The Office of Labor-Management Standards (OLMS) enforces certain provisions of the Labor-Management Reporting and Disclosure Act (LMRDA), including reporting and disclosure requirements for labor unions, their officers and employees, employers, labor relations consultants, and surety companies. The LMRDA also requires, in part, that unions meet basic standards of fiscal responsibility. The purpose of this Compliance Tip is to help union officials and accountants who prepare Form LM-2 (Labor Organization Annual Report) avoid some common reporting errors.

The five most common errors are listed below:

- Itemization pages for Schedules 14 – 19 contained an incomplete description of either the Type or Classification (Column B) of the entity or individual making or receiving the payment or the Purpose (Column C) of the payment. This alone accounted for almost 20% of the reporting errors.

- Insufficient details were provided for Information Items 10 – 21. When Items 10 – 18 are checked “Yes,” the filer is required to provide more details in Item 69 (Additional Information).

- The changes in the cost of Investments and Fixed Assets during the reporting period did not reconcile with the changes indicated by the related transactions.

- The Less Deduction lines in Schedule 11 (Disbursements to Officers) and Schedule 12 (Disbursements to Employees) were not completed, or Item 67a (Total Withheld) did not reconcile with the total deductions disclosed on the Schedule 11 and 12 Less Deductions lines.

- Filers provided inadequate detail or failed to follow instructions in Schedules 1 – 10.

Please note that these reporting errors may not be brought to your attention when you complete your validation process using the Electronic Forms System (EFS). For example, even though EFS will direct you to Item 69 to provide additional information if you check “Yes” for Items 10 – 18, it does not determine whether or not your additional information was adequate. Likewise, EFS does not validate your entries in Columns B (type of business or job classification) or C (purpose of receipt/disbursement) of an itemization page.

The following recommendations are made to help you prepare an accurate Form LM-2 Report:

1. Complete description of Type/Classification and Purpose of Schedules 14 – 19 itemization pages:

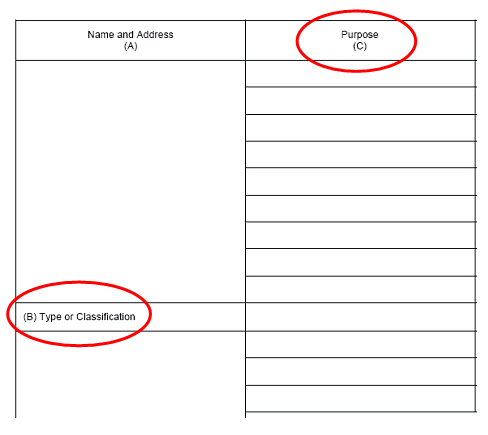

Figure 1 below shows the pertinent part of an itemization page used for Schedules 14 through 19. Note that an itemization page must be completed for Schedule 14 if Other Receipts from a single payer equal or exceed $5,000 or more per reporting year; likewise, an itemization page for Schedules 15 through 19 must be completed if disbursements are made to a single payee of $5,000 or more, within that functional activity category, per reporting year.

If no single receipt (in the case of Schedule 14) or no single disbursement within the appropriate functional activity category (in the case of Schedules 15 – 19) equals or exceeds $5,000, then only Columns A (Name and Address), B (Type or Classification), and Line I (Total of All Non-itemized Transactions with this Payee/Payer) must be completed.

If there are one or more receipts (in the case of Schedule 14) or disbursements within a functional activity category (in the case of Schedules 15 – 19) of $5,000 or more, then in addition to Columns A and B, Columns C (Purpose), D (Date), and E (Amount) must be completed for each transaction of $5,000 or more. Line I should also be completed to disclose the total of any non-itemized transactions with that payee/payer.

Figure 1.

Here are a few things to keep in mind when you complete Columns B and C of an itemization page:

- The Column B “Type or Classification” does not refer to your chart of accounts, but rather to the payer (in the case of Schedule 14) or the payee (in the case of Schedules 15 – 19). The Form LM-2 Instructions require that you describe the type of business or job classification of the entity or individual for whom you are preparing the itemization page. For example, if you have received a rebate or refund from a conference hotel, your entry in Column B could be “Hotel.” If your disbursement was to your law firm for legal representation in an arbitration hearing, your entry in Column B could be “Law Firm” or “Legal Counsel.”

