Fact Sheet # 79D: Hours Worked Applicable to Domestic Service Employment Under the Fair Labor Standards Act (FLSA)

April 2016

Background

Domestic service employment means services of a household nature performed by a worker in or about a private home (permanent or temporary). The term includes services performed by workers such as companions, babysitters, cooks, waiters, maids, housekeepers, nannies, nurses, janitors, caretakers, handymen, gardeners, home health aides, personal care aides, and family chauffeurs. This listing is illustrative and not exhaustive. Employees providing services in a private home are generally domestic service employees covered under the Fair Labor Standards Act (FLSA). These employees must be paid at least the federal minimum wage for all hours worked and overtime pay at not less than time and one half the regular rate of pay for hours worked over 40 in a workweek. Section 13(a)(15) of the FLSA provides a narrow exemption from the minimum wage and overtime requirements for casual babysitters and workers employed to perform companionship services for an elderly person or person with an illness, injury or disability. Section 13(b)(21) of the FLSA provides an exemption from the overtime, but not the minimum wage requirement for those employees who reside in the private home where they work (live-in domestic service employees).

This fact sheet is intended to provide guidance on those circumstances in which an employee who is covered by the FLSA minimum wage and overtime provisions is engaged in compensable work and therefore must be paid for those hours worked. The key issue in determining when workers are performing compensable work is whether they are working or engaged to wait for work or whether they have been completely relieved from duty and are able to use the time for their own purposes.

Hours Worked

Generally, when an employee is “on duty” (that is they must be in the home and prepared to provide services when required), they are working. For example, a nurse who must watch over an ill patient, a chauffeur who must be at the home and ready to drive when directed, or a nanny who must watch over her charge even when sleeping are all on duty and must be paid for all of that time. Under the FLSA, an employee who reads a book, knits, or works a puzzle while awaiting assignments is working during the period of inactivity. In such cases, the employee is “engaged to wait” and must be paid for such time.

On the other hand, domestic service employees (including live-in employees) who have been completely relieved from duty and are able to use the time for their own purposes—to go to a movie, run a personal errand, attend a parent-teacher conference— need not be paid for this time.

Example: Emily, a live-in care provider, assists her roommate who has a disability in the morning for three hours, then goes to class at the local university, returns home to study, watches television, and does her own laundry before assisting the roommate for two hours in the evening. Emily has only worked five hours; the hours spent actually engaged in assisting the roommate who has a disability is deemed to be compensable hours worked.

Example: George is hired as a personal attendant for Mr. Norton. He is expected to report to work at 7:00 am, when Mr. Norton’s daughter departs for work, and to stay until she returns in the evening, usually at 8:00 pm. While at the Norton residence, George is expected to be available should Mr. Norton need assistance with dressing, preparing meals, taking walks in the garden, or for any other reason. Three days a week George leaves at 1:00 pm to attend to personal business and returns at 4:00 pm. There are some days when George chooses not to leave the residence during this time but rather to stay and read a book or tend to personal paperwork. George is “engaged to wait” and is considered to be working during all the time he is at the residence attending to, or is expected to be available to, Mr. Norton. George is not working when he is completely relieved from duty for a period long enough to use the time effectively for his own purposes, such as running personal errands, reading a book, or doing personal paperwork.

Live-in Domestic Service Employees

A live-in domestic service employee is an employee who provides domestic services in a private home and resides on his or her employer’s premises on a “permanent basis” or for “extended periods of time.” See Fact Sheet 79B Live-In Domestic Service Workers Under the Fair Labor Standards Act (FLSA). Employees who work and sleep on the employer’s premises seven days per week and therefore have no home of their own other than the one provided by the employer are considered to “permanently reside” on the employer’s premises. Moreover, in accordance with longstanding agency policy, employees who work and sleep on the employer’s premises for five days a week (120 hours or more) are considered to reside on the employer’s premises for “extended periods of time.” Only those employees who are providing domestic services in a private home and are residing on the employer’s premises “permanently” or for “extended periods of time” are considered live-in domestic service employees under the FLSA. Employees who work 24-hour shifts are not necessarily live-in domestic service workers.

An employee who lives on the employer’s premises is not necessarily considered working all the time he or she is on the premises.

Example: Wendy is employed as a live-in domestic service worker for Mr. White. Wendy and Mr. White have an agreement that she will provide assistance with toileting, bathing, dressing, preparing breakfast and transportation to Mr. White’s workplace. This normally takes 2.5 hours depending on traffic to Mr. White’s office. Mr. White is at work from 9:00 am to 4:00 pm, and Wendy is not required to remain with Mr. White. In fact, Wendy goes to another part-time job at the grocery store. At the end of Mr. White’s workday, Wendy transports Mr. White to his home, prepares dinner for him and cleans up afterward before assisting Mr. White as he retires for the evening. This normally takes 4 hours. Wendy’s compensable hours worked in this scenario are 6.5.

Example: William lives with his cousin, Ms. Jones, who has a developmental disability. William is employed by a state agency to tend to her basic needs—preparing meals and feeding her, bathing, dressing, and administering medications. William spends 6 hours a day performing these functions and otherwise is free to leave the residence and to use the remainder of his day as he sees fit. William’s hours worked are the 6 hours he spends preparing meals, feeding, bathing, and administering medications to his cousin, Ms. Jones.

