Fact Sheet #79G: Application of the Fair Labor Standards Act to Shared Living Programs, including Adult Foster Care and Paid Roommate Situations

March 2014

The Department of Labor (“Department”) published a Final Rule on October 1, 2013 extending minimum wage and overtime pay protections under the Fair Labor Standards Act (“FLSA”) to many direct care workers (such as home health aides, personal care assistants, and workers in similar occupations) who provide essential home care assistance to people with disabilities and older adults. The Rule takes effect on January 1, 2015.

Simultaneously with this Fact Sheet, the Department is publishing Administrator’s Interpretation 2014-1 (“AI”) discussing how longstanding FLSA principles apply to “shared living programs.” These are programs that provide supports and services allowing people with disabilities and older adults to live in their own homes or in family homes in their communities, as opposed to in congregate settings like group homes or institutions, and in which the individual receiving assistance and the worker providing it live and share a life together. These programs are referred to by various titles, such as “adult foster care,” “host home,” “paid roommate,” “supported living,” or “life sharing.”

This Fact Sheet, along with the AI, provides guidance on how the FLSA’s requirements may apply to home care work that occurs in shared living arrangements. Because the design of shared living programs can vary greatly, the guidance in this Fact Sheet is not intended to be a substitute for a fact-specific analysis of any particular shared living program and, importantly, any particular arrangement for services under that program.

Terms within and scope of this Fact Sheet

Throughout this Fact Sheet, the term “consumer” refers to an individual receiving services and “provider” refers to the individual providing those services. Where the term “consumer” refers to the person receiving services as a potential employer for purposes of the FLSA, it is used as shorthand; a consumer or that person’s family, household member, or other representative could be the employer. The term “third party” refers to any entity other than the consumer or the consumer’s family or household that is involved in administering a shared living program, such as a state, local government, or private agency and that might be a provider’s employer as well.

The common characteristic of shared living programs is that they involve a consumer and a person providing paid services living and sharing a life together in a private home. The specific arrangements will vary greatly across programs, states, and the preferences and needs of the individuals receiving the supports and services. Shared living programs are most commonly funded through Medicaid, but they may also involve other public or private funding. Although these programs are known by a range of names, for purposes of the FLSA, it is the particular facts of the arrangement between a provider, consumer, and, if relevant, third party that determine whether and how the FLSA applies, not the name or characterization of the program.

Regardless of what they are called in a particular state, group homes or other models involving workers coming into a home for shifts to provide care do not constitute shared living as the Department is using the term here and are, therefore, not within the scope of this Fact Sheet. Nor are personal arrangements where an employment relationship clearly does not exist (for example, an individual who provides care for a spouse or child with a disability without the expectation of compensation, or an individual who shares an apartment with an individual with disabilities based on friendship or mutual convenience without providing any formal services to the individual and without any expectation of compensation). Additionally, the analysis below does not address workers, sometimes called respite workers, hired to provide assistance when the provider is unavailable or otherwise needs relief from his or her responsibilities. While such a worker is likely to be entitled to FLSA minimum wage and overtime pay protections, that determination requires a separate assessment of the circumstances of the individual’s work arrangement.

FLSA Analysis for Different Shared Living Models

A provider is entitled to receive at least the federal minimum wage and overtime pay in any workweek in which the FLSA applies. The FLSA applies if three factors are present: there is an employment relationship (in other words, the worker is an employee rather than an independent contractor); the employer is a covered employer (in other words, the employer is of the type or size that must comply with the Act); and the employee is not exempt (in other words, an employer may not claim any exemptions from the Act’s requirements). If all three factors are present, the employee must be paid for all “hours worked.” Under the FLSA, there are special rules for determining hours worked for live-in employees (including most shared living providers), and if certain conditions are met, the fair value of board, lodging, and other facilities counts towards the minimum wage requirement. The FLSA also allows for wages to be paid in the form of a stipend, salary, or other non-hourly wage provided that, when converted to an hourly rate each workweek, it satisfies minimum wage and overtime pay requirements.

For purposes of this Fact Sheet, shared living arrangements are grouped into three types: (1) those in which the consumer lives in a provider’s home; (2) those in which the provider lives in the consumer’s home; and (3) those in which the provider and consumer move into a new home together. The application of FLSA principles to each of these types of shared living is described below.

