The Employee Benefits Security Administration (EBSA), Department of Labor, is responsible for ensuring that employee benefit plans covered under the reporting and disclosure provisions of the Employee Retirement Income Security Act of 1974 (ERISA) have met applicable requirements. In 1988 the Office of the Chief Accountant (OCA) was established, in part, to enforce the reporting and disclosure provisions of ERISA and to administer an audit program to ensure compliance with the fiduciary requirements of the Federal Employees' Retirement System Act of 1986 (FERSA).

Since 1988, OCA's duties and responsibilities have evolved to comprise the development and implementation of both "front line" compliance assistance activities while maintaining a progressive reporting enforcement program. These strategies have as their goal to improve compliance with ERISA and Department of Labor Reporting and Disclosure Requirements.

OCA has implemented numerous programs aimed at protecting participants of pension and welfare plans through enforcing the timely and accurate filing of the Form 5500 Series Annual Return/Report (Form 5500). The Form 5500 is a detailed annual reporting form that contains extensive information about the plan, its investments and financial activity, and annual operations. Generally, plans are required to file the Form 5500 every year. The Form 5500 is a valuable tool for monitoring the financial health and operations of the plan.

ERISA Section 103(a)(3)(A) and Department of Labor regulation 29 CFR 2520.103 require the administrator of certain employee benefit plan to engage, on behalf of all plan participants, an independent qualified public accountant (IQPA) to conduct an audit of the financial statements and certain required schedules of the plan, in accordance with generally accepted auditing standards (GAAS) to determine whether the financial statements and required schedules are prepared in accordance with generally accepted accounting principles (GAAP) and Department of Labor regulations. The accountant's report is required to be included in the Form 5500 filing for these plans.

ERISA Section 104(a) establishes the requirement to file a Form 5500 within 210 days of the end of the plan year and provides the Department of Labor the authority to reject filings that are deemed to be incomplete. Section 104(b) requires plans to provide participants and beneficiaries with a summary plan description.

OCA is currently comprised of two Divisions: the Division of Reporting Compliance (DRC) and the Division of Accounting Services (DAS). Both Division review the Form 5500.

The Division of Reporting Compliance (DRC) is charged with reviewing the Form 5500 as a whole for compliance with the reporting and disclosure requirements. DRC is also charged with the responsibility for taking action on plan administrators who have failed to file (non-filers) or who have failed to timely file (late-filers) their annual Form 5500. DRC is responsible for the administration of EBSA's Delinquent Filer Voluntary Compliance Program (DFVC Program) which has been designed to encourage plan administrators to voluntarily file previously un-filed Form 5500 annual reports and to resolve late filer penalties. Finally, DRC is responsible for ensuring that certain required information is timely provided to plan participants when certain events occur affecting the operations of the plan (e.g., Blackout Notices).

The Division of Accounting Services (DAS) is charged with ensuring that plan audits are performed in accordance with generally accepted auditing standards and that accountant's reports are presented in accordance with established standards of financial accounting and reporting for employee benefit plans and ERISA and Department of Labor reporting and disclosure requirements.

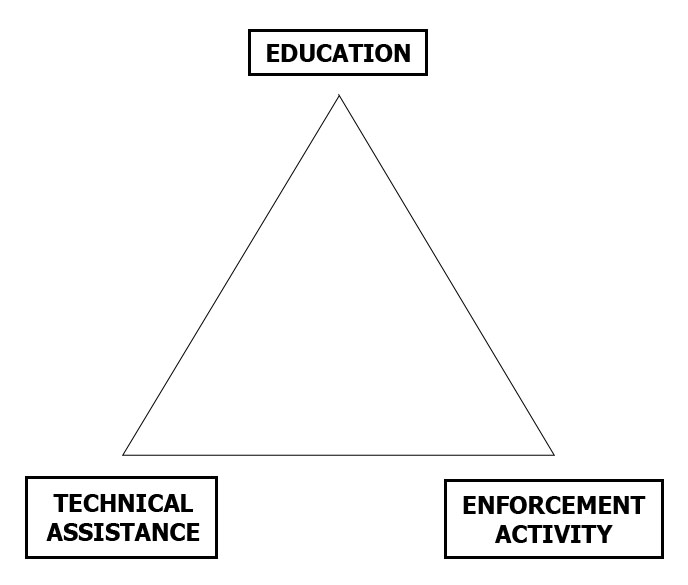

OCA performs its functions by way of a three-pronged approach through education, technical assistance, and enforcement activities to meet its goals.

Education: OCA is actively involved in the education of plan administrators, professional consultants/providers and accountants/auditors. OCA participates in an annual conference sponsored by the American Institute of Certified Public Accountants (AICPA). Over 700 accountants/auditors attend this annual conference. OCA also works with other organizations who conduct other national educational outreach programs aimed at heightening awareness on accounting, auditing, and reporting and disclosure issues impacting employee benefit plans. Finally, OCA works closely with the AICPA, the Financial Accounting Standards Board (FASB), and other entities to update the professional guidance available to practitioners.

Technical Assistance: OCA maintains a "help desk" function that provides a point-of-contact for accountants/auditors and other plan professionals seeking technical assistance on audit, accounting, and reporting and disclosure requirements. Calls to the help desk go to the "EFAST Help Desk" located in Lawrence, Kansas. The EFAST Help Desk has been established, in part, to provide toll-free technical assistance for plan professionals seeking general technical assistance. Live technical assistance is available through this toll-free number Monday thru Friday, from 8:00AM to 8:00PM, Eastern Time, except Federal holidays. The OCA staff receive technical inquiries from the EFAST Help Desk that it cannot answer. In addition, pre-recorded frequently asked questions and voice mail is available 24 hours a day, seven days a week. OCA also responds to technical assistance e-mail inquiries submitted via the internet.

Enforcement Activities: Education and Technical Assistance alone, however, are not sufficient to ensure that plan filings are prepared in accordance with ERISA and Department regulations or that audits are performed in accordance with GAAS. Accordingly, OCA has established a number of enforcement activities.

DRC's enforcement programs include detailed review of Form 5500s. Deficient Form 5500 filings may result in enforcement action. This enforcement action constitutes rejection of the Form 5500 and, if not remedied timely, a penalty assessed against the plan administrator. DRC's enforcement programs also include assessment of penalties against plan administrators who fail to file their plan's Form 5500, who fail to file timely, or who fail to provide required disclosure information to plan participants.

DAS' enforcement programs include the review of Form 5500s, related audit reports and supporting audit workpapers. Deficient financial statements, auditors' reports and/or audit workpapers may result in enforcement action. This enforcement action constitutes a rejection of the Form 5500 and, if not remedied timely, a penalty assessed against the plan administrator. In addition, DAS may refer plan auditors to the AICPA or the auditor's respective State Board of Accountancy for disciplinary action where substandard audit work is performed.

This guide has been developed to set forth the procedures for these enforcement activities and to establish uniform enforcement action documentation requirements to ensure uniformity.