Travel Time

An employee who travels from home to work and returns to his or her home at the end of the workday is engaged in ordinary home-to-work travel which is a normal incident of employment. Normal travel from home to work and return at the end of the workday is not work time. This is true whether the employee works at a fixed location or at a different location each day. For live-in domestic service employees, home-to-work travel that is typically unpaid does not apply in this case because the employee begins and ends his or her workday at the same home in which he or she resides. Travel that is all in a day’s work, however, is compensable hours worked.

Example: Barbara drives Mr. Jones to the Post Office and grocery store during the workday. Barbara is working and the travel time must be paid.

Travel away from the home is clearly work time when it cuts across the employee’s workday. The employee is merely substituting travel for other duties. Thus, if an employee hired to provide home care services to an individual (consumer) accompanies that consumer on travel away from home, the employee must be paid for all time spent traveling during the employee’s regular working hours. As an enforcement policy, WHD will not consider as work time the time the employee spends as a passenger on an airplane, train, boat, bus or automobile when in travel away from home outside of regular working hours. However, the employee must be paid for all hours engaged in work or “engaged to wait” while on travel. For example, an employee who is required to travel as a passenger with the consumer “as an assistant or helper” and is expected to perform services as needed is working even though traveling outside of the employee’s regular work hours. However, periods where the employee is completely relieved from duty, which are long enough to enable him or her to use the time effectively for his or her own purposes, are not hours worked and need not be compensated.

Example: John is a personal attendant for Mrs. Brown, who lives in Atlanta. Mrs. Brown attends a conference in New York City and John accompanies her by plane. John normally works 8:00 am to 4:00 pm. Mrs. Brown’s daughter takes her to the airport where they meet John for the flight at 6:00 pm. WHD will not consider the flight time as compensable hours because it is time spent in travel away from home outside of regular working hours as a passenger on an airplane if John is completely relieved from duty. If John provides assistance to Mrs. Brown while at the airport or during the flight or must be available to assist or help as needed, he is working and must be compensated for this time.

When an employee who is employed by a third party employer travels from home to work and returns to his or her home at the end of the workday is engaged in ordinary home-to-work travel, that is not compensable work time. However, travel from job site to job site during the workday, such as travel between several clients during the workday, is compensable hours worked. The third-party employer is responsible for ensuring that travel time from job site to job site is paid.

Example: Tiffany is a direct care worker who is employed by Handy Home Care Agency. She provides services to two of the agency's clients, Mr. Jackson, from 9:00am to 11:30am, and Mr. Smith, from 12:00pm to 6:00pm. Tiffany drives from Mr. Jackson's home, leaving at 11:30am, to Mr. Smith’s home, arriving at 12:00pm. The 30 minutes Tiffany spends traveling between the two homes is hours worked and, must be paid by the Handy Home Care Agency.

Sleep Time

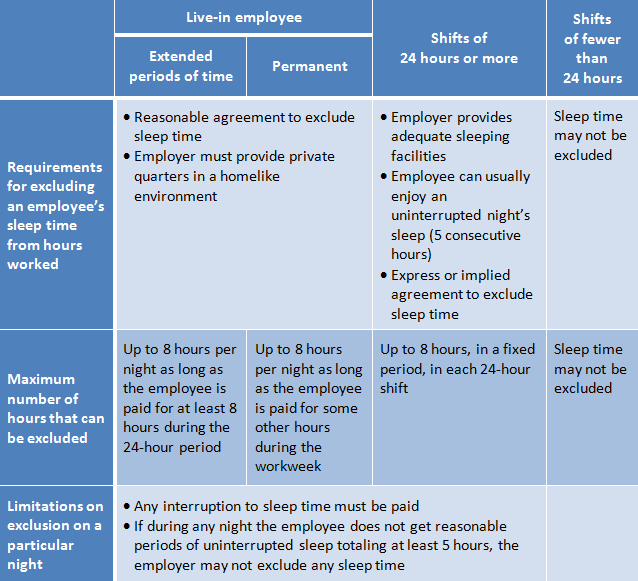

In some circumstances, an employer may exclude up to eight hours an employee spends sleeping at the worksite from the time for which an employee must be paid. The requirements for excluding sleep time vary depending on whether an employee is a “live-in” employee, is working a shift of 24 hours or more, or is working a shift of less than 24 hours. For all employees whose sleep time can usually be excluded, any interruptions to sleep time by a call to duty must be paid, and if the employee is interrupted such that he or she cannot get reasonable periods of sleep totaling at least five hours, the entire night must be paid.

The following chart summarizes the sleep time rules for each category of worker. Additional information about these requirements is available at http://www.dol.gov/agencies/whd/homecare/sleep_time.

Where to Obtain Additional Information

For additional information, visit our Wage and Hour Division Website: http://www.dol.gov/agencies/whd and/or call our toll-free information and helpline, available 8 a.m. to 5 p.m. in your time zone, 1-866-4USWAGE (1-866-487-9243).

This publication is for general information and is not to be considered in the same light as official statements of position contained in the regulations.