The Office of Labor-Management Standards (OLMS) enforces certain provisions of the Labor-Management Reporting and Disclosure Act (LMRDA). The LMRDA requires, in part, that unions meet basic standards of fiscal responsibility. To ensure compliance with the LMRDA and to safeguard union assets by promoting transparency and accountability, labor organizations should establish best practices for administering lost time payments. OLMS recommends that unions (1) adopt clear policies and procedures for making lost time or similar payments and (2) use vouchers that require detailed information to support lost time payments. These practices will allow the union to properly report lost time payments on the Labor Organization Annual Report, Forms LM-2, LM-3, or LM-4. Each of these components is discussed in more detail below.

Adopt a Policy and Procedures for Paying Lost Time

OLMS does not recommend one best lost time policy. Rather, we suggest that your union answer the following questions in as much detail as possible in developing its lost time policies and procedures.

Who is eligible to receive lost time payments from the union and for what purposes? For example, does your union permit payments to officials attending training programs, labor council meetings, or rallies? What about stewards handling grievances or members serving on a negotiating committee?

What rate of pay applies to a union lost time claim? If an official is paid a shift premium while on the job, will the premium be included in the lost time payment? If the official receives a salary at work, how will this be converted into an hourly equivalent? If a steward was scheduled to work overtime but instead performed union business, will the union pay lost time at the overtime rate? What about piece workers or those paid an hourly bonus?

How are union lost time claims approved and by whom? How is approval recorded in your union’s records? Does it require a vote of the membership or the executive board and is this recorded in meeting minutes? When should approval take place, before or after the lost time has been incurred?

How are union lost time claims documented in the union books and records? Must a particular form be used and submitted to claim lost time? What detail is required to document a lost time claim? What document is provided to substantiate the hourly rate; is it a bargaining unit contract, paycheck stub, or some other document? What other documents must be maintained to support lost time claims?

Is your union making tax and other deductions from lost time payments and using IRS, state, and local forms for this purpose?

Whatever your union’s policy and procedures, they should be reduced to writing and added to your union’s bylaws or discussed at an executive board or membership meeting where they can be supported by entries in the meeting minutes. Once established, it is important that your union consistently follow its procedures for handling lost time. You may want to have your union’s trustees or auditors compare the steps taken to pay lost time with the union’s policy to make sure that all required procedures are being followed.

NOTE: Your union should consider establishing a separate policy regarding pay for work a union official does on his or her own time (where there is no lost time) such as in the evenings or on weekends. This policy should clarify exactly what work is expected from each such official and what the corresponding salary is for them (please refer to Compliance Tip on “Authorization of Salary and Paid Leave for Union Officials”).

Use Vouchers to Support Lost-Time Claims

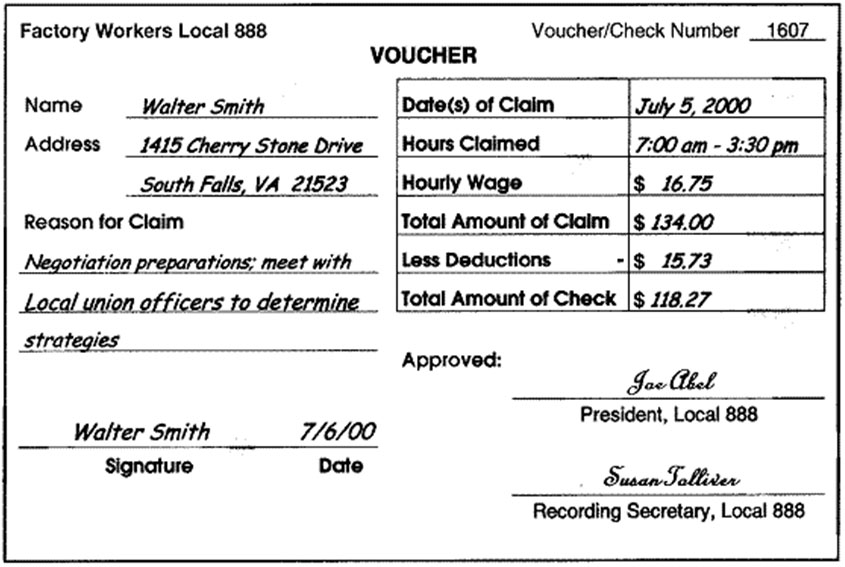

While it does not recommend any specific format, OLMS suggests that labor organizations use detailed vouchers to support lost time payments. Your union’s lost time voucher should include, at a minimum, the following information: the date of each claim, the total hours claimed, the hourly rate of pay, and the specific union business conducted. “Union business,” “meeting,” and “grievance work” are not sufficiently specific. A better explanation would be, for example, “Negotiations preparations; met with local union officers to determine strategies.” OLMS recommends that the voucher also include the beginning and ending times of the hours lost each day so that the union can compare the claim to employer payroll records to verify the number of hours lost.

Your lost-time policy should make it clear that everyone claiming lost-time must use this voucher. There should be clear instructions concerning who should receive the voucher for review and who approves it. Part of the approval process may include a review to ensure that the claimant has not already received wages or payment for some or all of the lost-time claimed.

The sample form below incorporates OLMS’ recommendations for information to include on a lost time voucher. All of the elements described above are included and there is space for noting any deductions, such as payroll taxes or other withholding. Please note that the amounts in the figure below, including the “deductions”, are illustrative and may not reflect actual experience. Note the form provides space for the claimant and approving officers to sign.

Report Lost Time Payments on LM-2, LM-3 or LM-4 Reports

Like all disbursements made during your union’s fiscal year, union lost time payments must be reported on the Form LM-2, LM-3, or LM-4 Labor Organization Annual Report filed by your organization with the Department of Labor.

Here are some things to keep in mind when completing your Form LM-2, 3 or 4. There are instructions regarding the reporting of union lost time payments that are specific to each form. Carefully read the form instructions before you fill out your union’s report. Forms LM-2 and LM-3 require separate reporting of payments to officers and to employees. Form LM-4, which is used by the smallest unions, provides that all payments to every officer and employee are to be added together and reported in one line item. Note that lost time payments to an individual who is not an officer of your union must be reported as a payment to an employee, even if your union does not otherwise consider the individual to be an employee of the union.

Below are summary instructions for reporting lost time payments to officers and employees on the Form LM-2, LM-3, and LM-4 reports:

- Form LM-2

List each officer of your union in Column (A) of Schedule 11 (All Officers and Disbursements to Officers). For each officer listed, include the total amount of lost time paid to him or her in Column (D) of Schedule 11 along with any gross salary payments to that officer.

In Column (A) of Schedule 12 (Disbursements to Employees), list each employee of your union who received more than $10,000 in total disbursements from your organization and any affiliates. For each employee listed, include the total amount of lost time paid to him or her in Column (D) of Schedule 12 along with any gross salary payments to that employee.

Include the combined total of all lost time to all employees receiving $10,000 or less in total disbursements from your organization and any affiliates in Column (D) on Line 6 of Schedule 12 along with any gross salary payments to them. - Form LM-3

List each officer of your union in Column (A) of Item 24 (All Officers and Disbursements to Officers). For each officer listed, include the total amount of lost time paid to him or her in Column (D) of Item 24 along with any gross salary payments to that officer.

Include in Item 46 (To Employees) all lost time payments along with any other direct or indirect payments to employees. - Form LM-4

Add all lost time payments made to every officer and employee to any other payments to these individuals, such as gross salaries, allowances, and expenses. Enter this total in Item 18.

If you have any questions, please contact your nearest OLMS field office.

Last Updated: 12-21-16