Return to Main PWRB

INTRODUCTION

OVERVIEW OF DAVIS-BACON SURVEY PROCESS

KEY CLASSES

CERTIFIED PAYROLLS

SURVEY FORM WD-10 & INSTRUCTIONS

INTRODUCTION

- WHD conducts a continuing program for obtaining and compiling wage rate information, including the conduct of surveys requesting the voluntary submission of wage data by contractors, contractors’ associations, labor organizations, public officials, and other interested parties as the basis for developing Davis-Bacon wage determinations that reflect the wages paid to laborers and mechanics working on different types of construction in local areas across the country. These wage determinations set minimum pay requirements for federal and federally assisted construction subject to Davis-Bacon and Related Acts (DBRA) prevailing wage requirements.

- Based on the data submitted in response to such surveys, WHD determines the locally prevailing wages that are included on Davis-Bacon wage determinations and incorporated into DBRA-covered contracts.

- This chapter of the Prevailing Wage Resource Book provides information concerning the WHD survey process whereby data is requested, analyzed, compiled, and used to issue the Davis-Bacon wage determinations that are incorporated into DBRA-covered contracts.

Statutory and regulatory requirements

- The DBA requires that the minimum wage requirements included in covered contracts be “based on the wages the Secretary of Labor determines to be prevailing for the corresponding classes of laborers and mechanics employed on projects of a character similar to the contract work” in the area (usually a county) in which proposed contract work is to be performed. 40 USC 3142(b).

- As noted in 29 CFR 1.1(a), the responsibility for such determinations has been delegated to the WHD Administrator and authorized representatives.

- 29 CFR part 1 establishes the procedures for issuing and applying Davis-Bacon wage determinations to covered contracts.

- The regulatory definition of the term “prevailing wage” is stated at 29 CFR 1.2:

- The term prevailing wage means:

- The wage paid to the majority (more than 50 percent) of the laborers or mechanics in the classification on similar projects in the area during the period in question;

- If the same wage is not paid to a majority of those employed in the classification, the prevailing wage will be the wage paid to the greatest number, provided that such greatest number constitutes at least 30 percent of those employed; or

- If no wage rate is paid to 30% of those so employed, the prevailing wage will be the average of the wages paid to those employed in the classification, weighted by the total employed in the classification.

- The term prevailing wage means:

- The regulation further states at 29 CFR 1.3 that:

- For the purpose of making wage determinations, the Administrator will conduct a continuing program for the obtaining and compiling of wage rate information.

- WHD conducts a continuing program for the obtaining and compiling of wage rate information, in accordance with 29 CFR 1.3, which addresses “Obtaining and compiling wage rate information.” As mandated by 29 CFR 1.3(a):

- The Administrator will encourage the voluntary submission of wage rate data by contractors, contractors’ associations, labor organizations, public officials and other interested parties, reflecting wage rates paid to laborers and mechanics on various types of construction in the area.

- The Administrator may also obtain data from agencies on wage rates paid on construction projects under their jurisdiction.

- The information submitted should reflect the wage rates paid to workers employed in a particular classification in an area, the type or types of construction on which such rates are paid, and whether or not such wage rates were paid on Federal or federally assisted projects subject to Davis-Bacon prevailing wage requirements.

- In determining the prevailing wages at the time of issuance of a wage determination, the Administrator will be guided by the definition of prevailing wage in 29 CFR 1.2 and will consider the types of information listed in 29 CFR 1.3.

- A listing of types of information that may be considered in making wage rate determinations is provided in 29 CFR 1.3(b). It includes:

- Statements showing wage rates paid on projects, which should include:

- The names and addresses of contractors, including subcontractors,

- The locations, approximate costs, dates of construction and types of projects,

- Whether or not the projects are Federal or federally assisted projects subject to Davis-Bacon prevailing wage requirements,

- The number of workers employed in each classification on each project, and

- The respective wage rates paid such workers;

- Signed collective bargaining agreements, for which the Administrator may request that the parties to such agreements submit statements certifying to their scope and application;

- Wage rates determined for public construction by State and local officials pursuant to State and local prevailing wage legislation;

- Wage rate data submitted to the Department of Labor by contracting agencies as part of requests for conformances under 29 CFR 5.5(a)(1)(iii); and

- Any other information pertinent to the determination of prevailing wage rates.