- In the “Purpose” section (Column C), the filer must provide a brief statement or description of the reason the receipt/disbursement was made. For example, if the rebate is from a conference hotel, the Column C entry could read “Rebate from Conference Hotel.” Likewise, if the disbursement is to outside legal counsel for representation in an arbitration hearing, the Column C entry could read “Representation in Arbitration Case.”

2. Provide sufficient detail for information Items 10 – 21:

The second most prevalent reporting error by Form LM-2 filers is when “Yes” is checked for Items 10 – 18, but filers do not provide the required detailed explanation in Item 69. In the following table, the required details from the Form LM-2 Instructions are spelled out in summary form for easy reference. Some filers also leave blank spaces in Item 21 (an informational item on union dues and fees), so guidance on correctly completing this item follows the table.

Item Number and Description | Details required in Item 69 if Item Number is checked “Yes” |

|---|---|

| 10. Create or participate in administration of trust? | Provide the full name, address, and purpose of each trust or fund. If a report has been filed for the trust or other fund under the Employee Retirement Income Security Act of 1974 (ERISA), report the ERISA file number (Employer Identification Number) and plan number, if any. |

| 11(a). Political Action Committee? | Provide the full name of each separate political action committee (PAC) fund and list the name of any government agency, such as the Federal Election Commission or a state agency, with which the PAC has filed a publicly available report and the relevant file number of the PAC. |

| 11(b). Subsidiary Organization? | Provide the name, address and purpose of each subsidiary organization. Indicate whether the information concerning the subsidiary’s financial condition and operations is included in the Form LM-2 or in a separate report. |

| 12. Audit by outside accountant or parent body auditor/representative? | Indicate whether the audit or review was performed by an outside accountant or parent body auditor/representative. If an outside accountant performed the audit or review, provide the name of the accountant or accounting firm. |

| 13. Discover any loss or shortage of funds or other assets? | Describe the loss or shortage, including such information as the amount of the loss or shortage of funds or a description of the property that was lost, how it was lost, and to what extent, if any, there has been an agreement to make restitution or any recovery by means of repayment, fidelity bond, insurance, or other means. |

| 15. Acquire or dispose of any assets in a manner other than purchase or sale? | Describe in detail the manner in which you acquired or disposed of the asset(s), such as donation to a charitable organization, trade-in, writing off a receivable, etc. The description should include the type of asset, its value, and the identity of the recipient or donor, if any. Also report the cost or other basis at which any acquired assets were entered on your books or the cost or other basis at which any assets disposed of were carried on the books. For assets that were traded-in, enter in Item 69 the cost, book value, and trade-in allowance. |

| 16. Any assets pledged as security or encumbered in any way? | Identify those assets pledged or encumbered at the end of the reporting period, and report their fair market value and provide details of the transactions related to the encumbrance. |

| 17. Any contingent liabilities? | Describe the transactions or events resulting in the contingent liabilities and include the identity of the claimant or creditor. A pending administrative or judicial action is considered a contingent liability that must be reported if, in the opinion of legal counsel, it is reasonably possible the union will be required to make some payment. List each administrative or judicial action, including the case number, court, and caption. |

| 18. Any changes in constitution, bylaws, or in practices/procedures listed in the instructions? | Attach to your Form LM-2 report a dated copy of the complete document that has been amended. Please see the Instructions for details for attaching documents. If your union’s parent body files a uniform or model constitution and bylaws on your behalf, state that fact in Item 69. |