1. Shared Living in a Provider’s Home

In this type of shared living arrangement, a provider allows a consumer to move into his or her existing home in order to integrate the individual into the shared experiences of a home and family. This type of shared living arrangement is common in many state Medicaid systems and is often referred to as “adult foster care” or “host home.” The primary question in this type of shared living arrangement is whether there is an employment relationship as to which FLSA requirements apply – that is, whether the provider is an employee of the consumer and/or a third party who finances the cost of providing care to the consumer, or is instead an independent contractor.

Determining whether a provider is an employee or an independent contractor requires consideration of the “economic realities” of the relationship between the provider and a potential employer. The economic realities test examines a number of factors relevant to whether a provider is economically dependent on the consumer or the third party. The fact-specific analysis distinguishes an independent contractor engaged in a business of his or her own from a worker who, as a matter of economic reality, follows the usual path of an employee and is dependent on the employer he or she serves. The factors commonly considered, along with a more detailed explanation of the economic realities test, can be found in Fact Sheet 13: Employment Relationship Under the FLSA. The FLSA does not require payment of minimum wage and overtime compensation to providers who are properly categorized as independent contractors.

1(a) Arrangements in which there is not an employment relationship (i.e., the provider is an independent contractor).

In most shared living arrangements in a provider’s home, the provider will not be an employee of the consumer. Of the economic realities test factors, two – the degree of control the potential employer exercises over the worker and the extent of the relative investments of the worker and potential employer – are most relevant to the analysis in this type of shared living program, and in typical circumstances, neither will point to the existence of an employment relationship. First, the provider will typically determine (with consideration to the consumer’s needs and preferences) much of the way daily life proceeds, such as the routines and schedules within the home. In other words, although the provider takes the consumer’s preferences into account, on the whole, an adult foster care provider often integrates the consumer into an existing set of circumstances rather than taking direction from the consumer. Second, in such arrangements the provider makes investments to take on the provider role, whereas the consumer has not. Specifically, the provider has obtained and maintains the home in which the services are provided and may have made modifications to the home, such as making a bathroom wheelchair accessible or transforming a first-floor room into a bedroom, in order to be permitted to become the consumer’s provider.

In adult foster care arrangements in which the third party’s role is limited, as is generally true, the provider will also not be an employee of a third party (such as the state, an adult foster care agency, or another third party acting on the state’s behalf). Specifically, under the economic realities test, the third party will likely not be an employer of the provider if the third party’s involvement is to recruit providers into the program, facilitate matching of consumers and providers, oversee quality management and monitoring compliance with licensing and other program requirements once the arrangement is established, and set the amount the adult foster care provider will be paid, i.e., if it does not determine whether a provider will choose to participate in the program, whether a provider will bring a particular consumer into his or her home, or, importantly, how the day-to-day activities of the home and provision of services to the consumer will occur. However, as discussed below in Section 1(b), in circumstances in which the third party has more involvement in the workplace, there will often be an employment relationship between the third party and the provider.

Some state programs allow a family member of the consumer to be an adult foster care provider. The provider’s status as a family member (as opposed to being unrelated to the consumer) and the fact that the consumer may have already lived with the family member before he or she became a provider is not determinative of whether the family member is an employee or independent contractor. The same economic realities analysis applies to each provider whether he or she is a family member of the consumer or not.

1(b) Arrangements in which there is an employment relationship.

Because the analysis of whether an employment relationship exists is fact-specific, it could also be the case that a provider is an employee where a consumer lives in a provider’s home or a program is called adult foster care or host home. In arrangements in which a third party (perhaps through a case manager) is so involved in the provider’s relationship with the consumer that the third party’s role becomes one of direction and management of the workplace, the provider will be an employee of that third party rather than an independent contractor. For example, the provider will likely be an employee of a third party that finds and rents a residence in which the arrangement can occur, or whose case manager makes frequent visits or phone calls to the home specifically to instruct the provider about particular tasks to perform or ways to fulfill or not fulfill duties. Additionally, if adult foster care providers are part of a collective bargaining agreement with a third party, such as a state, that entity may be a third party employer if the terms of the agreement reflect sufficient involvement by the third party with the providers’ conditions of employment, such as wages and benefits.

