |

8,371 |

132,812 |

- |

- |

- |

|

25-49 |

77,276 |

5,288 |

71,988 |

77,183 |

5,238 |

71,945 |

94 |

51 |

43 |

|

50-99 |

47,366 |

5,386 |

41,980 |

47,161 |

5,349 |

41,812 |

205 |

37 |

168 |

|

100-249 |

30,716 |

5,304 |

25,411 |

30,317 |

5,093 |

25,224 |

398 |

211 |

187 |

|

250-499 |

13,830 |

3,561 |

10,269 |

13,313 |

3,274 |

10,039 |

517 |

287 |

230 |

|

500-999 |

8,076 |

2,732 |

5,344 |

7,471 |

2,381 |

5,090 |

605 |

351 |

254 |

|

1,000-2,499 |

6,080 |

2,524 |

3,556 |

5,422 |

2,123 |

3,299 |

658 |

401 |

257 |

|

2,500-4,999 |

2,403 |

1,088 |

1,315 |

2,110 |

904 |

1,206 |

293 |

184 |

109 |

|

5,000-9,999 |

1,353 |

672 |

681 |

1,185 |

547 |

638 |

168 |

125 |

43 |

|

10,000-19,999 |

681 |

341 |

340 |

592 |

270 |

322 |

89 |

71 |

18 |

|

20,000-49,999 |

395 |

217 |

178 |

341 |

172 |

169 |

54 |

45 |

9 |

|

50,000 or more |

170 |

114 |

56 |

137 |

85 |

52 |

33 |

29 |

4 |

Footnotes

- Includes single employer plans, plans of controlled groups of corporations, and multiple-employer noncollectively bargained plans.

- Includes multiemployer plans and multiple-employer collectively bargained plans.

Note: Excludes plans covering only one participant.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Table B2: Distribution of Pension Plans by amount of assets, 1996

|

Amount of Assets |

Total Plans |

Total Plans |

Total Plans |

Single Employer Plans(1) |

Single Employer Plans(1) |

Single Employer Plans(1) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

|---|---|---|---|---|---|---|---|---|---|

|

Total |

696,224 |

63,657 |

632,566 |

692,957 |

61,790 |

631,167 |

3,267 |

1,867 |

1,399 |

|

None or not reported |

81,465 |

14,994 |

66,471 |

81,394 |

14,972 |

66,422 |

72 |

22 |

50 |

|

$1-24K |

36,860 |

490 |

36,370 |

36,799 |

462 |

36,337 |

61 |

28 |

33 |

|

25-49K |

34,683 |

813 |

33,870 |

34,677 |

810 |

33,867 |

6 |

3 |

3 |

|

50-99K |

58,148 |

2,044 |

56,103 |

58,094 |

2,039 |

56,054 |

54 |

5 |

49 |

|

100-249K |

121,928 |

6,306 |

115,622 |

121,900 |

6,299 |

115,601 |

28 |

7 |

21 |

|

250-499K |

111,572 |

7,205 |

104,367 |

111,505 |

7,194 |

104,310 |

67 |

11 |

56 |

|

500-999K |

101,736 |

8,446 |

93,290 |

101,610 |

8,408 |

93,202 |

126 |

38 |

87 |

|

1-2.4M |

85,111 |

8,925 |

76,186 |

84,904 |

8,865 |

76,039 |

207 |

60 |

147 |

|

2.5-4.9M |

30,319 |

4,117 |

26,203 |

29,898 |

3,976 |

25,921 |

422 |

140 |

281 |

|

5-9.9M |

14,650 |

2,820 |

11,830 |

14,249 |

2,600 |

11,649 |

400 |

219 |

181 |

|

10-24.9M |

9,949 |

2,964 |

6,985 |

9,332 |

2,574 |

6,757 |

618 |

390 |

228 |

|

25-49.9M |

4,048 |

1,637 |

2,411 |

3,639 |

1,352 |

2,287 |

409 |

285 |

124 |

|

50-74.9M |

1,534 |

752 |

782 |

1,332 |

595 |

737 |

202 |

157 |

45 |

|

75-99.9M |

882 |

417 |

465 |

756 |

320 |

436 |

126 |

97 |

29 |

|

100-149.9M |

917 |

418 |

499 |

788 |

317 |

471 |

129 |

101 |

28 |

|

150-199.9M |

525 |

268 |

257 |

441 |

199 |

242 |

84 |

69 |

15 |

|

200-249.9M |

301 |

164 |

137 |

259 |

126 |

133 |

42 |

38 |

4 |

|

250-499.9M |

735 |

381 |

354 |

624 |

282 |

342 |

111 |

99 |

12 |

|

500-999.9M |

427 |

243 |

184 |

372 |

193 |

179 |

55 |

50 |

5 |

|

1-2.49B |

289 |

162 |

127 |

256 |

129 |

127 |

33 |

33 |

- |

|

2.5B or more |

144 |

91 |

53 |

129 |

76 |

53 |

15 |

15 |

- |

Footnotes

- Includes single employer plans, plans of controlled groups of corporations and multiple-employer noncollectively bargained plans.