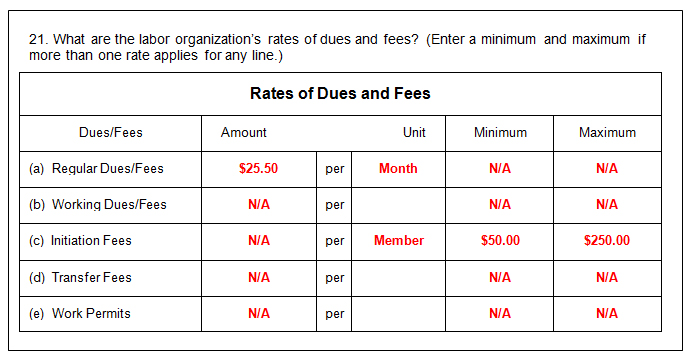

In Item 21, you must populate all cells with an amount or “N/A.” In the following example, if regular monthly dues are $25.50 per month, and the initiation fee is a minimum of $50.00 and a maximum of $250.00 per member and there are no other working dues/fees, transfer fees or work permits, the completed Item 21 should correspond to the example below.

3. Reconcile Investments and Fixed Assets Schedules: EFS validation will not detect reconciliation problems in investments (Schedule 5) and fixed assets (Schedule 6). The change in the “Cost” of investments and fixed assets during the reporting period should agree with the cost of any related sales or purchases reported in Schedules 3 or 4, and any non-cash acquisitions or disposals reported in Item 69 in support of Item 15. We recommend you complete the reconciliation worksheets below after you have completed and validated your Form LM-2 but before you transmit it to determine if the changes in investments and fixed assets reconcile. If you are unable to successfully reconcile your figures, you can provide a detailed explanation in Item 69.

In the “Investment” worksheet below, using the prior year’s Form LM-2 report, enter from Schedule 5 the sum of the Marketable Securities Total Cost line and the Other Investments Total Cost line into line 1 of this worksheet. Then add the Purchases from the current reporting year’s Schedule 4, Column B and subtract from that Sales from Schedule 3, Column B. The result is the computed ending cost of Investments; the computed ending cost must equal the actual ending cost that you have reported in your current year’s Schedule 5, Marketable Securities Total Cost line and Other Investments Total Cost line. If line 4 and line 5 in the worksheet below are not equal (or line 4 minus line 5 does not equal zero), then you need to reconcile these two numbers or provide an explanation of the difference in Item 69.

Line # | Investments | Amount |

|---|---|---|

1 | Beginning Cost (Prior Year's Schedule 5, sum of Marketable Securities Total Cost line and Other Investments Total Cost line) | $ |

2 | Plus: Cost of purchases (Current year's Schedule 4, Column B) | $ |

3 | Less: Cost of sales (Current year's Schedule 3, Column B) | $ |

4 | Less: Cost of current Year's Fixed Asset Disposals (Items 15 & 69) | $ |

5 | Computed Ending Cost (Lines 1 plus 2 minus 3) | $ |

6 | Actual Ending Cost (Current Year's Schedule 5, sum of Marketable Securities Total Cost line and Other Investments Total Cost line) | $ |

7 | Difference (Must equal zero to reconcile) | $ |

In the following worksheet, the change in the cost of fixed assets (Schedule 6) during the reporting period can be reconciled, by again referring to the previous year’s LM report as well as the current year’s Schedules 3, 4 and 6 and Items 15 and 69, if applicable.

Line # | Fixed Assets | Amount |

|---|---|---|

1 | Beginning cost (Prior Year's Schedule 6, Column B) | $ |

2 | Plus: Cost of purchases (Current Year's Schedule 4, Column B) | $ |

3 | Less: Cost of sales (Current Year's Schedule 3, Column B) | $ |

4 | Less: Cost of current Year's Fixed Asset Disposals (Items 15 & 69) | $ |

5 | Computed Ending Cost (lines 1 plus 2 minus lines 3 and 4) | $ |

6 | Actual Ending Cost (Current Year's Schedule 6, Column B) | $ |

7 | Difference (Must equal zero to reconcile) | $ |

If line 5 and line 6 in the worksheet above are not equal (or line 5 minus line 6 does not equal zero), then you need to reconcile these two numbers or provide an explanation of the difference in Item 69.

