DAVIS-BACON ACT, AS AMENDED

PHYSICAL INCLUSION OF WAGE DETERMINATION(S) IN BID SPECIFICATIONS AND CONTRACTS

GENERAL AND PROJECT WAGE DETERMINATIONS

MODIFICATIONS AND REISSUED DECISIONS

WAGE DETERMINATION EXTENSIONS

CORRECTION OF INADVERTENT CLERICAL ERRORS

SELECTING THE PROPER WAGE DETERMINATION(S)

- Location

- Type of construction

- Application of multiple wage determinations

- Current wage determinations

- Updates to wage determinations prior to contract award

- Updates to wage determinations after contract award

UNDERSTANDING GENERAL WAGE DETERMINATIONS

- Locating and obtaining Davis-Bacon wage determinations

- Previous (archived) GWDs

- Future GWDs (to be revised)

- How to interpret a GWD

- Classifications, basic hourly rate, and fringe benefits

- Classification identifiers (union majority prevailing and “Survey” weighted average)

- Regularly conformed rates

- State adopted rates

PROJECT WAGE DETERMINATION REQUEST FORM, SF-308

DAVIS-BACON ACT, AS AMENDED

(Excerpt from 40 USC 3142)

- The DBA requires the DOL to determine prevailing wage rates for inclusion in covered contracts based upon those paid to “corresponding classes of laborers and mechanics employed on projects of a character similar to the contract work in the civil subdivision of the State in which the work is to be performed, or in the District of Columbia if the work is to be performed there. . . .” (40 USC 3142, emphasis added.)

- A “wage determination” is the listing of wage rates and fringe benefit rates for each classification of laborers and mechanics which the WHD Administrator has determined to be prevailing in a given area (usually a county) for a particular type of construction.

PHYSICAL INCLUSION OF WAGE DETERMINATION(S) IN BID SPECIFICATIONS AND CONTRACTS

- DOL regulations, at 29 CFR part 1, establish the procedures for predetermining the wage rates required to be included in bid specifications/contracts for construction projects to which the Davis-Bacon and Related Acts (DBRA) apply. (See excerpt, above, from the Davis-Bacon Act (DBA).) The Federal Acquisition Regulation (FAR) also discusses the application of proper wage determinations in 48 CFR Subpart 22.4 – “Labor Standards for Contracts Involving Construction.”

- It is important for the actual wage determination(s) to be physically included in the bid specifications/contracts. Contractors need to know the minimum wages they will be required to pay while they develop their cost estimates for work to be performed. With the exception of project wage determinations, which are rarely issued, Davis-Bacon wage determinations are available at www.sam.gov.

- It is generally the responsibility of the federal agency that funds or assists Davis-Bacon covered construction:

- To ensure that the proper Davis-Bacon wage determination(s) is/are applied to such construction contract(s). (See 29 CFR 1.5 and 1.6(b)).

- To advise contractors which wage determination applies to various construction items if a contract includes multiple wage determinations.

- To be able/ready to advise contractors as needed regarding the duties performed by the various classifications in the wage determination. If two or more classifications in the applicable wage determination may perform the work in question, an area practice survey may be required. Where the classifications are from a single sector of the industry (union or non-union), data needs to be collected only from that sector of the construction industry (for the type of construction involved). Where union and non-union-based classifications are involved, the data should be obtained from both sectors. (See the “Area Practice” section of the materials in the Prevailing Wage Resource Book, DBRA Compliance Principles chapter for a detailed discussion of area practice surveys.)

- Questions and disputes regarding the application of the proper Davis-Bacon wage determination(s) to covered construction projects should be referred to the WHD Branch of Construction Wage Determinations.

- It can be disruptive and costly for an agency to correct a situation where a covered contract is awarded without a wage determination, or with the wrong wage determination (i.e., a wage determination that by its terms or according to the requirements of 29 CFR part 1, further discussed below, clearly does not apply to the contract). When this happens, corrective action is required:

- The agency must either terminate and resolicit the contract with the correct wage determination or incorporate the correct wage determination into the contract, along with any adjustment in contract price, where appropriate. The incorporation must be retroactive to the date of contract award (or the start of construction, if there is no contract award), unless the Administrator directs otherwise.

- If the agency initiates the incorporation, it should notify WHD promptly. If the incorporation occurs due to a request from WHD, the agency must perform the incorporation within 30 days of the date of that request, unless the agency has obtained an extension from WHD.

- If a Related Act funding recipient or sub-recipient does not incorporate the correct wage determination as required into its contract(s), the federal funding agency must provide no further funding or assistance until the correct wage determination has been incorporated, and must refer the dispute to WHD for a determination under 29 CFR 5.13.

- If the agency chooses to terminate and resolicit the contract, the agency must first either withhold or cross-withhold sufficient funds to cover any back wage liability due to the use of the incorrect wage determination, or must otherwise ensure that sufficient funds are available to cover the potential back wages due.

- Under any of the circumstances described in 29 CFR 1.6(f), notwithstanding the requirement to incorporate the correct wage determination(s) within 30 days, the correct wage determination(s) will be effective by operation of law, retroactive to the date of award or the beginning of construction (where there is no contract award or where there is coverage under the National Housing Act or under section 8 of the U.S. Housing Act of 1937), in accordance with 29 CFR 5.5(e). (29 CFR 1.6(f)(4).)

GENERAL AND PROJECT WAGE DETERMINATIONS

- The WHD issues two types of Davis-Bacon wage determinations: general determinations and project determinations.