- Includes multiemployer plans and multiple-employer collectively bargained plans.

Note: Excludes plans covering only one participant. The letters K, M, and B denote thousands, millions, and billions, respectively.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Table B3: Distribution of Pension Plans by industry, 1996

|

Industry |

Total Plans |

Total Plans |

Total Plans |

Single Employer Plans(1) |

Single Employer Plans(1) |

Single Employer Plans(1) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

|---|---|---|---|---|---|---|---|---|---|

|

Total |

696,224 |

63,657 |

632,566 |

692,957 |

61,790 |

631,167 |

3,267 |

1,867 |

1,399 |

|

Agriculture |

11,318 |

1,138 |

10,180 |

11,310 |

1,131 |

10,179 |

8 |

7 |

1 |

|

Mining |

3,606 |

609 |

2,997 |

3,598 |

604 |

2,994 |

8 |

5 |

3 |

|

Construction |

45,618 |

3,084 |

42,534 |

43,700 |

2,090 |

41,610 |

1,918 |

994 |

924 |

|

Manufacturing |

92,111 |

13,643 |

78,468 |

91,803 |

13,407 |

78,395 |

309 |

236 |

73 |

|

Transportation |

10,678 |

1,135 |

9,542 |

10,411 |

922 |

9,488 |

267 |

213 |

54 |

|

Communications and utilities |

8,196 |

1,673 |

6,523 |

8,182 |

1,666 |

6,516 |

14 |

7 |

7 |

|

Wholesale trade |

49,478 |

3,964 |

45,514 |

49,410 |

3,906 |

45,504 |

68 |

58 |

10 |

|

Retail trade |

52,319 |

2,843 |

49,476 |

52,193 |

2,737 |

49,456 |

126 |

106 |

20 |

|

Finance, insurance and real estate |

48,049 |

6,208 |

41,841 |

48,038 |

6,201 |

41,837 |

11 |

7 |

4 |

|

Services |

324,052 |

18,097 |

305,955 |

323,553 |

17,866 |

305,687 |

499 |

231 |

268 |

|

Tax-exempt organizations |

40,427 |

10,661 |

29,766 |

40,392 |

10,659 |

29,733 |

35 |

2 |

33 |

|

Industry not reported |

10,372 |

602 |

9,770 |

10,368 |

600 |

9,768 |

4 |

2 |

2 |

Footnotes

- Includes single employer plans, plans of controlled groups of corporations and multiple-employer noncollectively bargained plans.

- Includes multiemployer plans and multiple-employer collectively bargained plans.

Note: Excludes plans covering only one participant.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Table B4: Distribution of Participants by number of participants, 1996 (numbers in thousands)

|

Number of Participants |

Total Plans |

Total Plans |

Total Plans |

Single Employer Plans(1) |

Single Employer Plans(1) |

Single Employer Plans(1) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

|---|---|---|---|---|---|---|---|---|---|

|

Total |

91,716 |

41,111 |

50,605 |

80,841 |

32,467 |

48,374 |

10,876 |

8,644 |

2,231 |

|

2-9 |

1,375 |

96 |

1,280 |

1,375 |

95 |

1,280 |

(3) |

(3) |

(3) |

|

10-24 |

2,211 |

130 |

2,081 |

2,211 |

130 |

2,081 |

- |

- |

- |

|

25-49 |

2,685 |

182 |

2,503 |

2,681 |

180 |

2,501 |

3 |

2 |

2 |

|

50-99 |

3,301 |

386 |

2,914 |

3,284 |

384 |

2,900 |

17 |

3 |

14 |

|

100-249 |

4,933 |

879 |

4,055 |

4,865 |

841 |

4,023 |

69 |

37 |

31 |

|

250-499 |

4,816 |

1,262 |

3,555 |

4,627 |

1,155 |

3,472 |

189 |

106 |

83 |

|

500-999 |

5,685 |

1,940 |

3,745 |

5,251 |

1,687 |

3,565 |

433 |

253 |

180 |

|

1,000-2,499 |

9,491 |

3,977 |

5,515 |

8,438 |

3,328 |

5,110 |

1,053 |

648 |

405 |

|

2,500-4,999 |

8,342 |

3,811 |

4,531 |

7,314 |

3,161 |

4,152 |

1,028 |

650 |

378 |

|

5,000-9,999 |

9,379 |

4,669 |

4,709 |

8,222 |

3,801 |

4,420 |

1,157 |

868 |

289 |

|

10,000-19,999 |

9,543 |

4,802 |

4,741 |

8,307 |

3,813 |

4,494 |

1,236 |

989 |

247 |

|

20,000-49,999 |

12,237 |

6,479 |

5,759 |

10,535 |

5,098 |

5,437 |

1,702 |

1,381 |

321 |

|

50,000 or more |

17,719 |

12,500 |

5,219 |

13,732 |

8,793 |

4,939 |

3,987 |

3,706 |

280 |

Footnotes

- Includes singte employer plans, plans of controlled groups of corporations and multiple-employer noncollectively bargained plans.