4. Properly complete Schedules 11 and 12 deductions and reconcile with Item 67a

Item 67a (Statement B) shows the total amount of payroll taxes and deductions withheld from officers and employees, which must agree with the sum of the amounts reported on the Less Deductions lines of Schedules 11 and 12. A worksheet is provided below for this purpose.

Line # | Deductions | Amount |

|---|---|---|

1 | Schedule 11, Less Deductions line | $ |

2 | Plus: Schedule 12, Less Deductions line | $ |

3 | Computed deductions (line 1 plus line 2) | $ |

4 | Item 67a (Total Withheld) | $ |

5 | Difference (Must equal zero to reconcile) | $ |

The most common mistake made is that the Less Deductions lines in Schedules 11 and 12 are left blank. Again, the sum of these two lines must equal the total in Item 67a.

5. Schedules 1 – 10 lack sufficient detail

Finally LM-2 filers sometimes fail to provide the required detail in Schedules 1 – 10. The following table lists those Schedules where problems are most commonly noted: Schedules 2 – 6 and 9, along with the problem and the required detail that must be provided.

Schedule Number | Problems noted and fixes required |

|---|---|

| Schedule 2, Loans Receivable |

|

| Schedule 3, Sale of Investments and Fixed Assets |

|

| Schedule 4, Purchase of Investments and Fixed Assets |

|

| Schedule 5, Investments |

|

| Schedule 6, Fixed Assets |

|

| Schedule 9, Loans Payable |

|

Additional Common Form LM-2 Reporting Errors

The following are some additional reporting errors that have been frequently identified:

- Schedules 15 – 19 include officer and employee travel related disbursements that should be reported in Schedules 11and/or 12. The only exceptions, such as indirect disbursements for temporary lodging (room rent only) or transportation by public carrier necessary for conducting official union business, are detailed in the Form LM-2 Instructions for Schedules 11 and 12.

- The union’s share of payroll taxes as an employer and property taxes paid by the union must not be reported in Schedule 18 or 19. These disbursements are reportable in Item 65 (Direct Taxes).

- Disbursements are improperly reported in Schedule 19 (Union Administration) instead of Schedule 18 (General Overhead).

Generally, Schedule 19 (Union Administration) is reserved for disbursements related to the general governance of the union [such as activities relating to the nomination and election of union officers; the union’s regular membership meetings; intermediate, national and international meetings; union disciplinary proceedings; the administration of trusteeships; and the administration of apprenticeship and member education programs (not including political education, which should be reported in Schedule 16).] and complying with obligations established by the government (such as filing Form LM‐2). For example, printing of election ballots, rental of meeting facilities for a union convention, printing of transcripts of a trusteeship hearing, etc., should be reported in Schedule 19.

On the other hand, Schedule 18 (General Overhead) is used to report the labor organization's direct and indirect disbursements to all entities and individuals during the reporting period associated with general overhead that cannot be allocated to any of the other disbursement categories in Statement B. For example, disbursements for rent, insurance, office supplies, postage, utilities, accountant fees, subscriptions, bank account fees, building maintenance, etc., should be reported in Schedule 18 unless these costs were specifically for any of the union administration purposes described above or should be reported in another, more appropriate disbursements category elsewhere on the report.

- Disbursements to credit card companies are incorrectly reported as a single disbursement to the credit card company as the vendor. Instead, charges appearing on credit card bills paid during the reporting period must be allocated to the recipient of the payment by the credit card company. Please see the Form LM-2 Instructions for additional information on credit card disbursements under the heading: Special Instructions for Reporting Credit Card Disbursements.

- Fixed assets are not properly depreciated. In general, the book value of a fixed asset is cost less depreciation. A labor union is required to record the purchase of fixed assets as assets in its financial records and to charge a portion of the cost of those items in each year in which they have a useful life (i.e., depreciate). If a fixed asset is appropriate to expense, the book value is cost less the amount expensed. This will result in a zero book value.

If outside accountants prepare your union’s Form LM-2, we recommend you share this Compliance Tip with them.

If you have any questions, please email us at OLMS-Public@dol.gov or contact your nearest OLMS field office below.

If you have any questions, please contact your nearest OLMS District Office.

Last Updated: 10-21-15