Wage and Hour Division

Fact Sheet: How do I know if I am working on a federal contract under which I am entitled to accrue and use paid sick leave?

September 2016

Approximately 22% of the American workforce is employed by companies that do business with the federal government. These companies enter into contracts with the federal government to provide a good or service and are called “contractors.” The employees of these contractors may work at retail stores, military base commissaries and exchanges, fast food establishments, information technology firms, or construction companies, among others, that work on federal projects. The Department’s new paid sick leave rule will let certain employees working on some types of federal contracts accrue and use paid sick leave starting as early as January 1, 2017. These tips will help you figure out if you are working on a federal contract to which the paid sick leave rule applies:

-

First, here are the types of contracts and subcontracts that are covered by the new paid sick leave rule:

- a contract for construction covered by the Davis-Bacon Act;

- a contract for services covered by the Service Contract Act (SCA);

- a contract for concessions (a business operating on federal property to furnish services, such as a gift shop operating in a federal park);

- a contract in connection with federal property or lands and related to offering services for federal employees, their dependents, or the general public, such as a daycare center operating in a federal building serving federal employees.

These types of contracts are covered by the new paid sick leave rule only if they are “new.” A contract awarded on or after January 1, 2017 is “new,” unless the federal government issued a solicitation for the contract prior to January 1, 2017.

You must be working on or in connection with a covered contract in order to accrue and use paid sick leave under the rule. That means you are covered if you are doing the work called for in the contract or you are doing work necessary to the performance of the contract even if it is work not specifically called for in the contract.

The paid sick leave rule does not apply to contracts for the manufacturing or furnishing of materials, supplies, articles, or equipment to the federal government (contracts that are subject to the Walsh-Healey Public Contracts Act). Also, the rule only applies to contracts, or portions of contracts, with the federal government performed within the United States (defined as the 50 States and the District of Columbia).

-

Check your pay stub or other notice from your employer. Employers that must provide sick leave are required to inform employees in writing at least at the end of each pay period or each month of the amount of paid sick leave available.

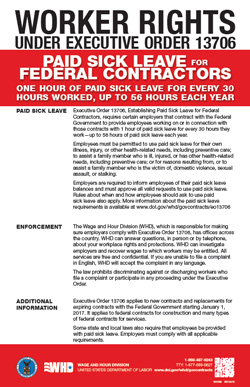

Check workplace posters. Most employers are required to post notices in prominent and accessible locations at a worksite that detail worker protections afforded by various workplace laws (e.g. minimum wage, overtime, safety and health). These posters are often in a break room, in the supervisor’s trailer on a construction site, on a bulletin board outside, in the employee handbook, or on the employer’s internal website. Employers covered by the paid sick leave rules must post this poster:

-

If you don’t see the paid sick leave poster, check for other posters:

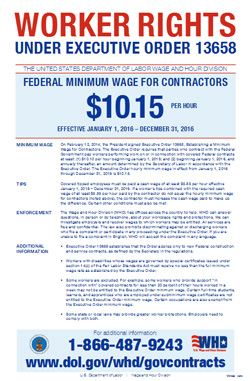

- “Worker Rights Under Executive Order 13658,” the Minimum Wage Executive Order poster

- “Employee Rights Under the Davis-Bacon Act”

- “Employee Rights on Government Contracts” (make sure that “Service Contract Act” is checked on your poster)

- These posters may help you determine if you are working on a contract covered by the paid sick leave rule because a contract covered by the Minimum Wage Executive Order, the Davis-Bacon Act and/or the Service Contract Act are also covered by the paid sick leave rule, provided the contract is “new” (issued or awarded on or after January 1, 2017).