- The term “wage determination” includes not only the original decision but any subsequent decisions modifying, superseding, correcting, or otherwise changing the rates and/or scope of the original decision.

General wage determinations (GWDs)

- GWDs are in effect for most counties in the United States for each general type of construction – building, residential, highway, and heavy. In many areas separate schedules are also issued for sewer and water line construction, for dredging, and for certain other types of projects which would otherwise be categorized as “heavy” construction.

- Annual editions of the GWDs are issued in the first quarter of each calendar year (“rollover”). Each annual edition supersedes the previous GWDs, and the wage decision numbers reflect the year of a new edition.

- Any changes in wage rates on the GWDs are made in weekly updates, generally on Friday, and are reflected in modification numbers on the GWD.

- On June 14, 2019, the System for Award Management (SAM) website (https://sam.gov/content/wage-determinations) became the official site for all Davis-Bacon GWDs. This is a free on-line service.

Project wage determinations

- Project Wage Determinations may be obtained on a case-by-case basis for individual projects where:

- The project involves work in more than one county and will have workers who may work in more than one county;

- There is no GWD in effect for a county/type of construction needed for an upcoming project; or

- All or virtually all the work on a contract will be performed by a classification that is not listed in the GWD that would otherwise apply and bid opening/award has not yet taken place.

- To request a project wage determination, a Standard Form 308 (SF-308) “Request for Determination and Response to Request” should be used by the agency (normally a federal agency).

- If the project involves multiple types of construction, the requesting agency should attach information indicating the expected cost breakdown by type of construction.

- The time required for processing requests for a project wage determination varies according to the facts and circumstances in each case. An agency should anticipate that such processing will take at least 30 days.

- The completed SF-308 should be sent to:

- U.S. Department of Labor Wage and Hour Division

Division of Construction Wage Determinations

200 Constitution Ave., NW

Washington, D.C. 20210

Or via email to:

DBA308project@dol.gov - SF-308s can be downloaded from the “Forms” section of the SAM website (https://sam.gov/content/wage-determinations). The SF-308 is also available at FAR 48 CFR 53.301 - 330.

- Project wage determinations are applicable only to the particular project for which they are issued and are effective for 180 days. If a project wage determination is not incorporated into an awarded contract in the period of its effectiveness, it is void.

- Accordingly, if it appears that a wage determination may expire between bid opening and contract award, the agency should request a new project wage determination sufficiently in advance of the bid opening to assure receipt prior thereto.

- However, when due to unavoidable circumstances, a project wage determination expires before award but after bid opening (or other date specified in 29 CFR 1.6(a)(3) for certain United States Department of Housing and Urban Development (HUD) programs), an extension of the project wage determination’s expiration date may be requested from and granted by the WHD Administrator if certain conditions are met. (See “Wage Determination Extensions,” below.)

- “Special” Project Wage Determinations may be issued for retroactive application to covered contracts let without a Davis-Bacon wage determination, or with a wage determination which by its terms or the provisions of 29 CFR part 1 clearly does not apply to the contract – for example, if a wage determination for the wrong county or an out-of-date wage decision has been included in an awarded contract, and there was no GWD in effect for the given county and type of construction at the time of contract award. 29 CFR 1.6(f).

MODIFICATIONS AND REISSUED DECISIONS

- Both GWDs and project wage determinations may be modified or superseded from time to time.

- Wage determinations are normally revised either:

- To apply the results of a new survey, or

- To update prevailing wage rates that are based on union collective bargaining agreements to reflect collectively bargained changes in wage and fringe benefit rates (escalators), or

- To include adjustments to non-collectively bargained prevailing wage and fringe benefit rates on general wage determinations, with the adjustments based on U.S. Bureau of Labor Statistics Employment Cost Index (ECI) data or its successor data.

- “Reissued wage decisions” replace the prior GWDs and carry wage decision numbers that reflect the new year. Reissued wage decisions have a modification number of “0” followed by the date of issuance.

- “Modifications” are listed numerically on the wage determination modification record for that year’s edition. The date of issuance of the modification follows the modification number. A modification to a GWD replaces the entire GWD that it modifies.

- Wage determinations are normally revised either:

WAGE DETERMINATION EXTENSIONS

- Bid solicitation documents must be amended to include subsequently issued modifications to a GWD or a new project wage determination (if the project wage determination expired), unless the federal contracting or federal funding agency requests an extension from the WHD and the WHD Administrator grants the extension. If such a request comes from a funding recipient, the funding recipient must obtain their federal funding agency’s concurrence with the request before submitting that request to the WHD.

- An agency may request an extension after bid opening if:

- GWD: Award does not take place within 90 days after the bid opening; or

- Project wage determination: The determination expires prior to award.

- For certain HUD-assisted projects, different dates apply to when an extension may be requested. 29 CFR 1.6(c)(2)(ii)(D) and 1.6(a)(3), respectively.

- A request for an extension must be supported by a written finding, including factual support that the extension is necessary and proper in the public interest to prevent injustice or undue hardship or to avoid serious impairment in the conduct of Government business.

- Example: Due to unavoidable delays in the contracting process, a contract for the remediation of a wastewater treatment facility was not awarded within 90 days of bid opening. The request documented that due to various legal requirements, an incorporation of the updated wage determination would significantly delay contract award and the start of construction. During that additional time, the delay in repairing the facility would result in the continued discharge of pollutants documented as harmful to the health of the city’s residents. The extension would therefore prevent undue hardship to the city’s residents.