- Also, in making highway wage rate determinations pursuant to 23 USC 113, the highway department of the State in which a project in the Federal-Aid highway system is to be performed shall be consulted, and the Administrator shall give due regard to the information thus obtained.

- Statements showing wage rates paid on projects, which should include:

- Data from Federal or federally assisted projects will be used in compiling wage rate data for heavy and highway wage determinations. In compiling wage rate data for building and residential wage determinations, the Administrator will not use data from Federal or federally assisted projects subject to Davis-Bacon prevailing wage requirements unless it is determined that there is insufficient wage data to determine the prevailing wages in the absence of such data. 29 CFR 1.3(d).

- In determining the prevailing wage, the Administrator may treat variable wage rates paid by a contractor or contractors to workers within the same classification as the same wage where the pay rates are functionally equivalent, as explained by one or more collective bargaining agreements or written policies otherwise maintained by a contractor or contractors. 29 CFR 1.3(e).

- If the Administrator determines that there is insufficient wage survey data to determine the prevailing wage for a classification for which conformance requests are regularly submitted pursuant to 29 CFR 5.5(a)(1)(iii), the Administrator may list the classification and wage and fringe benefit rates for the classification on the wage determination, provided that:

- The work performed by the classification is not performed by a classification in the wage determination;

- The classification is used in the area by the construction industry; and

- The wage rate for the classification bears a reasonable relationship to the wage rates contained in the wage determination.

- The Administrator also may make a wage determination by adopting, with or without modification, one or more prevailing wage rates determined for public construction by State and/or local officials, under the circumstances set forth in 29 CFR 1.6(h).

OVERVIEW OF DAVIS-BACON SURVEY PROCESS

- When a survey is started, national and local interested parties are notified of the survey, its boundaries, time frame, and cutoff date by letter. The notification letter requests that interested parties help facilitate the survey briefing process and that they encourage contractors/members to participate in the survey through the submission of wage data.

- Prior to the data collection period, WHD works with stakeholders (including contractors, associations, unions, and other interested parties) to communicate the parameters of the survey and identify interested parties that can provide wage survey data. Interested parties are invited to attend survey briefings to learn more about the survey process and how to participate. Form WD-10A is available and can be used by contractors and other interested parties to submit additional prime contractor and subcontractor information to help ensure that contractors and other interested parties are broadly invited to participate in the survey.