In adult foster care arrangements in which an employment relationship does, in fact, exist between a provider and a third party, two other conditions – exemptions and coverage – must be examined before determining whether the employer is required to comply with FLSA requirements. First, as addressed in the October 2013 Final Rule, third party employers may no longer claim the companionship services exemption from minimum wage and overtime or the live-in domestic service employee exemption from overtime pay. The second condition is coverage. As explained in greater detail in the AI, any state or state agency that employs a home care provider is, by definition, covered by the FLSA, while a private agency may be covered if its annual gross volume of business is at least $500,000. And a provider employed by a private agency that fails to meet that dollar threshold would still be individually covered if he or she regularly travels between states during the course of the job. Under any of these conditions in which coverage is met, the provider is entitled to receive at least the federal minimum wage and overtime pay from the third party.

For cases in which the FLSA does apply, see Sections 4 and 5 below and the AI for a discussion of certain FLSA principles related to hours worked and compensation.

2. Shared Living in a Consumer’s Home

In this type of shared living arrangement, a provider moves into a consumer’s home to perform services such as providing fellowship and protection, helping integrate the consumer into the community, or merely being present during nights in case of an emergency. These arrangements are sometimes called roommate arrangements. Typically, the provider lives rent-free in the consumer’s home and might or might not receive additional payment. These arrangements are often funded by Medicaid but may also be funded by another public program or privately. The threshold issue in these types of shared living arrangements is whether the consumer is the sole employer (and if so, whether an exemption applies) or whether there also is a third party that is a joint employer. As explained in Section 1, determining whether or not an employment relationship exists requires assessing the economic realities of the relationships between the provider and the consumer as well as the provider and any third party.

2(a) Whether consumers must comply with the FLSA under these arrangements

When a provider moves into a consumer’s home to provide services, the provider will typically be the employee of the consumer. Several facts lead to a determination that in this type of shared living arrangement, the provider is not like an independent business: the consumer is likely to set the provider’s schedule, direct the provider how and when to perform certain tasks, and otherwise control the provider’s work. Additionally, the provider is unlikely to have invested in the arrangement, whereas the consumer has acquired a home in which there is sufficient space for the provider to also reside and as the owner/lessee, has overall control of the premises where the work is being performed.

After reaching the conclusion that an employment relationship does exist between a provider and a consumer, two other conditions must be considered before determining that the consumer is required to comply with FLSA requirements. First, the consumer must be an FLSA-covered employer. As explained in the AI, shared living arrangements in which the provider moves into the consumer’s home almost certainly involve “domestic service employment,” a category of employment that is broadly covered under the Act. Therefore, the consumer will essentially always be a covered employer.

Second, depending on the arrangement, a consumer employing a provider may be able to apply certain exemptions from paying minimum wage and/or overtime:

- Companionship Services Exemption: Under the October 2013 Final Rule, a consumer is exempted from paying minimum wage and overtime pay to direct care workers who provide “fellowship” and “protection” to consumers. If the provider performs medically related tasks or spends more than 20 percent of work time providing “care” (defined as assisting with activities of daily living (“ADLs”) and instrumental activities of daily living (“IADLs”)), the consumer may not claim the companionship services exemption. See Fact Sheet #79A: Companionship Services Under the FLSA. While the applicability of this exemption must be analyzed based on the facts of a specific arrangement, it is likely that a consumer will be able to apply the companionship exemption in living arrangements in which the provider’s only responsibility is to spend nights at the consumer’s residence in case of an emergency.

- Live-in Domestic Service Overtime Exemption: If a provider lives in the consumer’s residence permanently or for extended periods of time (as opposed to, for instance, working an overnight shift), as will often be the case in shared living arrangements that occur in a consumer’s home, a consumer may claim the live-in domestic service exemption from overtime even if the companionship services exemption may not be claimed. For details on what constitutes a “live-in” domestic service worker and other conditions of the exemption, see Fact Sheet #79B: Live-In Domestic Service Workers Under the FLSA. In these circumstances, the consumer is exempt only from paying the FLSA overtime premium and must still pay at least the federal minimum wage for all hours worked (unless the companionship services exemption described in the previous paragraph applies).

In situations in which a consumer employs a provider, is a covered employer, and is unable to claim FLSA exemptions, see Sections 4 and 5 below for an analysis of how certain FLSA principles apply, including using the value of rent or board to offset wage obligations and creating agreements with providers to exclude certain sleep time and other personal breaks from hours worked.

2(b) Whether states and other third parties must also comply with the FLSA as joint employers under these arrangements

A third party (such as the state, a shared living agency, or another third party acting on the state’s behalf) could be a joint employer along with a consumer in shared living arrangements in a consumer’s home. Determining whether a third party is an employer under these programs requires consideration of the economic realities test, as described above in Section 1 related to arrangements that take place in a provider’s home. (Also, see Fact Sheets 13 and 79E.)