- Includes multiemployer plans and multiple-employer collectively bargained plans.

- Less than 500.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Table B5: Distribution of Participants by amount of assets, 1996 (numbers in thousands)

|

Amount of Assets |

Total Plans |

Total Plans |

Total Plans |

Single Employer Plans(1) |

Single Employer Plans(1) |

Single Employer Plans(1) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

|---|---|---|---|---|---|---|---|---|---|

|

Total |

91,716 |

41,111 |

50,605 |

80,841 |

32,467 |

48,374 |

10,876 |

8,644 |

2,231 |

|

None or not reported |

1,404 |

378 |

1,026 |

1,369 |

347 |

1,022 |

35 |

31 |

4 |

|

$1-24K |

318 |

8 |

310 |

314 |

7 |

307 |

4 |

0 |

3 |

|

25-49K |

340 |

10 |

331 |

339 |

9 |

330 |

1 |

1 |

1 |

|

50-99K |

682 |

28 |

654 |

676 |

26 |

650 |

6 |

2 |

4 |

|

100-249K |

1,809 |

110 |

1,699 |

1,801 |

108 |

1,693 |

8 |

2 |

6 |

|

250-499K |

2,252 |

183 |

2,069 |

2,233 |

178 |

2,054 |

19 |

5 |

15 |

|

500-999K |

3,116 |

317 |

2,799 |

3,065 |

312 |

2,753 |

51 |

5 |

46 |

|

1-2.4M |

5,117 |

796 |

4,321 |

4,999 |

774 |

4,225 |

119 |

22 |

96 |

|

2.5-4.9M |

4,304 |

884 |

3,420 |

4,115 |

839 |

3,276 |

189 |

45 |

144 |

|

5-9.9M |

4,585 |

1,265 |

3,321 |

4,339 |

1,162 |

3,177 |

246 |

103 |

143 |

|

10-24.9M |

7,231 |

2,661 |

4,569 |

6,576 |

2,353 |

4,223 |

655 |

308 |

347 |

|

25-49.9M |

6,502 |

2,730 |

3,773 |

5,793 |

2,302 |

3,491 |

709 |

427 |

282 |

|

50-74.9M |

4,459 |

2,435 |

2,024 |

3,969 |

2,120 |

1,848 |

491 |

315 |

176 |

|

75-99.9M |

2,864 |

1,446 |

1,417 |

2,487 |

1,185 |

1,302 |

377 |

262 |

115 |

|

100-149.9M |

3,845 |

1,831 |

2,014 |

3,269 |

1,501 |

1,768 |

576 |

330 |

247 |

|

150-199.9M |

3,290 |

1,578 |

1,713 |

2,638 |

1,156 |

1,482 |

652 |

422 |

231 |

|

200-249.9M |

2,127 |

1,192 |

935 |

1,794 |

875 |

919 |

333 |

317 |

16 |

|

250-499.9M |

7,589 |

4,031 |

3,558 |

6,335 |

2,966 |

3,369 |

1,254 |

1,065 |

188 |

|

500-999.9M |

7,302 |

4,298 |

3,005 |

6,039 |

3,203 |

2,836 |

1,263 |

1,094 |

168 |

|

1-2.49B |

10,416 |

5,806 |

4,610 |

8,943 |

4,333 |

4,610 |

1,473 |

1,473 |

- |

|

2.5B or more |

12,165 |

9,126 |

3,039 |

9,750 |

6,711 |

3,039 |

2,415 |

2,415 |

- |

Footnotes

- Includes single employer plans, plans of controlled groups of corporations, and multiple-employer noncollectively bargained plans.

- Includes multiemployer plans and multiple-employer collectively bargained plans.

Notes: Excludes plans covering only one participant. The letters K, M, and B denote thousands, millions, and billions, respectively.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Table B6: Distribution of Participants by industry, 1996 (numbers in thousands)