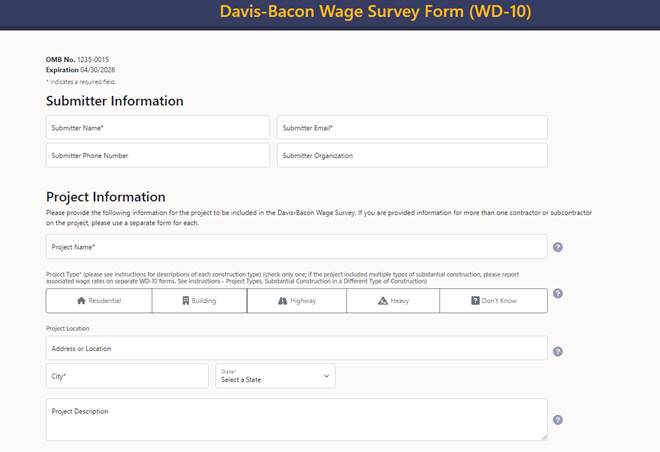

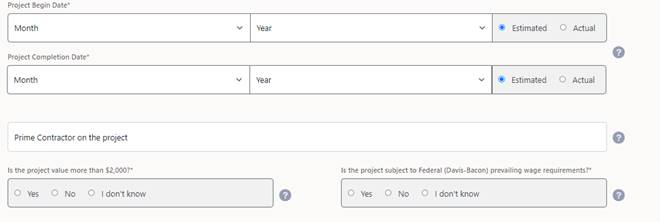

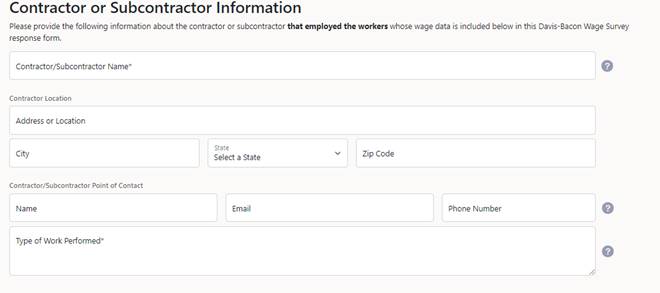

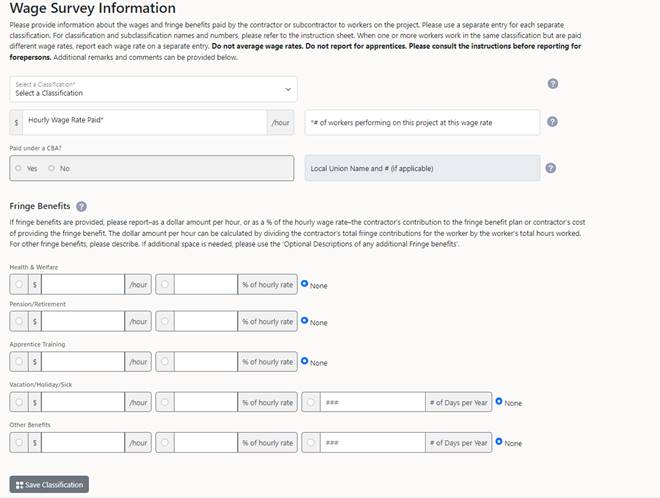

- Wage and fringe benefit data are collected from construction contractors and other interested parties on Form WD-10, an electronic version of which is found at: http://www.dol.gov/whd/programs/dbra/WD10Instrctns/wd10instructions.htm .

- WHD analysts follow up on all non-responses and may call contractors to obtain missing data and/or to clarify wage data submissions.

- Wage data submissions are verified as to area, time frame, construction type, and timeliness. WHD analyzes the survey data and resolves “area practice” issues that arise in the survey process when multiple classifications perform the same work.

- The wage data are tabulated, and prevailing wage rates and fringe benefits are calculated.

- If a majority of the workers in a classification were paid the same rate, that rate will be determined to be the prevailing wage for the classification. For example, if a majority were paid the same union rate negotiated for certain work under a collective bargaining agreement, that rate will be determined to be the prevailing wage for the classification.

- If the same wage is not paid to a majority of those employed in the classification, the prevailing wage will be the wage paid to the greatest number, provided that such greatest number constitutes at least 30 percent of those employed.

- If no wage rate is paid to at least 30% of those so employed, the prevailing wage will be the average of the wages paid to those employed in the classification, weighted by the total employed in the classification. 29 CFR 1.2.

- Wage rates and wage determinations are tested to ensure that they are based on sufficient wage data. A prevailing wage rate is issued for a specific classification only when sufficient wage data for that classification has been obtained through the survey process. Similarly, wage determinations are developed and issued only when sufficient data has been obtained for a sufficient number of classifications.

- WHD generally provides interested parties with a period of three (3) months to submit data for a survey, and follow-up analysis and clarification can take 12-18 months after the survey cut-off date.

- Accurate and comprehensive wage determinations are enhanced by robust participation in the survey process by interested parties.

- Contracting agencies may submit certified payroll data as part of the survey process, and submission of such data can be essential to determining prevailing wage rates for heavy and highway construction in particular.

- Federal agencies may also play a key role in survey success by encouraging participation amongst their contractors and subcontractors, unions, or other interested parties.

- The DOL/WHD prevailing wage determinations based upon survey data cannot reflect wage data that is not submitted. They can only reflect the data that is actually submitted.