One of a number of factors that must be considered in assessing whether a provider is employed by a third party is the extent of the control the third party exercises in the arrangement. The more involved a third party becomes in directing the manner in which the provider performs the work (such as determining the tasks the provider performs or the manner in which he or she performs them), the more likely it is that the third party is an employer and therefore subject to the FLSA. For instance, if a provider must ask the third party’s permission to be away from the residence or to make a change to the consumer’s daily schedule, those facts weigh in favor of a finding that the provider is an employee. On the other hand, if a provider whose responsibility as a roommate is to sleep at the home must notify a third party that she will need to be away from the residence overnight but the third party cannot refuse to grant her request or sanction her for taking the evening off, those facts would not weigh in favor of employee status. Additionally, if a third party collectively bargains with providers or is otherwise involved in determining providers’ conditions of employment—such as, but not limited to, wage rates, vacation or sick time, health insurance, or other benefits—the third party will likely be a joint employer of the provider.

A third party employer in this type of shared living arrangement is required to pay its providers at least the federal minimum wage and overtime pay if it is an FLSA-covered employer. As explained in the AI, shared living arrangements that occur in the consumer’s home involve domestic service employment, as to which special coverage rules apply; in these situations, any third party employer will nearly always be a covered employer. A third party may not claim any FLSA exemption in these circumstances; the companionship services exemption and live-in domestic service exemption are only available to consumers or their families or households.

3. Shared Living in a New Home Created by the Consumer and Provider

A wide spectrum of shared living arrangements exist, and it will not always be the case that either the provider or the consumer previously occupied the residence in which the arrangement occurs. For example, the two may move in together because neither previously lived in a residence that would accommodate them both. Whether these situations are more like those described in Section 1 (shared living in a provider’s home) or Section 2 (shared living in a consumer’s home) depends upon all of the circumstances that go to who controls the residence and relationship. Relevant facts include who identified the residence, arranged to buy or lease it, furnished common areas, maintains the residence (for example, by cleaning it and making repairs), and pays the mortgage or rent. No single fact alone is controlling.

Under arrangements in which the provider has primary control over the residence and relationship, the consumer likely does not employ the provider, and the analysis of whether a third party is an employer of the provider described in Section 1 applies. For example, if in order to become an adult foster care provider, an individual moves from a one-bedroom to a two-bedroom apartment, furnishing the apartment except for the second bedroom and arranging for certain upgrades so that it meets program requirements, and then a consumer moves in and his name is added to the lease, the provider is likely not an employee of the consumer.

On the other hand, under arrangements in which the consumer exercises control over the residence, either in a situation in which the consumer controls the newly established home or where control over the home is shared, it is likely that the consumer employs the provider and the analysis described in Section 2, including whether a third party is an employer, applies. For example, if a provider and consumer are matched as roommates through a Medicaid-funded program and then jointly identify and rent an apartment they like, furnish the apartment, and take on responsibility for keeping the apartment clean and purchasing food, assuming the consumer exercises control over the residence, the provider is likely employed by the consumer. A complete analysis should still be performed pursuant to the discussion in Section 2.

4. FLSA principles for determining hours worked and compensation for shared living providers

If, following a fact-specific analysis of specific shared living arrangements, the consumer and/or the state or other third party must comply with the FLSA’s wage requirements, certain FLSA principles may be relevant.

Reasonable agreements. Because of the intertwined nature of a live-in provider’s work and personal activities, it is often difficult to determine what constitutes hours worked (in other words, what time must be paid). The employer and provider may come to a “reasonable agreement” to exclude from paid hours worked the amount of time the provider spends engaging in typical private pursuits, such as eating, sleeping, entertaining, and other periods of complete freedom from all duties. Any calls to duty during these otherwise unpaid periods must be paid. Sleep time of no more than eight hours may be excluded if the provider can generally enjoy uninterrupted sleep. To exclude off-duty breaks other than meal and sleep time, they must be long enough to enable the provider to make effective use of his or her own time.