|

Industry |

Total Plans |

Total Plans |

Total Plans |

Single Employer Plans(1) |

Single Employer Plans(1) |

Single Employer Plans(1) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

|---|---|---|---|---|---|---|---|---|---|

|

Total |

91,716 |

41,111 |

50,605 |

80,840 |

32,467 |

48,374 |

10,876 |

8,644 |

2,231 |

|

Agriculture |

451 |

156 |

294 |

434 |

141 |

293 |

17 |

15 |

1 |

|

Mining |

922 |

501 |

422 |

771 |

356 |

415 |

152 |

145 |

7 |

|

Construction |

5,708 |

3,078 |

2,631 |

1,472 |

167 |

1,305 |

4,236 |

2,911 |

1,326 |

|

Manufacturing |

33,994 |

17,402 |

16,592 |

32,617 |

16,231 |

16,386 |

1,377 |

1,171 |

206 |

|

Transportation |

4,676 |

2,522 |

2,154 |

3,158 |

1,122 |

2,036 |

1,518 |

1,399 |

119 |

|

Communications and utilities |

4,911 |

2,395 |

2,516 |

4,860 |

2,354 |

2,506 |

51 |

42 |

10 |

|

Wholesale trade |

3,332 |

964 |

2,368 |

3,080 |

723 |

2,357 |

251 |

241 |

10 |

|

Retail trade |

8,996 |

3,402 |

5,594 |

7,559 |

2,109 |

5,450 |

1,437 |

1,293 |

144 |

|

Finance, insurance and real estate |

9,106 |

3,962 |

5,144 |

9,069 |

3,935 |

5,134 |

36 |

27 |

9 |

|

Services |

17,141 |

5,640 |

11,502 |

15,355 |

4,244 |

11,112 |

1,786 |

1,396 |

390 |

|

Tax-exempt organizations |

2,151 |

1,022 |

1,129 |

2,140 |

1,018 |

1,122 |

11 |

4 |

7 |

|

Industry not reported |

328 |

68 |

260 |

324 |

67 |

257 |

4 |

1 |

2 |

Footnotes

- Includes single employer plans, plans of controlled groups of corporations, and multiple-employer noncollectively bargained plans.

- Includes multiemployer plans and multiple-employer collectively bargained plans.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Table B7: Distribution of Active Participants by type of plan, 1996(1) (numbers in thousands)

|

Type of Plan |

Total Plans |

Single Employer Plans(2) |

Multiemployer Plans(3) |

|---|---|---|---|

|

Total |

67,888 |

61,417 |

6,470 |

|

Defined benefit |

23,262 |

18,681 |

4,581 |

|

Defined contribution |

44,625 |

42,736 |

1,889 |

|

Profit sharing and thrift-savings |

35,256 |

34,961 |

295 |

|

Stock bonus |

3,041 |

3,041 |

- |

|

Target benefit |

132 |

128 |

3 |

|

Money purchase |

4,131 |

2,706 |

1,425 |

|

Annuity-403(b)(1) |

108 |

95 |

13 |

|

Custodial account-403(b)7 |

12 |

12 |

- |

|

IRAs or annuities (Code 408) |

25 |

21 |

3 |

|

Other defined contribution |

1,919 |

1,771 |

148 |

Footnotes

- Active participants include any workers currently in employment covered by a plan and who are earning or retaining credited service under a plan. Active participants also include any nonvested former employees who have not yet incurred a break in service.

- Includes single employer plans, plans of controlled groups of corporations, and multiple-employer noncollectively bargained plans.

- Includes multiemployer plans and multiple-employer collectively bargained plans.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Table B8: Number of Plans by type of plan and method of funding, 1996

|

Method of Funding |

Total Plans |

Total Plans |

Total Plans |

Single Employer Plans(1) |

Single Employer Plans(1) |

Single Employer Plans(1) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

|---|---|---|---|---|---|---|---|---|---|

|

Funding arrangement for investment of Assets |

|||||||||

|

Total |

696,224 |

63,657 |

632,566 |

692,957 |

61,790 |

631,167 |

3,267 |

1,867 |

1,399 |

|

Trust |

470,870 |

36,148 |

434,722 |

468,578 |

34,836 |

433,741 |

2,292 |

1,312 |

980 |

|

Insurance |

14,655 |

2,955 |

11,700 |

14,636 |

2,945 |

11,691 |

19 |

10 |

9 |

|

Trust and insurance |

167,302 |

16,620 |

150,681 |

166,384 |

16,076 |

150,308 |

918 |

544 |

373 |

|

Other |

43,397 |

7,934 |

35,463 |

43,359 |

7,933 |

35,426 |

38 |

1 |

37 |

|

Funding arrangement for payment of benefits |

|||||||||

|

Total |

696,224 |

63,657 |

632,566 |

692,957 |

61,790 |

631,167 |

3,267 |

1,867 |

1,399 |

|

Trust |

462,390 |

35,869 |

426,521 |

461,098 |

35,137 |

425,961 |

1,292 |

732 |

559 |

|

Insurance |

48,644 |

7,850 |

40,794 |

48,499 |

7,781 |

40,717 |

145 |

69 |

76 |

|

Trust and insurance |

126,178 |

11,772 |

114,406 |

124,419 |

10,734 |

113,686 |

1,759 |

1,038 |

721 |

|

Other |

59,011 |

8,165 |

50,846 |

58,941 |

8,138 |

50,803 |

70 |

28 |

43 |

Footnotes

- Includes single employer plans, plans of controlled groups of corporations, and multiple-employer noncollectively bargained plans.