CORRECTION OF INADVERTENT CLERICAL ERRORS

- Upon the Administrator’s own initiative or at the request of an agency, the Administrator may correct any wage determination, without regard to 29 CFR 1.6(a) or (c), whenever the Administrator finds that it contains clerical errors. Such corrections must be included in any solicitations, bidding documents, or ongoing contracts containing the wage determination in question, and such inclusion, and application of the correction(s), must be retroactive to the start of construction if construction has begun. 29 CFR 1.6(d), reiterated in the FAR at 48 CFR 22.404-7.

- Please send all requests for correction of inadvertent clerical errors to: DBABCWDAppeal@dol.gov

SELECTING THE PROPER WAGE DETERMINATION(S)

- Three factors must be considered in selecting Davis-Bacon wage determinations:

- Location

- Type of Construction

- Current Wage Determination(s)

Location

- It is a longstanding practice that Davis-Bacon wage determinations are made on a county-by- county basis. The contracting agency must first identify the State and county where the construction work will be performed. In some cases, a project may be located in more than one county and/or State. In such cases, the contracting agency must incorporate the applicable wage determinations for each county/State where work is to be performed under the contract or request a project wage determination. The bid specifications must also include instructions specifying the contract work to which each wage determination applies.

Type of construction

“Projects of a similar character”

- As a matter of longstanding policy, DOL has distinguished among four general types of construction for purposes of making prevailing wage determinations: building construction, residential construction, heavy construction, and highway construction. All Agency Memoranda (AAMs) 130, 131, and 236 provide guidance in the application of this policy. Generally, for wage determination purposes, a “project” consists of all construction necessary to complete a facility regardless of the number of contracts involved, so long as all contracts awarded are closely related in purpose, time, and place.

- AAM 130 – “Application Of The Standard Of Comparison ‘Projects of a Character Similar’ Under the Davis-Bacon And Related Acts” – provides general descriptions of each type of construction and includes lists of examples in each general category. In brief:

- Building Construction includes the construction, rehabilitation and repair of sheltered enclosures with walk-in access for the purpose of housing persons, machinery, equipment, or supplies.

- Residential Construction includes the construction, rehabilitation, and repair of single family houses, townhouses, and apartment buildings of no more than four (4) stories in height.

- Highway Construction includes the construction, alteration or repair of roads, streets, highways, runways, parking areas and most other paving work not incidental to building or heavy construction.

- Heavy Construction is a “catch-all” category which includes those projects which cannot be classified as Building, Residential or Highway. Heavy construction is often further distinguished on the basis of the characteristics of particular projects, such as dredging, water and sewer line, dams, major bridges, solar and wind farms, and flood control projects.

- Any questions or disputes regarding the appropriate classification of a project with regard to type of construction should be referred to the WHD for resolution prior to bid opening (or other appropriate wage determination lock-in date; a discussion of “lock-in-dates” may be found in the “Area Practice” section of the Prevailing Wage Resource Book, DBRA Compliance Principles chapter.) A request for a ruling should include a complete description of the project and other relevant information, such as wage payment data from similar construction projects in the local area, documentation of the views of parties in dispute, and other material interested parties wish to have considered. This may be appropriate where questions arise concerning the proper categorization of an entire project or particular portions of a project. (Below is a brief discussion of how to determine when multiple wage determinations should be applied to different types of construction to be performed on a project.)

Application of Multiple Wage Determinations

- Multiple wage determinations may apply when a project includes construction, alteration, or repair items that in themselves would be a different type, or category, of construction. All Agency Memoranda 130, 131 and 236 provide further guidance on the application of multiple wage determinations for projects that involve more than one type of construction. AAMs 130, 131, and 236 should be read concurrently.

- Work must be in a different category of construction from the other work on the project for multiple wage determinations to apply. For example, preparatory site work such as clearing and grading the site is included within the same category as the main category of the project.

- If the project does have work that is in itself in a separate category of construction, the contracting agency must then determine whether the amount of work in the other category of construction is substantial. Generally, construction in another category is considered to be substantial if the total cost of all the work in that category exceeds either 20% of the total project cost or $2.5 million. If the total work in the other category is substantial, then multiple wage determinations will generally apply.

- Generally, if the work in the other category will be less than 20% of the total project cost and will cost less than $2.5 million, it is considered incidental to the primary type of construction involved on the project, and a separate wage determination is generally not applicable.

- Where multiple wage determinations are incorporated into the bid specifications/contract it is very important that the agency provide instructions specifying the contract work to which each wage determination applies. 29 CFR 1.6(b), reiterated in the FAR at 48 CFR 22.404-2.

- Such instructions are needed not only when the wage determinations for different types of construction (and/or locations) are in separate wage determinations but also where wage schedules for various types of construction (and/or counties) have been consolidated into a single wage determination. (This has often been done for administrative convenience in issuing wage determinations.)

- Because of the complexities in the application of multiple wage determinations or schedules, the contracting agency should consult with the WHD Branch of Construction Wage Determinations to resolve any questions.

Current wage determination(s)

- It is the responsibility of the contracting agency to ensure that the appropriate up-to-date wage determination is included in the bid/RFP, grant documents, or the like, and that modifications are included up to the time of award, or other applicable wage determination lock-in date.