A reasonable agreement should also clearly and specifically identify the tasks the provider is required to perform. While certain provider activities can be clearly categorized as hours worked (such as helping a consumer bathe) and certain others are clearly personal time (such as a provider attending classes during a period of time she is completely relieved of duties), some activities do not always constitute either on- or off-duty time. For instance, going to a community event together at a time when the provider could choose to spend time apart from the consumer may be considered an unpaid, shared social outing under a reasonable agreement that only requires the provider to assist the consumer at certain times during the day. On the other hand, attending the same event together may be considered hours worked if the reasonable agreement states that the provider’s duties include engaging the consumer in these very sorts of community activities. Determining hours worked in some arrangements may involve a potentially complicated analysis; therefore, reasonable agreements entered into by a live-in provider and an employer should accurately reflect the work that is required to be performed and cannot be used to improperly limit the number of hours that are paid. Furthermore, regardless of what the agreement anticipates, the actual amount of time a provider spends performing work tasks must be compensated. For instance, if the agreement provides for 6 hours of paid assistance each day but the consumer needs 9 hours on a particular day, those additional hours must be counted as compensable hours worked.

As explained in the Final Rule (and noted in the AI), in the case of a provider who is a family or preexisting household member of the consumer, some unpaid services, often called “natural supports” in the context of Medicaid programs, may be outside the scope of the reasonable agreement. If the reasonable agreement does not treat the provider unequally because he or she is a family or household member, such differentiation between the employment relationship and familial relationship is permitted.

Sleep time. For a provider who lives on the consumer’s premises permanently (i.e., has no other home), an employer, under certain circumstances, may exclude sleep time, even in arrangements in which the provider is required to remain on the premises overnight. This exclusion is only permissible when the time is during normal sleeping hours, i.e., overnight rather than during the daytime. No more than eight hours per night of sleep time may be excluded. As with other off-duty time, any interruption to sleep time by a call to duty must be paid regardless of an agreement to exclude the time. And importantly, in order to deduct sleep time, the provider must typically be paid for some hours during non-sleep time such as in the early morning, late evening, or on weekends. Although the Department has not set a specific number of hours that must be compensated in order to permit the exclusion of sleep time in arrangements where the provider is required to spend overnight hours on the premises, the circumstances must be such that the agreement regarding work and non-work time is reasonable. For example, if a provider and her employer agree to exclude eight hours of sleep time per night and the provider is paid an hourly rate for services she performs between the hours of 8:00pm and 10:00pm each evening and 6:00am and 8:00am each morning, that agreement would typically be reasonable. Or if a provider’s sole responsibility is to be at the residence five nights a week from 10:00pm to 8:00am, it will likely be reasonable to agree to treat two of those ten hours as hours worked and exclude the remaining eight hours as sleep time. Similarly, it will typically be reasonable to exclude sleep time during weeknights if the provider and employer agree that four hours per day spent in the residence on two weekdays and each weekend day are hours worked that must be compensated. On the other hand, if a provider’s sole responsibility is to be at the residence for eight hours each night, an agreement to exclude all time the provider is required to be on the premises will not be reasonable, nor would an agreement to consider one hour per day to be hours worked.

Rent and utilities. Under some of these shared living arrangements, the provider is compensated either partially or fully by being able to live rent-free in the consumer’s home. Section 3(m) of the FLSA allows an employer to credit the fair value of the board, lodging, and other facilities towards the minimum wage requirement provided certain conditions are met. See the AI for a complete list of requirements for claiming this credit. Of course, the employer must still meet its wage obligation. For example, a provider receives cash wages of $180 in a workweek for 30 hours of work, plus free rent and utilities valued at $100 per week. Adding the wage plus rent and utilities credit together then dividing by the number of hours worked ($280 / 30) results in an amount of $9.33 per hour. Assuming the rent and utilities credit is properly taken, this payment structure complies with the federal minimum wage requirement. If during the following week, the same provider worked for 50 hours and received $300 in cash wages in addition to the $100 value of rent and utilities, the employer’s minimum wage obligation would still be met, but the provider would be due overtime compensation. Specifically, she would receive a total of $400, or $8 ($400 / 50) per hour, and her employer would owe her one-half times that regular rate for the 10 hours worked over 40—i.e., an additional $40 ($8 x .5 x 10)—in overtime compensation. Furthermore, the section 3(m) credit may be the sole payment a live-in employee receives, provided it is sufficient to cover the employer’s minimum wage obligation. For example, a provider whose reasonable agreement anticipates 12 hours per week of paid work (with the remaining time she is on the premises excluded as off-duty time or sleep time) could be compensated entirely by not paying rent. If the fair value of her lodging is $500 per month (or $115.38 per week), her arrangement complies with the FLSA because she receives $9.62 per hour ($115.38 / 12).