- “Worker Rights Under Executive Order 13658,” the Minimum Wage Executive Order poster

-

-

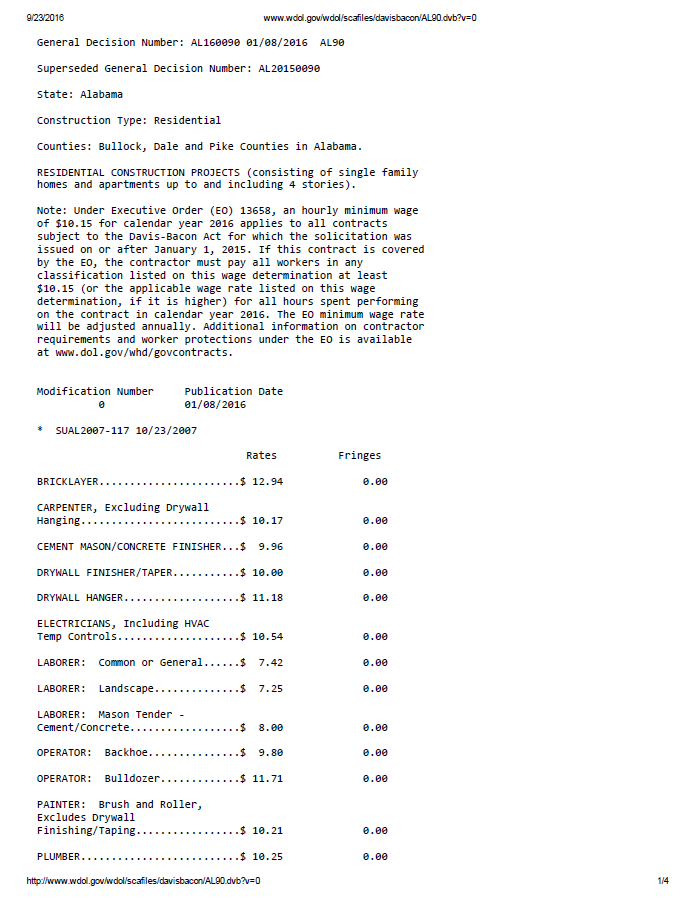

Check to see if a Service Contract Act or Davis-Bacon Act wage determination is posted at your worksite. If a Service Contract Act or Davis-Bacon Act wage determination is posted at your worksite, then the paid sick leave rule may apply to you (if you are working on a “new” contract, as described above). Here is an example of the first page of a wage determination:

-

Check the buildings and signs near your workplace. “Federal” generally refers to the United States government, not a state, county, or local government. If you are working in or near a federal building or federal project, you might be an employee working on a federal contract covered by the paid sick leave rule. Note that if you are a U.S. government employee, this rule does not apply to you – you likely already have paid sick leave. Here are some ways you can determine whether your employer might be a federal contractor:

- The name of the building, facility or area where you work has “U.S.” in front of it (for example, “U.S. Courthouse”)

- The name of a federal agency is on signs on or near your worksite. The agency might have “National” or “U.S” in its name (for example, “National Park Service”, “U.S. Department of Transportation”). Note that many federal projects that use contractors are run by sub-components of federal agencies. So, workers in a national park, for example, may only see “National Park Service” on signs, and not anything that says “U.S.”, even though the National Park Service is part of the U.S. Department of Interior.

- This is a list of most federal agencies and subagencies: https://www.federalregister.gov/agencies

Check federal contracting databases. Look in the Federal Procurement Data System at www.fpds.gov/, a database run by the Federal Government. In this system, you can enter the name of your employer in the "ezSearch" box, and then, within the results, click on "View" to see the "Principal Place of Performance" to see if this matches with your worksite. Note that this database catalogs almost every change in terms that a federal contractor makes with the federal government, so your search may return a lot of results. Consider this database a starting point, and not an end point, of your research. The results may not be for your workplace, and the results may not necessarily mean that your employer currently has a federal contract or that you are working on a contract covered by the paid sick leave rule.

-

Contact the U.S. Department of Labor. If you believe you might be covered by the paid sick leave rule, but you are not getting paid sick days, contact the U.S. Department of Labor, Wage and Hour Division at 1-866-487-9243 or call or visit your local Wage and Hour Division office.

If you have any questions about the paid sick leave rule, contact the U.S. Department of Labor, Wage and Hour Division at 1-866-487-9243 or call or visit your local Wage and Hour Division office.