- Includes multiemployer plans and multiple-employer collectively bargained plans.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Table B9: Number of Participants by type of plan and method of funding, 1996 (numbers in thousands)

|

Method of Funding |

Total Plans |

Total Plans |

Total Plans |

Single Employer Plans(1) |

Single Employer Plans(1) |

Single Employer Plans(1) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

|---|---|---|---|---|---|---|---|---|---|

|

Funding arrangement for investment of Assets |

|||||||||

|

Total |

91,716 |

41,111 |

50,605 |

80,841 |

32,467 |

48,374 |

10,876 |

8,644 |

2,231 |

|

Trust |

57,564 |

26,273 |

31,292 |

50,975 |

21,296 |

29,679 |

6,589 |

4,977 |

1,613 |

|

Insurance |

678 |

283 |

396 |

670 |

280 |

390 |

9 |

3 |

5 |

|

Trust and insurance |

32,586 |

14,270 |

18,316 |

28,308 |

10,606 |

17,702 |

4,278 |

3,664 |

613 |

|

Other |

888 |

285 |

602 |

888 |

285 |

602 |

0 |

0 |

0 |

|

Funding arrangement for payment of benefits |

|||||||||

|

Total |

91,716 |

41,111 |

50,605 |

80,841 |

32,467 |

48,374 |

10,876 |

8,644 |

2,231 |

|

Trust |

55,227 |

24,080 |

31,147 |

50,733 |

20,488 |

30,244 |

4,494 |

3,591 |

903 |

|

Insurance |

3,472 |

1,349 |

2,123 |

3,372 |

1,282 |

2,090 |

100 |

66 |

34 |

|

Trust and insurance |

31,873 |

15,363 |

16,510 |

25,598 |

10,378 |

15,219 |

6,275 |

4,985 |

1,290 |

|

Other |

1,145 |

320 |

825 |

1,139 |

318 |

821 |

6 |

2 |

4 |

Footnotes

- Includes single employer plans, plans of controlled groups of corporations, and multiple-employer noncollectively bargained plans.

- Includes multiemployer plans and multiple-employer collectively bargained plans.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Section C: Financial

Table C1: Distribution of Assets by number of participants, 1996 (amounts in millions)

|

Number of Participants |

Total Plans |

Total Plans |

Total Plans |

Single Employer Plans(1) |

Single Employer Plans(1) |

Single Employer Plans(1) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

|---|---|---|---|---|---|---|---|---|---|

|

Total |

$3,136,281 |

$1,585,397 |

$1,550,884 |

$2,837,125 |

$1,316,599 |

$1,520,526 |

$299,156 |

$268,798 |

$30,358 |

|

None or not reported |

3,047 |

895 |

2,152 |

2,981 |

853 |

2,127 |

66 |

41 |

25 |

|

2-9 |

119,260 |

11,122 |

108,138 |

118,865 |

10,730 |

108,136 |

395 |

392 |

2 |

|

10-24 |

88,727 |

3,885 |

84,842 |

88,727 |

3,885 |

84,842 |

- |

- |

- |

|

25-49 |

71,908 |

4,588 |

67,320 |

71,741 |

4,433 |

67,308 |

167 |

154 |

12 |

|

50-99 |

77,042 |

8,087 |

68,955 |

76,560 |

7,969 |

68,592 |

482 |

119 |

363 |

|

100-249 |

102,897 |

18,261 |

84,636 |

100,805 |

16,875 |

83,930 |

2,092 |

1,385 |

706 |

|

250-499 |

99,625 |

28,300 |

71,325 |

93,980 |

24,136 |

69,843 |

5,645 |

4,164 |

1,482 |

|

500-999 |

128,569 |

47,817 |

80,752 |

114,962 |

37,844 |

77,118 |

13,607 |

9,973 |

3,633 |

|

1,000-2,499 |

238,037 |

109,407 |

128,630 |

206,600 |

84,620 |

121,980 |

31,436 |

24,787 |

6,650 |

|

2,500-4,999 |

236,535 |

117,524 |

119,011 |

204,459 |

91,813 |

112,646 |

32,076 |

25,711 |

6,366 |

|

5,000-9,999 |

318,264 |

166,327 |

151,937 |

284,050 |

135,077 |

148,973 |

34,213 |

31,250 |

2,963 |

|

10,000-19,999 |

345,356 |

189,295 |

156,061 |

306,652 |

153,946 |

152,706 |

38,704 |

35,349 |

3,355 |

|

20,000-49,999 |

530,161 |

271,123 |

259,039 |

484,100 |

229,304 |

254,796 |

46,062 |

41,819 |

4,243 |

|

50,000 or more |

776,854 |

608,768 |

168,086 |

682,643 |

515,113 |

167,529 |

94,211 |

93,654 |

557 |

Footnotes

- Includes single employer plans, plans of controlled groups of corporations and multiple-employer noncollectively bargained plans.