5. Compliance with the FLSA

If the FLSA’s minimum wage requirement applies, an employee must be paid at least the minimum wage for all hours worked. If its overtime pay requirement applies, an employee must receive one and a half times her regular rate of pay for all hours worked over 40 in the workweek.

In shared living arrangements, a provider may receive compensation in the form of hourly wages, a daily or monthly stipend, a weekly or monthly salary, room and board, or as some combination of such payments. The FLSA allows an employer to take credit for these various types of compensation as described below.

5(a) Minimum wage

The federal minimum wage is currently $7.25 per hour. An hourly wage of that much or more satisfies the federal minimum wage requirement. If an employee receives a daily stipend, the total amount of the stipends received in a workweek divided by the number of hours worked that week is the hourly rate, which must be equal to or greater than minimum wage. For example, if a provider receives $68 per day and works seven hours each day five days per week, she has received $9.71 (($68 x 5) / (7 x 5)) per hour, and the federal minimum wage requirement has therefore been met. If an employee receives a monthly stipend, that amount is multiplied by 12 and divided by 52 to determine the weekly rate, which is then divided by the number of hours worked each week to calculate the hourly rate. So a provider who receives $1750 per month has earned a $403.85 ($1750 x 12 / 52) weekly rate, and if she works 40 hours in a particular workweek, she has earned $10.10 ($403.85 / 40) per hour. The same formula also applies to a salary or any other compensation that is not expressed as an hourly wage.

5(b) Overtime

Where the FLSA’s overtime compensation requirement applies, an employee must receive one and one-half times her regular hourly rate of pay for all hours worked over 40 in a workweek. For example, if a provider receives $57 as a daily rate and works seven hours for each of seven days in a particular workweek, she would be owed an additional $36.63 for that week because her hourly rate is $8.14 ($57 / 7), one half of that is $4.07, and she must receive overtime compensation for 9 hours (the number over 40 worked in the week). See Fact Sheet 23: Overtime Pay Requirements of the FLSA.

5(c) Recordkeeping

In addition to its minimum wage and overtime requirements, the FLSA mandates that employers keep records regarding its employees, their hours worked, and their compensation. In particular, an employer of a live-in provider must maintain the reasonable agreement with the employee regarding hours worked and, as of January 1, 2015 when the Final Rule takes effect will also be responsible for keeping records of the actual hours worked by the provider rather than merely relying on the reasonable agreement. See Fact Sheet #79C: Recordkeeping Requirements for Individuals, Families, or Households Who Employ Domestic Service Workers Under the FLSA.

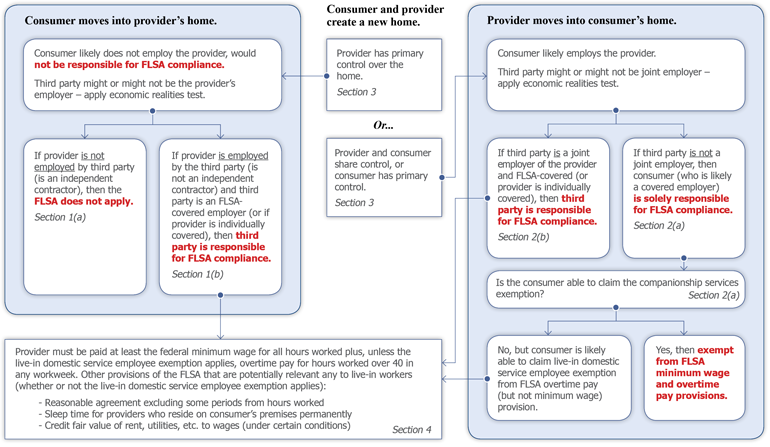

Determining whether FLSA minimum wage and overtime pay requirements apply to particular shared living arrangements requires a fact-specific analysis. This diagram, along with the Fact Sheet discussion, may help illustrate generally whether and how the FLSA applies to some common scenarios.

Where to Obtain Additional Information

For additional information, visit our Wage and Hour Division Website: http://www.dol.gov/agencies/whd and/or call our toll-free information and helpline, available 8 a.m. to 5 p.m. in your time zone, 1-866-4USWAGE (1-866-487-9243).

This publication is for general information and is not to be considered in the same light as official statements of position contained in the regulations.