- General and project wage determinations may be revised from time to time to keep them current. A revised wage determination replaces the previous wage determination. Section 1.6 of Regulations, 29 CFR part 1, sets forth, in detail, the requirements regarding inclusion of up-to-date wage determinations in bid/contract documents.

Updates to wage determinations prior to contract award

- As stated in 29 CFR 1.6(c)(2)(ii), if a revised wage determination is issued before contract award (or the start of construction when there is no award), it must be incorporated into the covered contract, except as follows:

- For contracts entered into pursuant to sealed bidding procedures, a revised wage determination issued at least 10 calendar days before the opening of bids is effective with respect to the solicitation and contract. If a revised wage determination is issued less than 10 calendar days before the opening of bids, it is effective with respect to the solicitation and contract unless the agency finds that there is not a reasonable time still available before bid opening to notify bidders of the revision and a report of the finding is inserted in the contract file. 29 CFR 1.6(c)(2)(ii)(A).

- Other exceptions apply with respect to projects assisted under the National Housing Act (29 CFR 1.6(c)(2)(ii)(B)) and projects to receive housing assistance payments under section 8 of the U.S. Housing Act of 1937 (29 CFR 1.6(c)(2)(ii)(C)).

- However, where a GWD has been included in the solicitation, if the contract is not awarded within 90 days after bid opening (or other applicable dates for certain HUD projects), any new modifications to the wage determination(s) must be incorporated into the contract up to award, unless the contracting/assisting agency requests and obtains an extension of the 90-day period. 29 CFR 1.6(c)(2)(ii)(D).

- Similarly, if, due to unavoidable circumstances, a project wage decision expires between bid opening and contract award (or other applicable dates for certain HUD projects), the contracting/assisting agency may request an extension instead of a new project wage determination. 29 CFR 1.6(a)(3)(ii).

- Note: For further guidance in the application of other dates to HUD- assisted projects, it is appropriate to contact a HUD labor advisor. See: http://www.hud.gov/offices/olr/laborrelstf.cfm.

Updates to wage determinations after contract award

- “Modifications” to Davis-Bacon wage determinations and “Reissued” wage determinations issued after award of a contract generally do not apply to a contract. 29 CFR 1.6(c)(2)(iii).

- Therefore, a Davis-Bacon wage determination that is appropriately applied to a covered contract typically establishes the minimum wage rates and fringe benefits which must be paid for the entire term of the contract.

- After bid opening/award of a contract, properly applied Davis-Bacon wage determinations will not be modified, except rarely, such as where a correction of an inadvertent clerical error is issued. 29 CFR 1.6(b) and (c), reiterated in the FAR at 48 CFR 22.404-2 and 22,404-7. See also 29 CFR 1.6(d, (e), (f), and (g), and 48 CFR 22.404-9.

- However, where a contract or order is changed to include additional, substantial construction, alteration, and/or repair work not within the scope of work of the original contract or order, or to require the contractor to perform work for an additional time period not originally obligated, including where an option to extend the term of a contract is exercised, the contracting agency must include the most recent revision of any wage determination(s) at the time the contract is changed or the option is exercised. This does not apply where the contractor is simply given additional time to complete its original commitment or where the additional construction, alteration, and/or repair work in the modification is merely incidental. 29 CFR 1.6(c)(2)(iii)(A).

- Some contracts call for construction, alteration, and/or repair work over a period of time that is not tied to the completion of any particular project. Examples of such contracts include, but are not limited to:

- indefinite-delivery-indefinite-quantity construction contracts to perform any necessary repairs to a Federal facility over a period of time;

- long-term operations-and-maintenance contracts that may include construction, alteration, and/or repair work covered by Davis-Bacon labor standards; or

- schedule contracts or blanket purchase agreements in which a contractor agrees to provide certain construction work at agreed-upon prices to Federal agencies.

- For the types of contracts described here, the contracting agency must incorporate into the contract the most recent revision(s) of any applicable wage determination(s) on each anniversary date of the contract’s award (or each anniversary date of the beginning of construction when there is no award) unless the agency has sought and received prior written approval from the Department for an alternative process. Such revised wage determination(s) will apply to any construction work that begins or is obligated under such a contract during the 12 months following that anniversary date until such construction work is completed, even if the completion of that work extends beyond the twelve-month period.

- Where such contracts have task orders, purchase orders, or other similar contract instruments awarded under the master contract, the master contract must specify that the applicable updated wage determination must be included in such task orders, purchase orders, or other similar contract instrument, and the ordering agency must so incorporate the applicable updated wage determinations into their orders.

- Once the applicable updated wage determination revision has been incorporated into such task orders, purchase orders, or other similar contract instruments, that wage determination revision remains applicable for the duration of such order, unless the order is changed to include additional, substantial construction, alteration, and/or repair work not within the scope of work, when the wage determination must be updated as set forth in 29 CFR 1.6(c)(2)(iii)(A), or the order itself includes the exercise of options. Where such orders do include the exercise of options, updated applicable wage determination revisions, as incorporated into the master contract, must be included when an option is exercised on such an order.