- Includes multiemployer plans and multiple-employer collectively bargained plans.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Table C2: Distribution of Assets by asset size, 1996 (amounts in millions)

|

Amount of Assets |

Total Plans |

Total Plans |

Total Plans |

Single Employer Plans(1) |

Single Employer Plans(1) |

Single Employer Plans(1) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

|---|---|---|---|---|---|---|---|---|---|

|

Total |

$3,136,281 |

$1,585,397 |

$1,550,884 |

$2,837,125 |

$1,316,599 |

$1,520,526 |

$299,156 |

$268,798 |

$30,358 |

|

1-24K |

485 |

5 |

480 |

484 |

4 |

480 |

1 |

1 |

(3) |

|

25-49K |

1,296 |

32 |

1,264 |

1,296 |

32 |

1,264 |

(3) |

(3) |

(3) |

|

50-99K |

4,282 |

153 |

4,129 |

4,278 |

152 |

4,126 |

4 |

(3) |

4 |

|

100-249K |

20,574 |

1,104 |

19,470 |

20,569 |

1,103 |

19,466 |

5 |

1 |

3 |

|

250-499K |

40,530 |

2,678 |

37,852 |

40,506 |

2,674 |

37,832 |

24 |

4 |

20 |

|

500-999K |

72,147 |

6,113 |

66,034 |

72,053 |

6,085 |

65,968 |

94 |

29 |

66 |

|

1-2.4M |

130,725 |

13,951 |

116,774 |

130,377 |

13,843 |

116,534 |

348 |

108 |

241 |

|

2.5-4.9M |

105,722 |

14,538 |

91,184 |

104,229 |

14,029 |

90,200 |

1,493 |

509 |

984 |

|

5-9.9M |

101,750 |

19,993 |

81,757 |

98,837 |

18,400 |

80,437 |

2,913 |

1,594 |

1,319 |

|

10-24.9M |

152,578 |

47,418 |

105,160 |

142,388 |

40,863 |

101,525 |

10,190 |

6,555 |

3,634 |

|

25-49.9M |

142,132 |

57,465 |

84,667 |

127,506 |

47,327 |

80,179 |

14,626 |

10,138 |

4,488 |

|

50-74.9M |

93,583 |

45,874 |

47,709 |

81,203 |

36,161 |

45,042 |

12,380 |

9,713 |

2,667 |

|

75-99.9M |

76,300 |

36,060 |

40,239 |

65,432 |

27,658 |

37,773 |

10,868 |

8,402 |

2,466 |

|

100-149.9M |

112,011 |

51,039 |

60,971 |

96,103 |

38,529 |

57,574 |

15,908 |

12,510 |

3,398 |

|

150-199.9M |

91,122 |

46,819 |

44,303 |

76,487 |

34,837 |

41,651 |

14,635 |

11,983 |

2,652 |

|

200-249.9M |

66,958 |

36,434 |

30,523 |

57,678 |

28,023 |

29,655 |

9,280 |

8,411 |

869 |

|

250-499.9M |

257,741 |

134,427 |

123,313 |

220,569 |

101,289 |

119,280 |

37,172 |

33,138 |

4,033 |

|

500-999.9M |

302,103 |

172,232 |

129,870 |

261,430 |

135,073 |

126,357 |

40,673 |

37,160 |

3,513 |

|

1-2.49B |

446,559 |

247,205 |

199,354 |

401,852 |

202,498 |

199,354 |

44,707 |

44,707 |

- |

|

2.5B or more |

917,685 |

651,855 |

265,830 |

833,849 |

568,019 |

265,830 |

83,836 |

83,836 |

- |

Footnotes

- Includes single employer plans, plans of controlled groups of corporatiions, and multiple-employer noncollectively bargained plans.

- Includes multiemployer plans and multiple-employer collectively bargained plans.

- Less than $500,000.

Note: Excludes plans covering only one participant. The letters K, M, and B denote thousands, millions, and billions, respectively.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Table C3: Distribution of Assets by industry, 1996 (amounts in millions)