KEY CLASSES

| BUILDING | RESIDENTIAL | HEAVY & HIGHWAY |

|---|---|---|

|

|

|

CERTIFIED PAYROLLS

- Data from projects to which Davis-Bacon prevailing wage requirements applied may be used in specified circumstances to supplement wage data from private projects to allow for development of a wage determination. 29 CFR 1.3(d).

- Relevant data from all heavy and highway projects, including those on which Davis-Bacon prevailing wage requirements applied, always may be used in determining the prevailing wages for heavy construction and for highway construction.

- In determining the prevailing wages for building and residential construction, data from Davis-Bacon prevailing wage projects will not be used in calculating the prevailing wage unless insufficient information is received from non-prevailing wage projects.

- Federal agencies may be requested to provide data from certified payrolls to supplement data submitted from other sources, where appropriate. Where that occurs:

- It is not necessary to send a copy of every certified payroll submitted for a particular project. Only sufficient certified payrolls to show the total unduplicated workers and wage rates in the various classifications needs to be submitted.

- Certified payroll information will be transcribed to the WD-10 form as it can be electronically scanned into WHD’s survey computer program. The use of certified payroll data or other data reflecting wages paid on projects subject to DBRA requirements may affect the resulting wage determination.

SURVEY FORM AND WD-10 INSTRUCTIONS

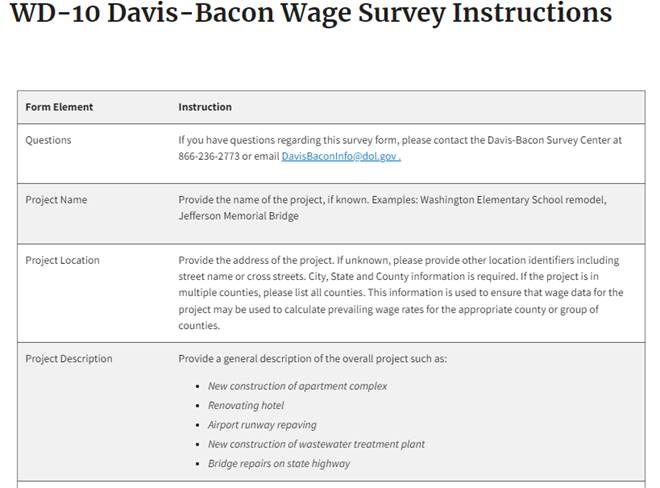

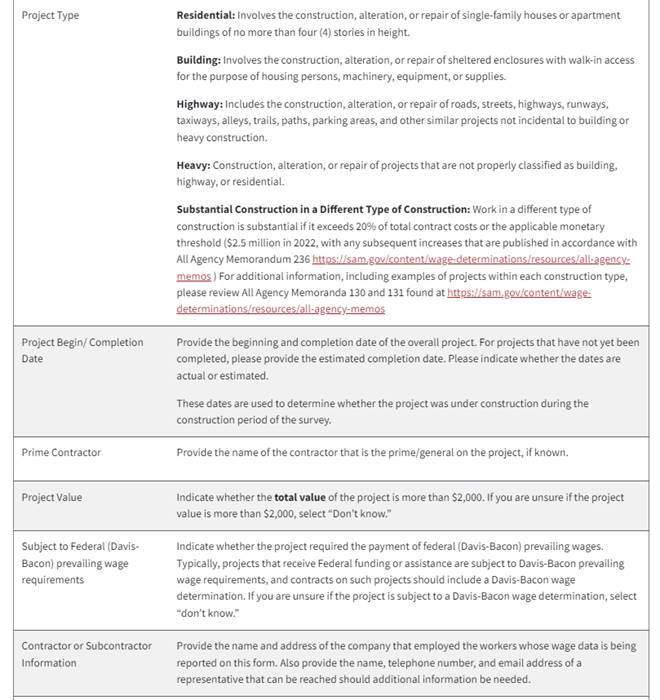

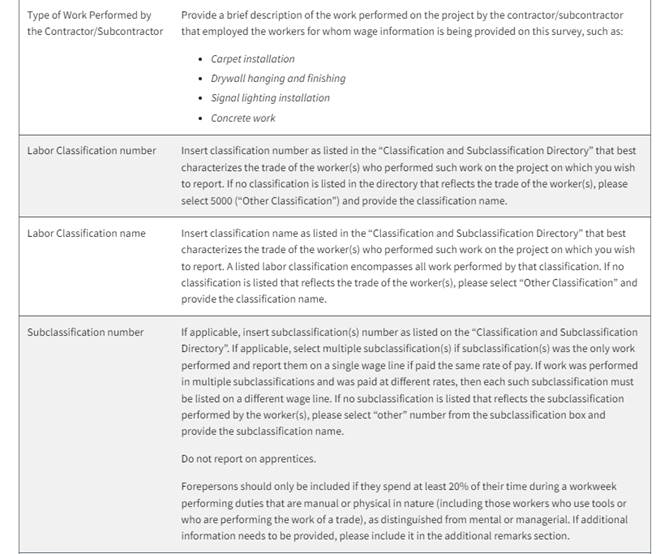

Davis-Bacon wage survey instructions

| Labor Classification Number/Name | Subclassification (if applicable) | Labor Classification Number/Name | Subclassification (if applicable) |