- For contracts to which both 29 CFR 1.6(c)(2)(iii)(A) and (B) apply, updated wage determinations must be incorporated pursuant to the requirements of both paragraphs. For example, if a contract calls for construction, alteration, and/or repair work over a period of time that is not tied to the completion of any particular project and also has an option provision to extend the contract’s term, the most recent revision(s) of any applicable wage determination(s) must be incorporated any time an option is exercised, as described in 29 CFR 1.6(c)(2)(iii)(A), and on the contract anniversary date, as described in paragraph 29 CFR 1.6(c)(2)(iii)(B). However, when a contract has been changed as described in paragraph 29 CFR 1.6(c)(2)(iii)(A), including by the exercise of an option, the date of that modification will be considered the contract anniversary date for the purpose of annually updating the wage determination(s) in accordance with 29 CFR 1.6(c)(2)(iii)(B) for that year and any subsequent years of contract performance.

- In pre-bid conferences, contractors should be advised/encouraged to review the Davis-Bacon wage determinations in the bid documents, and to raise any questions/complaints they have during the advertising period. Often, out-of-date rates, errors, and wrong assumptions regarding the application of Davis-Bacon wage determinations can be corrected prior to bid opening/award, avoiding potential compliance issues.

UNDERSTANDING GENERAL WAGE DETERMINATIONS

Locating and obtaining Davis-Bacon wage determinations

- The SAM website (http://www.sam.gov) contains all current general wage determinations as well as previous modifications to the wage determinations (archived wage determinations) and a listing of the wage determinations to be modified in the next publication cycle.

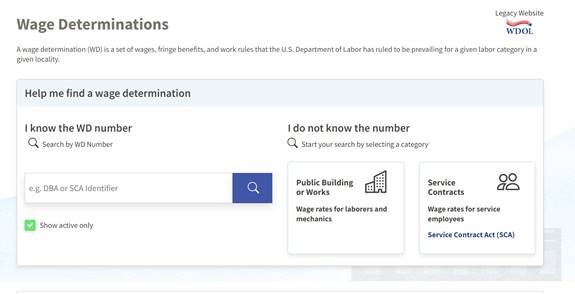

- Go to www.sam.gov website.

- Click the “Wage Determinations” tab on the left-hand side of the page.

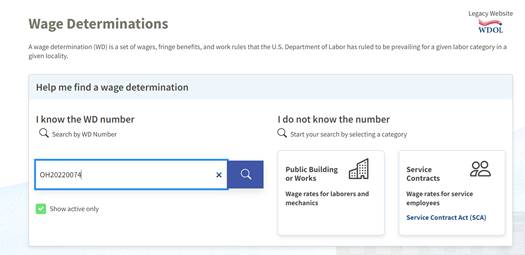

- The resulting screen provides two ways of searching for a wage determination (WD).

- Option 1 – The WD number is known

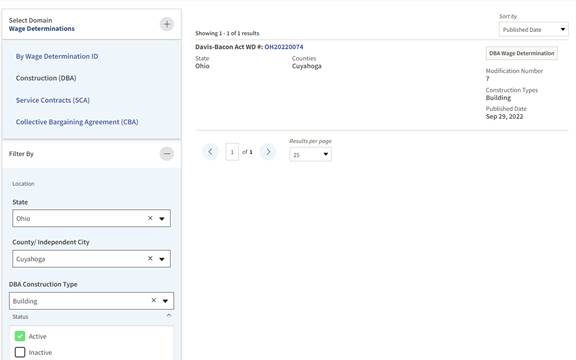

- Enter the WD number in the search bar under the section entitled “I know the WD number.” (For example, enter OH20220074.)

- Click the “magnifying glass” button in the blue box at the right end of the search bar to execute the search.

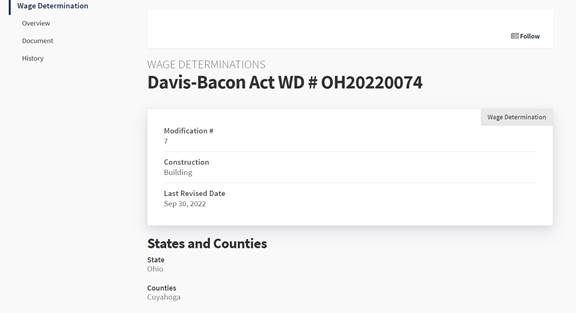

- After executing the search, the requested WD will be shown on the results page.

- Click on the WD number (because it is a hyperlink, the WD number is in blue).

- After clicking the WD number, you will be taken to the results page showing the last revision of the WD.

- Scroll down on the results page to view the WD under the “Document” heading. At this point, you have the option to download or print the WD by selecting one of the respective options to the right of the “Document” heading, which is immediately above the displayed WD. (Note: if you encounter any issues with printing the WD, please switch your web browser to Google Chrome and retry.)

- Option 2 – The WD number is unknown.

- Select “Public Building or Works” under the section entitled “I do not know the number.”

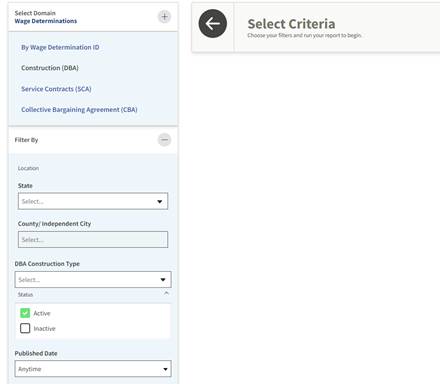

- The resulting screen provides filter options to narrow the search results by state, county or independent city, and construction type.

- Perform the following steps under the “Filter By” section:

- Select the applicable location from the “State” drop-down menu.

- Select the applicable county or independent city from the “County/Independent City” drop down menu.