|

Industry |

Total Plans |

Total Plans |

Total Plans |

Single Employer Plans(1) |

Single Employer Plans(1) |

Single Employer Plans(1) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

Multiemployer Plans(2) |

|---|---|---|---|---|---|---|---|---|---|

|

Total |

$3,136,281 |

$1,585,397 |

$1,550,884 |

$2,837,125 |

$1,316,599 |

$1,520,526 |

$299,156 |

$268,798 |

$30,358 |

|

Agriculture |

9,304 |

3,075 |

6,229 |

9,112 |

2,888 |

6,224 |

192 |

187 |

5 |

|

Mining |

36,603 |

19,115 |

17,488 |

29,712 |

12,354 |

17,358 |

6,891 |

6,761 |

130 |

|

Construction |

182,904 |

124,116 |

58,788 |

39,375 |

4,438 |

34,937 |

143,530 |

119,678 |

23,851 |

|

Manufacturing |

1,363,870 |

749,006 |

614,864 |

1,343,262 |

729,533 |

613,728 |

20,608 |

19,473 |

1,135 |

|

Transportation |

153,649 |

106,707 |

46,942 |

92,257 |

47,193 |

45,065 |

61,391 |

59,514 |

1,877 |

|

Communications and utilities |

311,683 |

211,417 |

100,266 |

309,492 |

209,296 |

100,197 |

2,191 |

2,121 |

70 |

|

Wholesale trade |

88,595 |

21,956 |

66,639 |

84,846 |

18,300 |

66,546 |

3,748 |

3,655 |

93 |

|

Retail trade |

126,121 |

44,925 |

81,196 |

104,099 |

23,291 |

80,808 |

22,021 |

21,633 |

388 |

|

Finance, insurance and real estate |

332,026 |

140,284 |

191,742 |

331,391 |

139,702 |

191,689 |

635 |

582 |

53 |

|

Services |

470,550 |

130,446 |

340,104 |

432,979 |

95,402 |

337,577 |

37,571 |

35,044 |

2,527 |

|

Tax-exempt organizations |

55,894 |

33,023 |

22,871 |

55,601 |

32,881 |

22,721 |

293 |

142 |

150 |

|

Industry not reported |

5,083 |

1,328 |

3,755 |

4,998 |

1,321 |

3,677 |

85 |

7 |

78 |

Footnotes

- Includes single employer plans, plans of controlled groups of corporations and multiple-employer noncollectively bargained plans.

- Includes multiemployer plans and multiple-employer collectively bargained plans.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Table C4: Balance Sheet of Pension Plans with 100 or More Participants by type of plan, 1996 (amounts in millions)

|

Type of Asset or Liability |

Total |

Defined Benefit |

Defined Contribution |

|---|---|---|---|

|

Assets |

|||

|

Receivables |

|||

|

Employer contributions |

$23,437 |

$10,945 |

$12,491 |

|

Participant contributions |

1,583 |

37 |

1,546 |

|

Income receivables |

4,757 |

3,044 |

1,713 |

|

Other receivables |

14,421 |

8,905 |

5,516 |

|

Less allowance for doubtful accounts |

162 |

153 |

9 |

|

Total receivables (net) |

44,035 |

22,778 |

21,257 |

|

General Investments |

|||

|

Interest-bearing cash |

55,392 |

23,872 |

31,520 |

|

Certificates of deposit |

4,048 |

1,355 |

2,692 |

|

U.S. Government securities |

141,699 |

112,113 |

29,586 |

|

Corporate debt instruments: Preferred |

33,201 |

25,368 |

7,832 |

|

Corporate debt instruments: All other |

57,011 |

43,925 |

13,086 |

|

Preferred stock |

15,128 |

2,492 |

12,636 |

|

Common stock |

381,555 |

274,468 |

107,087 |

|

Partnership/joint venture interests |

12,000 |

11,207 |

792 |

|

Income-producing real estate |

6,398 |

5,940 |

458 |

|

Nonincome-producing real estate |

545 |

460 |

85 |

|

Residential loans (other than to participants) secured by mortgages |

1,440 |

944 |

496 |

|

Commercial loans secured by mortgages |

3,400 |

3,093 |

307 |

|

Mortgage loans to participants |

1,047 |

128 |

919 |

|

Other loans to participants |

19,354 |

79 |

19,274 |

|

Other loans |

1,477 |

762 |

715 |

|

Value of interest in common/collective trusts |

190,998 |

100,133 |

90,865 |

|

Value of interest in pooled separate accounts |

89,351 |

49,399 |

39,952 |

|

Value of interest in master trusts |

1,034,309 |

763,777 |

270,532 |

|

Value of interest in 103-12 investment entities |

4,104 |

1,756 |

2,348 |

|

Value of interest in registered investment companies |

286,043 |

46,480 |

239,563 |

|

Value of funds held in insurance company general account |

117,398 |

27,565 |

89,833 |

|

Other or unspecified general investments |

75,348 |

31,701 |

43,647 |

|

Total general investments |

2,531,245 |

1,527,018 |

1,004,227 |

|

Employer securities |

193,886 |

5,381 |

188,506 |

|

Employer real property |

860 |

62 |

797 |

|

Unspecified investments |

3,096 |

32 |

3,064 |

|

Total noninterest-bearing cash |

2,894 |

1,275 |

1,618 |

|

Buildings and other property used in plan operations |

282 |

275 |

7 |

|

Total Assets |

2,776,297 |

1,556,821 |

1,219,476 |

|

Liabilities |

|||

|

Benefit claims payable |

5,778 |

1,136 |

4,642 |

|

Operating payables |

9,107 |

6,440 |

2,666 |

|

Acquisition indebtedness |

16,011 |

936 |

15,076 |

|

Other liabilities |

25,886 |

11,888 |

13,998 |

|

Total Liabilities |

56,782 |

20,400 |

36,382 |

|

Net Assets |

2,719,515 |

1,536,421 |

1,183,094 |

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Table C5: Balance Sheet of Single Employer Pension Plans with 100 or More Participants by type of plan, 1996(1) (amounts in millions)