|---|---|---|---|

|

|

|

|

|

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

|

|

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

||

|

|

|

|

|

|

|

|

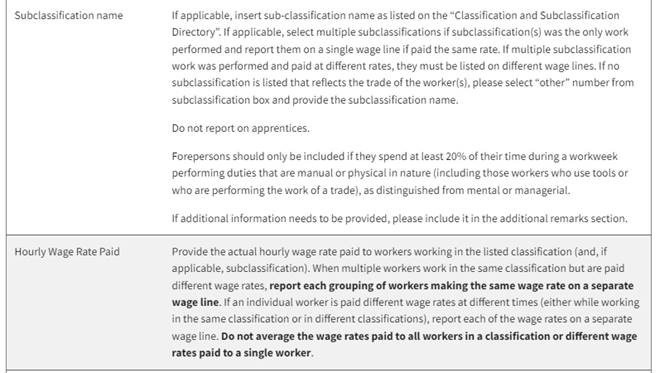

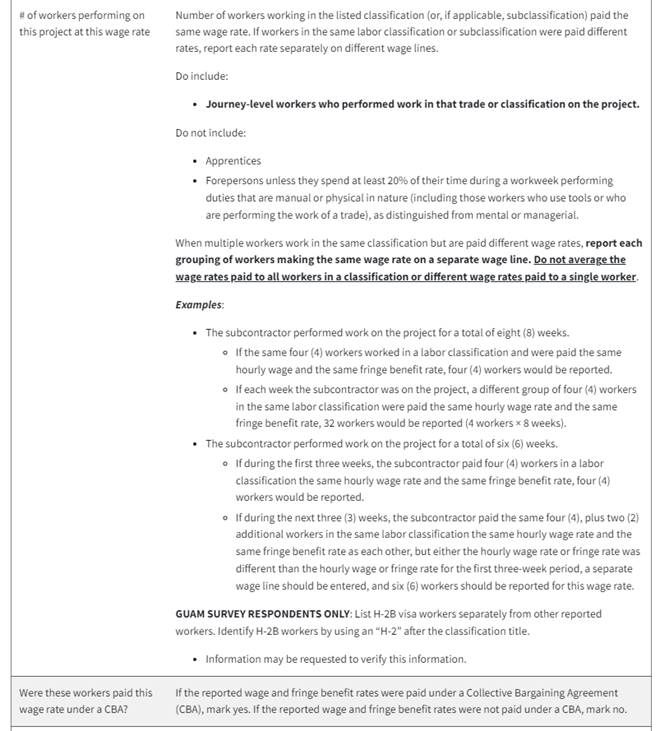