- Select the construction type from the “Construction Type” drop down menu:

- Building: construction, alteration, or repair of a sheltered enclosure with walk-in access for the purpose of housing person, machinery, equipment or supplies.

- Residential: construction, alteration, or repair of single family houses or apartment buildings of no more than four stories in height.

- Highway: construction, alteration, or repair of roads, streets, highways, runways, taxiways, alleys, trails, paths, parking areas, and other similar projects not incidental to building or heavy construction.

- Heavy: projects that are not properly classified as either “building”, “residential”, or “highway”.

- Click on the WD number (because it is a hyperlink, the WD number is in blue).

- After clicking on the WD number, you will be directed to the results page showing the last revision of the WD.

- Scroll down on the results page to view the WD under the “Document” heading. At this point, you have the option to download or print the WD by selecting one of the respective options to the right of the “Document” heading, which is immediately above the displayed WD. (Note: if you encounter any issues with printing the WD, please switch your web browser to Google Chrome and retry.)

- If the search parameters do not yield any result(s) or you are unable to locate a specific wage determination, then the contracting agency will need to submit a SF-308 form to request a project wage determination.

- Select “Public Building or Works” under the section entitled “I do not know the number.”

Previous (archived) GWDs

- Previous modifications of a wage determination can be found using Option 1 or 2 discussed above.

- When using Option 1 above, once you select the wage determination you will click on “History” to find archived wage determinations.

- When using Option 2, include “Inactive” status when entering the filter information.

Future GWDs (to be revised)

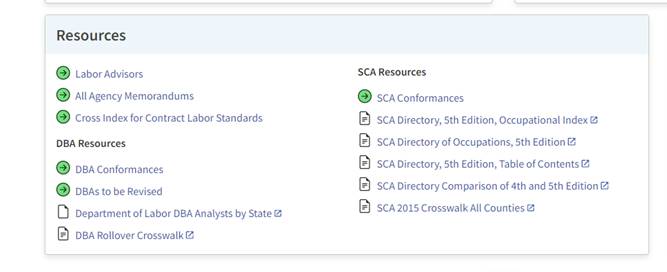

- A listing of the wage determinations scheduled to be modified in the next publication cycle can be obtained by choosing “DBAs to be revised” from the “Resources” on the Wage Determination main page as illustrated below in the sample screen.

How to interpret a GWD

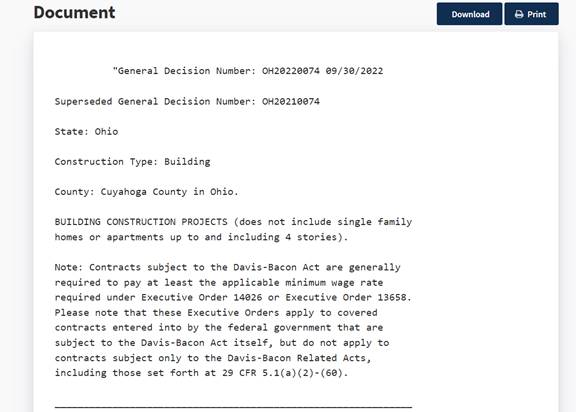

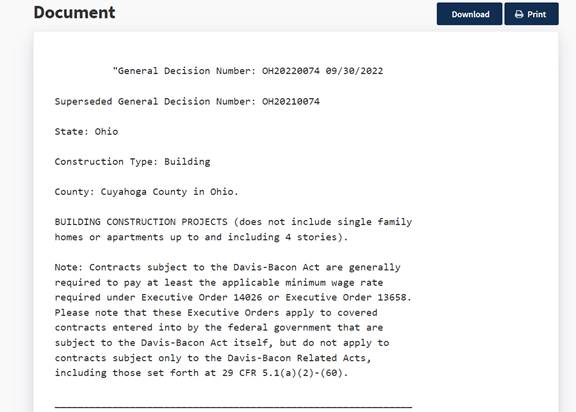

- Each wage determination begins with a cover sheet that defines its applicability by:

- The decision number

- The number of the decision superseded, if applicable

- State(s) covered

- Type of construction (building, heavy, highway, and/or residential)

- County(ies), parishes, and/or city(ies) covered

- Description of the construction to which the wage determination applies and/or construction excluded from its application

- Notes on Executive Orders 13658 and 14026

- Record of modifications, including the initial publication date, modification numbers and dates

- The cover sheet is illustrated in the sample below.

“General Decision Number: NH20230019 02/24/2023 Superseded General Decision Number: NH20220019 State: New Hampshire Construction Type: Building County: Merrimack County in New Hampshire. BUILDING CONSTRUCTION PROJECTS (does not include single family homes or apartments up to and including 4 stories). Note: Contracts subject to the Davis-Bacon Act are generally required to pay at least the applicable minimum wage rate required under Executive Order 14026 or Executive Order 13658. Please note that these Executive Orders apply to covered contracts entered into by the federal government that are subject to the Davis-Bacon Act itself, but do not apply to contracts subject only to the Davis-Bacon Related Acts, including those set forth at 29 CFR 5.1(a)(2)-(60). ______________________________________________________________ |If the contract is entered |. Executive Order 14026 | |into on or after January 30, | generally applies to the | |2022, or the contract is | contract. | |renewed or extended (e.g., an |. The contractor must pay | |option is exercised) on or | all covered workers at | |after January 30, 2022: | least $16.20 per hour (or | | | the applicable wage rate | | | listed on this wage | | | determination, if it is | | | higher) for all hours | | | spent performing on the | | | contract in 2023. | |______________________________|_____________________________| |If the contract was awarded on|. Executive Order 13658 | |or between January 1, 2015 and| generally applies to the | |January 29, 2022, and the | contract. | |contract is not renewed or |. The contractor must pay all| |extended on or after January | covered workers at least | |30, 2022: | $12.15 per hour (or the | | | applicable wage rate listed| | | on this wage determination,| | | if it is higher) for all | | | hours spent performing on | | | that contract in 2023. | |______________________________|_____________________________| The applicable Executive Order minimum wage rate will be adjusted annually. If this contract is covered by one of the Executive Orders and a classification considered necessary for performance of work on the contract does not appear on this wage determination, the contractor must still submit a conformance request. Additional information on contractor requirements and worker protections under the Executive Orders is available at http://www.dol.gov/whd/govcontracts. Modification Number Publication Date 0 01/06/2023 1 01/13/2023 2 02/10/2023 3 02/24/2023