|

Type of Asset or Liability |

Total |

Defined Benefit |

Defined Contribution |

|---|---|---|---|

|

Assets |

|||

|

Receivables |

|||

|

Employer contributions |

$22,034 |

$9,783 |

$12,252 |

|

Participant contributions |

1,569 |

33 |

1,536 |

|

Income receivables |

3,424 |

1,868 |

1,556 |

|

Other receivables |

12,872 |

7,500 |

5,372 |

|

Less allowance for doubtful accounts |

12 |

6 |

5 |

|

Total receivables (net) |

39,887 |

19,177 |

20,709 |

|

General Investments |

|||

|

Interest-bearing cash |

44,979 |

14,824 |

30,155 |

|

Certificates of deposit |

2,844 |

781 |

2,063 |

|

U.S. Government securities |

79,240 |

57,737 |

21,504 |

|

Corporate debt instruments: Preferred |

17,503 |

10,627 |

6,876 |

|

Corporate debt instruments: All other |

36,916 |

26,389 |

10,527 |

|

Preferred stock |

14,256 |

1,660 |

12,596 |

|

Common stock |

278,612 |

175,737 |

102,874 |

|

Partnership/joint venture interests |

11,085 |

10,305 |

780 |

|

Income-producing real estate |

2,844 |

2,441 |

403 |

|

Nonincome-producing real estate |

290 |

215 |

74 |

|

Residential loans (other than to participants) secured by mortgages |

865 |

457 |

408 |

|

Commercial loans secured by mortgages |

1,090 |

848 |

241 |

|

Mortgage loans to participants |

906 |

4 |

902 |

|

Other loans to participants |

19,052 |

53 |

18,999 |

|

Other loans |

712 |

10 |

702 |

|

Value of interest in common/collective trusts |

157,678 |

69,327 |

88,351 |

|

Value of interest in pooled separate accounts |

84,205 |

44,880 |

39,325 |

|

Value of interest in master trusts |

1,033,638 |

763,336 |

270,302 |

|

Value of interest in 103-12 investment entities |

2,574 |

806 |

1,769 |

|

Value of interest in registered investment companies |

276,974 |

39,273 |

237,702 |

|

Value of funds held in insurance company general account |

107,928 |

21,166 |

86,761 |

|

Other or unspecified general investments |

64,511 |

22,936 |

41,575 |

|

Total general investments |

2,238,701 |

1,263,813 |

974,888 |

|

Employer securities |

193,250 |

4,747 |

188,503 |

|

Employer real property |

856 |

58 |

797 |

|

Unspecified investments |

3,087 |

32 |

3,055 |

|

Total noninterest-bearing cash |

2,461 |

895 |

1,566 |

|

Buildings and other property used in plan operations |

9 |

7 |

2 |

|

Total Assets |

2,478,251 |

1,288,729 |

1,189,521 |

|

Liabilities |

|||

|

Benefit claims payable |

5,573 |

1,048 |

4,525 |

|

Operating payables |

8,260 |

5,648 |

2,612 |

|

Acquisition indebtedness |

15,819 |

749 |

15,069 |

|

Other liabilities |

23,679 |

9,825 |

13,854 |

|

Total Liabilities |

53,331 |

17,271 |

36,060 |

|

Net Assets |

2,424,919 |

1,271,458 |

1,153,461 |

Footnotes

- Includes single employer plans, plans of controlled groups of corporations and multiple-employer noncollectively bargained plans.

Source: Form 5500 series reports filed with the Internal Revenue Service for plan years beginning in 1996.

Table C6: Balance Sheet of Multiemployer Pension Plans with 100 or More Participants by type of plan, 1996(1) (amounts in millions)

|

Type of Asset or Liability |

Total |

Defined Benefit |

Defined Contribution |

|---|---|---|---|

|

Assets |

|||

|

Receivables |

|||

|

Employer contributions |

$1,403 |

$1,163 |

$240 |

|

Participant contributions |

15 |

5 |

10 |

|

Income receivables |

1,333 |

1,175 |

158 |

|

Other receivables |

1,549 |

1,404 |

144 |

|

Less allowance for doubtful accounts |

(150) |

(147) |

(4) |

|

Total receivables (net) |

4,148 |

3,600 |

548 |

|

General Investments |

|||

|

Interest-bearing cash |

10,413 |

9,047 |

1,366 |

|

Certificates of deposit |

1,204 |

574 |

630 |

|

U.S. Government securities |

62,458 |

54,376 |

8,082 |

|

Corporate debt instruments: Preferred |

15,698 |

14,741 |

956 |

|

Corporate debt instruments: All other |

20,095 |

17,536 |

2,559 |

|

Preferred stock |

872 |

832 |

40 |

|

Common stock |

102,944 |

98,731 |

4,213 |

|

Partnership/joint venture interests |

915 |

902 |

12 |

|

Income-producing real estate |

3,553 |

3,499 |

55 |

|

Nonincome-producing real estate |

256 |

245 |

11 |

|

Residential loans (other than to participants) secured by mortgages |

575 |

487 |

88 |

|

Commercial loans secured by mortgages |

2,310 |

2,244 |

66 |

|

Mortgage loans to participants |

141 |

124 |

17 |

|

Other loans to participants |

302 |

26 |