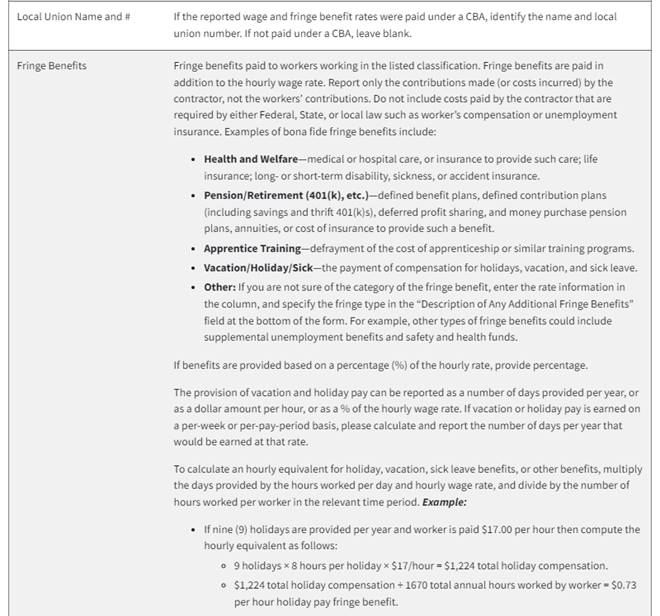

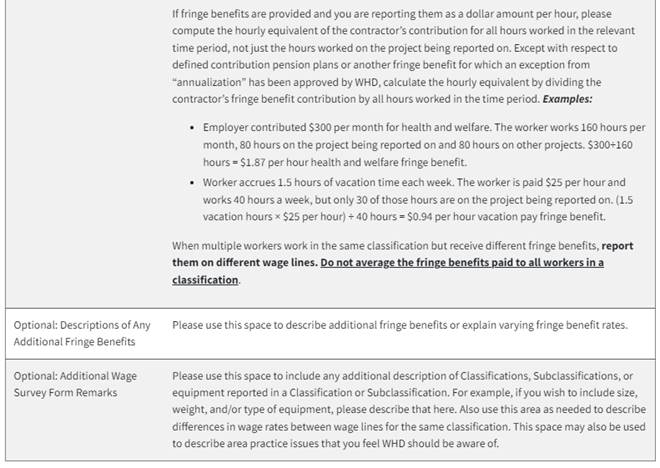

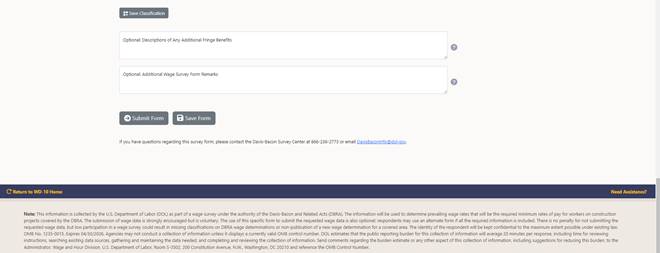

Davis-Bacon wage survey form (WD-10)

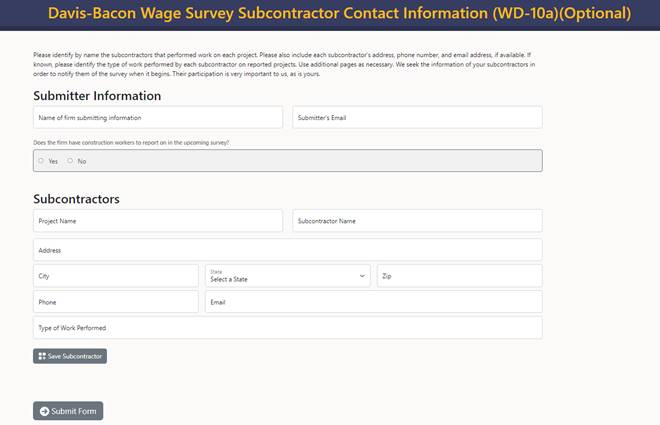

Davis-Bacon wage survey subcontractor contact information (WD-10a)