Classifications, basic hourly rates, and fringe benefits

- In the body of each wage determination is the listing of classifications (laborers and mechanics) and accompanying basic hourly wage rates and fringe benefit rates that have been determined to be prevailing for the specified type(s) of construction in the geographic area(s) covered by the wage determination.

- Classification listings may also include classification groupings, fringe benefit footnotes, descriptions of the geographic areas to which sub-classifications and different wage rates apply, and/or certain classification definitions.

- Above each classification (or group of classifications) listed on the wage determination is an alphanumeric “identifier” and date, which provide information about the source of the classification(s) and wage rate(s) listed for the classification. The discussion of “Classification Identifiers,” below, focuses on information about the source of a rate (union majority or survey weighted average rates).

- In wage determination modifications, an asterisk (“*”) is used to indicate that the item marked is changed by that modification to that particular wage determination.

- An example of this information is illustrated below:

ELEC0490-002 06/01/2022 Rates Fringes ELECTRICIAN......................$ 32.80 21.68 ---------------------------------------------------------------- * IRON0007-040 09/16/2022 Rates Fringes IRONWORKER, STRUCTURAL...........$ 29.71 24.34 ---------------------------------------------------------------- LABO0668-001 12/01/2022 Rates Fringes LABORER: Common or General......$ 24.51 20.82 ---------------------------------------------------------------- PLUM0131-003 06/06/2022 Rates Fringes PIPEFITTER.......................$ 38.50 25.05 ---------------------------------------------------------------- SUNH2015-005 06/16/2017 Rates Fringes Carpenter, Includes Drywall Finishing/Taping, Drywall Hanging and Metal Stud Installation.....................$ 26.19 9.06 CEMENT MASON/CONCRETE FINISHER...$ 23.55 7.14 IRONWORKER, REINFORCING..........$ 29.89 10.70 LABORER: Mason Tender - Brick...$ 19.60 2.73 In addition to current prevailing wages listed on the wage determination(s), if your contract is subject to the Executive Order(s) it may require a different minimum wage. The Executive Order information is listed on the applicable wage determination. Executive Order 14026 (MW EO 14026) generally applies to contracts entered into on or after January 30, 2022, or when the contract is renewed or extended (e.g., an option is exercised) on or after January 30, 2022). The contractor must pay all covered workers at least $16.20 per hour (or the applicable wage rates listed on the wage determination, if it is higher) for all hours spent performing on the contract in 2023. Please be sure to review the applicable wage determination for additional information regarding Executive Orders. If your contract is subject to the EO, you are required to pay the minimum wage rates of $16.20 per hour not the rate identified on the wage determination for the respective classification.

Classification identifiers

- The body of each wage determination lists the classifications and wage rates that have been found to be prevailing for the cited type(s) of construction in the area covered by the wage determination. The classifications are listed in alphabetical order of “identifiers” that indicate whether particular rates are union majority or survey weighted average wage rates.

- Some wage determinations contain only survey weighted average wage rates, some contain only union-negotiated majority wage rates, and others contain both union majority and survey weighted average wage rates that have been found to be prevailing in the area for the type of construction covered by the wage determination.

Union identifiers

- An identifier beginning with characters other than SU, SC, SA, or SP denotes that the union classification(s) and wage rate(s) have been found prevailing. The first four letters indicate the international union for the local union that negotiated the wage rates listed under that identifier (see listing below). The four-digit number that follows indicates the local union number.

- Example:

PLUM0131-003 06/06/2022 Rates Fringes PIPEFITTER.......................$ 38.50 25.05 The identifier is PLUM0131-003 06/06/2022. PLUM = Plumbers; 0131 = the local union number (district council number where applicable); and 003 = internal number used in processing the wage determination. The date following these characters is the effective date of the most current negotiated rate.

- Example:

- The same union may negotiate wage and fringe benefits for painters and glaziers. In such a case, the wage rate for the glazier, as well as that for the painter, will be found under an identifier beginning with “PAIN” (if the union rates were found prevailing for both glaziers and painters).

- Similarly, users may need to look under an identifier beginning with “CARP” to find not only rates for carpenters, but also those for millwrights, piledrivermen, and (marine) divers.

Union identifier code abbreviations

- Following are the identifier codes used to reference the various craft unions. Examples of classifications for which their local unions commonly negotiate wage and fringe benefit rates are shown in parentheses.

ASBE = International Association of Heat and Frost Insulators and Asbestos Workers

BOIL = International Brotherhood of Boiler Makers, Iron Shipbuilders, Blacksmiths, Forgers and Helpers

BRXX = International Union of Bricklayers, and Allied Craftsmen (bricklayers, cement masons, stone masons, tile, marble and terrazzo workers)

CARP = United Brotherhood of Carpenters and Joiners of America (carpenters, millwrights, piledrivermen, soft floor layers, divers)

ELEC = International Brotherhood of Electrical Workers

(electricians, communication systems installers, and other low voltage specialty workers)ELEV = International Union of Elevator Constructors ENGI = International Union of Operating Engineers

(operators of various types of power equipment)IRON = International Association of Bridge, Structural and Ornamental Iron Workers

LABO = Laborers’ International Union of North America

PAIN = International Brotherhood of Painters and Allied Trades (painters, drywall finishers, glaziers, soft floor layers)

PLAS = Operative Plasterers’ and Cement Masons’ International Association of the United States and Canada

(cement masons, plasterers)PLUM = United Association of Journeymen and Apprentices of the Plumbing and Pipe Fitting Industry of the United States and Canada (plumbers, pipefitters, steamfitters, sprinkler fitters)

ROOF = United Union of Roofers, Waterproofers, and Allied Workers

SHEE = Sheet Metal Workers International Association

TEAM = International Brotherhood of Teamsters

“Survey” weighted average identifiers

- Classification(s) for which the union rate(s) were not determined to be prevailing are listed under an “SU” identifier. SU means the rates listed under that identifier were derived from survey data by computing non-union contractor majority wage rates or, more commonly, weighted average rates, which could, for example, be based on only non-union contractors’ wage rates or a mixture of union and non-union contractors’ wage rates, i.e., the data reported for such a classification and used in computing the prevailing rate may include both union and non-union data. Note that various classifications, for which survey rates have been determined to be prevailing, may be listed in alphabetical order under this identifier.

- Example:

SUNH2015-005 06/16/2017 Rates Fringes Carpenter, Includes Drywall Finishing/Taping, Drywall Hanging and Metal Stud Installation.....................$ 26.19 9.06 CEMENT MASON/CONCRETE FINISHER...$ 23.55 7.14 IRONWORKER, REINFORCING..........$ 29.89 10.70 LABORER: Mason Tender - Brick...$ 19.60 2.73 LABORER: Mason Tender - Cement/Concrete..................$ 20.85 2.61- In this example, the identifier is SUNH2015-005 06/16/2017. SU indicates rates that are in most cases weighted average wage rates from a mix of union and non-union data (or, occasionally, non-union contractor majority wage rates); NH indicates the state of New Hampshire; 2015 is the year of the survey and 005 is an internal number used in producing the wage determination.

- A 1993 or later date indicate the classification(s) and wage rate(s) under that identifier were issued in the GWD on that date.

- In this example, the identifier is SUNH2015-005 06/16/2017. SU indicates rates that are in most cases weighted average wage rates from a mix of union and non-union data (or, occasionally, non-union contractor majority wage rates); NH indicates the state of New Hampshire; 2015 is the year of the survey and 005 is an internal number used in producing the wage determination.

- Example:

Union average rate identifiers

- Classification(s) listed under the UAVG identifier indicate that no single majority rate prevailed for those classifications; however, 100% of the data reported for the classification was union data.

- Example: UAVG-OH-0012 01/01/2019.

- UAVG indicates that the rate is a weighted union average rate. OH indicates the state.

- 0012 is the internal number used in the production of the wage determination.

- 01/01/2019 indicates the survey completion date for the classifications and rates under that identifier.

- A UAVG rate is updated once a year, usually in January, to reflect the updated weighted average based on the current negotiated/CBA rate of the union locals from which the rate is based.

- Example:

* UAVG-OH-0012 01/01/2019 Rates Fringes BRICKLAYER: TILE FINISHER........$ 26.88 11.81 BRICKLAYER: TILE SETTER..........$ 29.90 16.52

- Example:

Regularly conformed rates

- Wage Determinations can also contain classifications for which conformance requests are regularly submitted pursuant to 29 CFR 5.5(a)(1)(iii). Such classifications and wage and fringe benefit rates may be listed on wage determinations, provided that:

- The work performed by the classification is not performed by a classification in the wage determination;

- The classification is used in the area by the construction industry; and

- The wage rate for the classification bears a reasonable relationship to the wage rates contained in the wage determination.

- Regularly conformed rates will be identified on wage determinations with a “SC+State” identifier. They can also be referred to as supplemental rates.

State adopted rates

- The DBRA permits the Administrator to adopt prevailing wage rates determined for public construction by state and/or local officials, provided certain criteria are met.

- The state or local government sets wage rates and collects relevant data using a survey or other process that is open to full participation by all interested parties

- The wage rate reflects both a basic hourly wage rate and fringe benefits which can be calculated separately.

- The State or local government classifies laborers and mechanics in a manner that is recognized within the field of construction, and

- The State or local government’s criteria for setting prevailing wage rates are substantially similar to those DOL uses in making wage determinations.

- Wage rates that are state adopted will be reflected on wage determinations with an identifier of “SA+State”

PROJECT WAGE DETERMINATION REQUEST FORM, SF-308

- A copy of the DBRA Standard Form (SF) 308 is available here:

https://www.dol.gov/agencies/whd/government-contracts/construction/forms/sf-308